Reputational Due Diligence: Non-financial pre-deal advisory services for private equity firms

If the past ten years have proved anything it is the vulnerability of business to reputational ambush. The rise of populism in politics and the strength of social media campaigning have transformed this landscape.

An FTI analysis of over 100 corporate crises in the last 20 years* demonstrates value destruction of some $200bn that is directly attributable to reputational damage from and since the global financial crisis. Furthermore, reputational misfortune is over the trigger for an adverse regulatory response. It is, though, possible to identify potential reputational risks and remedies before an acquisition. That information should be available to Investment Committees before a commitment is made. FTI can offer an unrivalled service to the private equity sector.

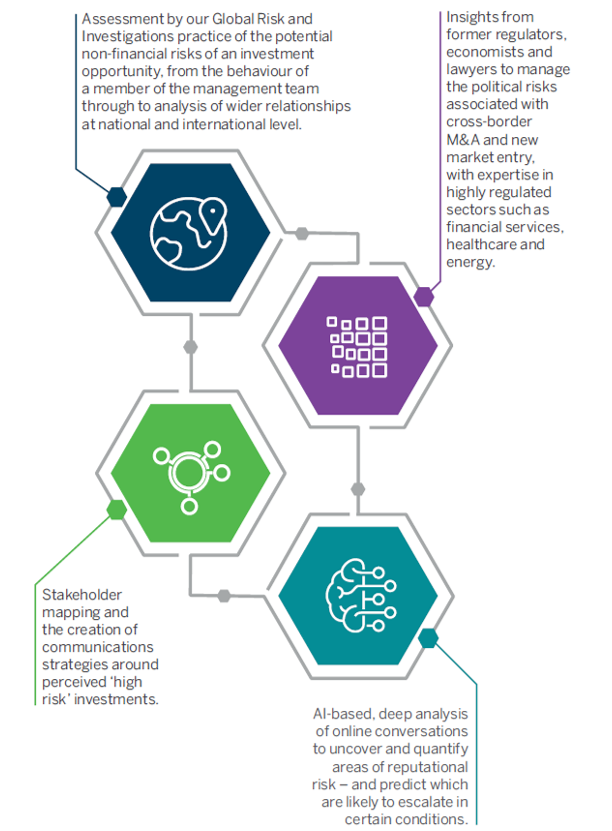

FTI Consulting’s Reputational Due Diligence Reports include: