U.S. Hydrogen Hubs and the Sprint to Decarbonize Air Travel

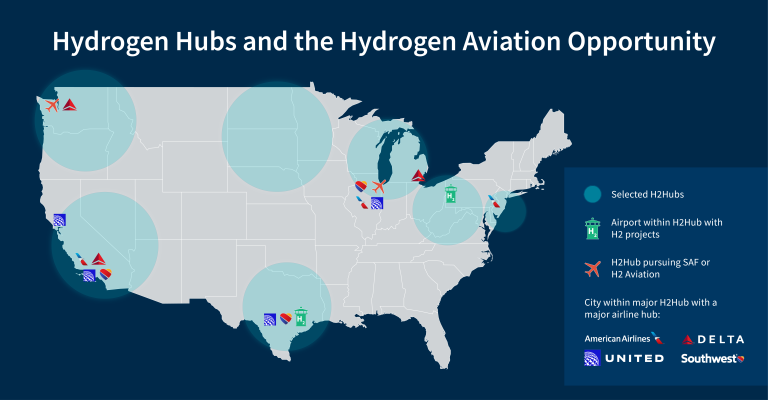

Six out of seven Hydrogen Hubs (H2 Hubs) selected to receive total awards of up to $7 billion in federal funding include major airports or airline hubs.[1] Combined with a flurry of private sector investment and policy support to produce abundant and cost-effective supply of hydrogen, is this the beginning of a new chapter in the effort to decarbonize air travel?

Aviation’s Net Zero Challenge

The clock is ticking for hard-to-decarbonize sectors like aviation. The four largest U.S. airlines – American,[2] Delta,[3] Southwest,[4] and United[5] – have announced a commitment to transform their operations to be net-zero by 2050. The same commitment has been made by aircraft manufacturers Boeing,[6] Airbus,[7] and many other airlines around the world.

Achieving net zero will require unprecedented collaboration across the entire aviation ecosystem including airlines, aircraft OEMs, airports and regulators. And there is no single technology, innovation or regulatory regime that can achieve this goal alone. The industry will need new fuels, new propulsion technology, new airframe designs, new airport infrastructure, as well as appropriate policy and financing support to achieve net zero.[8]

With major airline hubs located throughout the hydrogen hubs’ footprints, these regions are serving as an incubator for the development of hydrogen aviation and related infrastructure. Source: FTI Consulting, Inc.

The Trio of Solutions: SAF, Hydrogen and Electrification

Today, Sustainable Aviation Fuel (SAF) is widely recognized as the most immediate solution to help decarbonize air travel, and by 2050, the International Air Transport Association estimates SAF will contribute 65% of the emissions solution.[9] However, hydrogen, is expected to play a key role as well – initially in the scaling of SAF production (where it is a critical feedstock) or, increasingly over time as a direct fuel source, either to power fuel cells or to combust in new engines.[10]

In fact, ZeroAvia and Universal Hydrogen, both of which have operations in the U.S., have already conducted successful test flights for hydrogen-electric turboprop aircraft.[11] While the first aircraft will incorporate modifications to existing airframes, major OEMs like Airbus are committed to designing and producing new hydrogen-powered commercial aircraft, which are expected to enter service by 2035.[12]

Still others are looking at fully electric and hybrid-electric aircraft. United Airlines and Mesa Airlines each announced plans in 2021 to purchase 100 30-seat hybrid-electric planes, ready for service in 2028, that can fly up to 124 miles in electric-only mode and 250 miles in hybrid-electric mode.[13] These aircraft have the potential to reinvigorate regional air mobility and provide a zero emission option when powered by renewable electricity and fuels. Electric propulsion also has the ability to dramatically expand closer-in urban air mobility through the use of vertical take-off and landing aircraft (eVOTLs). Joby Aviation is developing eVOTL aircraft for commercial passenger service and is already demonstrating its so-called “air taxi” service across the Manhattan skyline.[14] These aircraft, and electric-powered flight more broadly, will provide a decarbonization solution for a key aviation segment.

A Symbiotic Relationship Between SAF and Hydrogen

SAF, which can reduce emissions by up to 90% if produced by renewable feedstock, serves as a one-to-one replacement for traditional jet fuel.[15] In theory, if sufficient volumes of SAF are available and cost-competitive, every aircraft in use today could transition to SAF tomorrow. But SAF is currently expensive to produce and, without a massive shift in the market, it is expected to remain so into the future.[16] One potential tool to help address these high costs in the near term is the SAF tax credit, which was included in the Inflation Reduction Act and provides up to $1.25 per gallon for qualify SAF that reduces greenhouse gas emissions by 50%. Additional funding is available (up to $.50 per gallon) based on further emissions reductions.[17]

Billion-dollar investments in new or retrofitted production facilities are another hurdle for SAF.[18] The acute shortage of renewable power and renewable feedstocks, like waste fats and oils, energy crops, and forestry residues, are also a challenge. Overcoming these hurdles, along with guidance from the Treasury Department about which feedstocks qualify for the SAF tax credit, will go a long way to meeting the Biden administration’s goal of producing 3 billion gallons of SAF annually.[19] For comparison, U.S. airlines used 18.3 billion gallons of jet fuel in 2019, the last full year of pre-pandemic data.[20]

Abundant and cheap hydrogen can accelerate SAF scale-up, but hydrogen costs need to decline to realize the full benefit of this symbiotic relationship. Those costs are expected to come down this decade as hydrogen production technology scales.[21] Hydrogen’s versatility can help decarbonize aviation from multiple pathways, especially if existing infrastructure like pipelines can be affordably retrofitted to distribute hydrogen from production centers to end use facilities.

Net Zero Aviation’s Biggest Challenges: Time, Cost and Perception

There’s no question that abundant hydrogen is a key part of the solution, but it does not solve the full challenge of net zero aviation. In addition to hydrogen-powered aircraft undergoing a justifiably vigorous and therefore lengthy certification process, each and every airport servicing those aircraft will need new infrastructure connecting the hydrogen from where it’s produced to the aircraft gate for refueling.[22] While much of the existing jet fuel infrastructure can be leveraged for SAF, hydrogen will require new storage and transmission systems.[23] Over $150 billion is needed for airport infrastructure upgrades over the next five years in the U.S., and these upgrades should start layering in plans for hydrogen infrastructure.[24]

Meanwhile, air traffic is only expected to rise, adding to the wear and tear on our nation’s airports. The Federal Aviation Administration estimates that passenger air travel will increase by 50% between 2023 and 2040.[25] In addition to putting strain on U.S. airports, the rise in air traffic adds pressure to the industry to identify a decarbonization strategy as soon as possible to mitigate any potential rise in industry emissions.

Complicating matters further will be how consumers react and adjust to new fuels, aircraft, and technologies powering net-zero flight. While these changes are likely to make air travel more expensive, at least until technology scales and the costs of hydrogen and renewables come down, airlines and OEMs will need to invest in consumer-facing messaging that addresses the public’s acceptance of these new technologies, especially as it relates to safety. Effectively framing these industry developments and securing consumer buy-in will be critical to the industry’s overall success throughout this transition.

Bottom Line

Two of the world’s busiest airports are located squarely within regions selected as hydrogen hubs, Chicago O’Hare International (ORD) and Los Angeles International (LAX).[26] Further, the Midwest hub has identified SAF as an end use application it intends to pursue within the hub’s activities.[27] The Pacific Northwest hub intends to leverage hydrogen for regional aviation and drones.[28] And executives at Pittsburgh International Airport[29] and Houston’s Airports (Bush and Hobby)[30] are finding ways to produce hydrogen and refuel aircraft at their locations. These regions are laying the foundation for hydrogen aviation and provide valuable lessons to those who follow suit.

Hydrogen is far from a panacea for aviation emissions, but along with SAF and small aircraft electrification, it will play a key role in achieving net zero goals. In order to meaningfully reduce aviation emissions next decade, it will require unprecedented coordination: technical expertise and engineering, commercial imperatives, political and policy support, and effective communications strategies, to name a few. And if we want to achieve net-zero air travel by 2050, the time to act is now.

FTI Consulting’s Strategic Communications team has been supporting hydrogen scale-up for more than a decade, building coalitions to elevate and shape conversations domestically and abroad. Combined with our decades of experience in the aviation industry, our expertise allows us to effectively help stakeholders position themselves – and the sector at large – for success over the long term. Please contact us to discuss.

[1] “Regional Clean Hydrogen Hubs Selections for Award Negotiations,” Department of Energy, Office of Clean Energy Demonstrations (last accessed Dec. 13, 2023), https://www.energy.gov/oced/regional-clean-hydrogen-hubs-selections-award-negotiations

[2] “Pathway to net zero,” American Airlines (last accessed Dec. 13, 2023), https://news.aa.com/esg/climate-change/pathway-to-net-zero/

[3] “Committed to Sustainability,” Delta Airlines (last accessed Dec. 13, 2023), https://www.delta.com/us/en/about-delta/sustainability

[4] “Planet,” Southwest Airlines (last accessed Dec. 13, 2023), https://www.southwest.com/citizenship/planet/

[5] “Our environmental commitment,” United Airlines (last accessed Dec. 13, 2023), https://www.united.com/ual/en/us/fly/company/global-citizenship/environment.html

[6] “Sustainable Aerospace Together,” Boeing 2023 Sustainability Report (last accessed Dec. 13, 2023), https://www.boeing.com/resources/boeingdotcom/principles/sustainability/sustainability-report/2023/assets/2023-Boeing-Sustainability-Report.pdf

[7] “Decarbonisation – Towards low-carbon air travel for future generations,” Airbus (last accessed Dec. 13, 2023), https://www.airbus.com/en/sustainability/respecting-the-planet/decarbonisation

[8] “Decarbonizing aviation: How can airlines and aircraft makers meet net-zero goals by 2050?,” World Economic Forum (Jun. 29, 2023), https://www.weforum.org/agenda/2023/06/decarbonizing-aviation-net-zero-goals-2050/

[9] “Net zero 2050: sustainable aviation fuels,” International Air Transport Association (Dec. 2023), https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet—alternative-fuels/

[10] “Fact Sheet 7: Liquid hydrogen as a potential low-carbon fuel for aviation,” International Air Transport Association (Aug. 2019), https://www.iata.org/contentassets/d13875e9ed784f75bac90f000760e998/fact_sheet7-hydrogen-fact-sheet_072020.pdf

[11] Maria Gallucci, “The first hydrogen-powered planes are taking flight,” Canary Media (Aug. 2, 2023) https://www.canarymedia.com/articles/air-travel/the-first-hydrogen-powered-planes-are-taking-flight

[12] “At Airbus, hydrogen power gathers pace,” Airbus (Jun. 20, 2023), https://www.airbus.com/en/newsroom/stories/2023-06-at-airbus-hydrogen-power-gathers-pace

[13] Ian Thomas, “United Airlines is aiming to have electric planes flying by 2030,” CNBC (published Oct. 6, 2022, updated Oct. 10, 2022), https://www.cnbc.com/2022/10/06/united-airlines-is-aiming-to-have-electric-planes-flying-by-2030.html

[14]“Joby Flies Quiet Electric Air Taxi in New York City,” Joby Aviation (Nov. 13, 2023), https://www.jobyaviation.com/news/joby-flies-quiet-electric-air-taxi-new-york-city/

[15] Matteo Prussi, Uisung Lee, Michael Wang, Robert Malina, Hugo Valin, Farzad Taheripour, César Velarde, Mark D. Staples, Laura Lonza, James I. Hileman, “CORSIA: The first internationally adopted approach to calculate life-cycle GHG emissions for aviation fuels,” ScienceDirect (Oct. 2021), https://www.sciencedirect.com/science/article/pii/S1364032121006833?via%3Dihub

[16] Sourasis Bose, “U.S. sustainable aviation fuel production target faces cost, margin challenges,” Reuters (Nov. 1, 2023), https://www.reuters.com/sustainability/us-sustainable-aviation-fuel-production-target-faces-cost-margin-challenges-2023-11-01/

[17] “Sustainable Aviation Fuel Credit,” Internal Revenue Service (Jan. 31, 2023), https://www.irs.gov/credits-deductions/businesses/sustainable-aviation-fuel-credit

[18] “Air Products, World Energy to build $2B SAF production facility,” Business & Industry Connection Magazine (Jul. 7, 2022), https://www.bicmagazine.com/projects-expansions/downstream/air-products-world-energy-to-build-2b-saf-production-facility/

[19] See supra note 16.

[20] “U.S. Airlines’ 2021 Total Fuel Use Decreases 25% from Pre-Pandemic 2019; December 2021 Fuel Use Down 13% from December 2019,” Bureau of Transportation Statistics (Feb. 2022), https://www.bts.gov/newsroom/us-airlines-2021-total-fuel-use-decreases-25-pre-pandemic-2019-december-2021-fuel-use-down

[21] “Hydrogen Shot,” Department of Energy, Office of Energy Efficiency & Renewable Energy (last accessed Dec. 13, 2023), https://www.energy.gov/eere/fuelcells/hydrogen-shot

[22] Nicola De Blasio Fridolin Pflugmann Henry Lee, “Hydrogen Deployment at Scale: The Infrastructure Challenge,” Harvard Kennedy School, Belfer Center for Science and International Affairs (Aug. 2021), https://www.belfercenter.org/publication/hydrogen-deployment-scale-infrastructure-challenge

[23] “Sustainable Aviation Fuel,” U.S. Department of Energy, Energy Efficiency & Renewable Energy (last accessed Dec. 13, 2032), https://afdc.energy.gov/fuels/sustainable_aviation_fuel.html

[24] “2023 U.S. Airport Infrastructure Needs Report: Growing Needs Heighten Urgency to Modernize America’s Airports,” Airports Council International (last accessed Dec. 13, 2023), https://airportscouncil.org/wp-content/uploads/2023/03/2023ACI-NAInfrastructureNeedsReportFINAL.pdf

[25] “Global Outlook for Air Transport,” page 15, International Air Transport Association (Jun. 2023), https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport—-june-2023/

[26] See supra note 1.

[27] See supra note 2.

[28] See supra note 3.

[29] See supra note 4.

[30] See supra note 5.

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com