Pre-Gaming the Post-Game: Market and Policy Implications of COVID-19

As governments, businesses and individuals grapple with the public health implications of the COVID-19 pandemic, severe economic implications loom ahead. Lawmakers are moving quickly to respond with monetary and fiscal stimuli.

Recent market volatility has led some to compare the current economic climate to the September 11, 2001 and the 2008 Financial Crisis. Clearly, the potential for large-scale government intervention in the marketplace is already apparent as a result of recent actions by the Federal Reserve, as well as legislation under consideration in Congress.

How does the COVID-19 situation compare to past market dislocations? We suggest an analytical framework below, comparing differences in terms of market response, monetary policy, and fiscal policy. Organizations seeking to protect value through this COVID-19 crisis should consider the similarities and differences in these crises and factor those observations into their business continuity and communications plans.

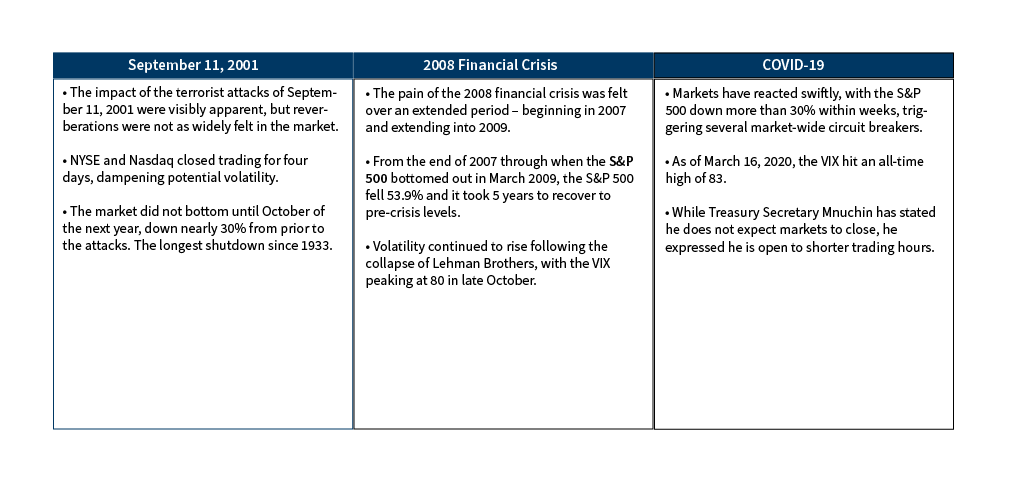

Market Response

The COVID-19 pandemic has caused a large amount of economic pain over a very short timeframe. While the outbreak started affecting global markets in late 2019, Wall Street barely acknowledged it until late February. From there, the pace and magnitude of lost market confidence has been jaw-dropping. Combined with another exogenous shock from the oil industry, volatility levels as measured by the VIX have reached an all-time high of 83, versus a long-run average of 18.

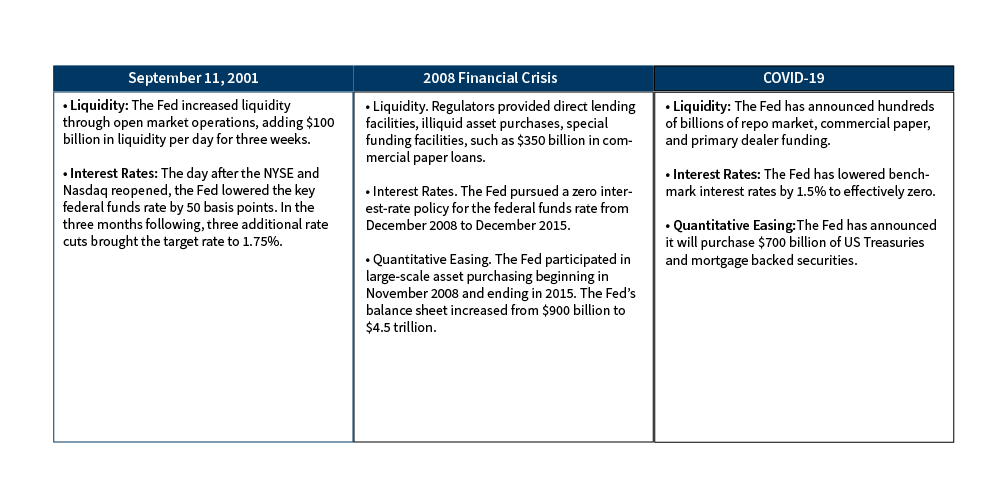

Monetary Response

In response to the COVID-19 pandemic, the Fed is pulling several of the same levers from the 2008 crisis in order to provide confidence and calm volatility in the equity markets. Financial crises generally resemble bank runs: long-term assets are funded with short-term liabilities, so if short-term liabilities come due in the midst of uncertainty, market-wide panic becomes possible. The Fed has traditionally stepped into crises to bridge this gap, effectively acting as a lender of last resort.

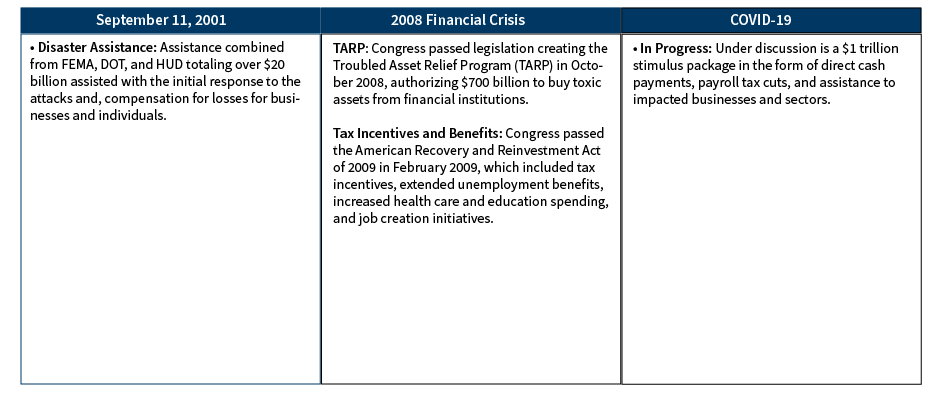

Fiscal Response

Unlike the 2008 financial crisis, the financial market volatility of the COVID-19 crisis was not triggered by underlying weakness in the financial system. Given the exogenous nature of this disaster, the financial vulnerabilities are closer in comparison to that of the terrorist attacks of September 11, 2001. Yet the impact of COVID-19 will reverberate across cities in America over the course of several months – rather than in one concentrated shock. The extended impact of the COVID-19 pandemic means that the fiscal response will be in focus for a longer period as the U.S. economy slows.

Thinking About the Post-Game

While several similarities exist across previous crises, the nature of the COVID-19 pandemic is fundamentally different. As such, organizations must be proactive in their response, but also nimble enough to pivot as a result of changing circumstances. Below are four key takeaways that organizations should incorporate into their planning throughout this crisis with an eye towards a different post-crisis reality.

- A compressed time frame necessitates immediate responses. The markets are acting and responding, nearly in real-time. The VIX has hit all-time highs, but importantly it’s also experienced larger day-to-day moves than ever, too. The Federal Reserve has been making new monetary policy announcements on a near-daily basis in an effort to buoy markets. None of the previous crises have seen such rapid market participant responses, which have necessitated fast-moving policy intervention at massive scale. Protecting business value in this environment requires leaders to anticipate organizational impact and take decisive action.

- Distribution of message is also key. In an information world ruled by Facebook, WhatsApp, and Twitter, misinformation spreads like wildfire. In order to protect brand value and prevent misrepresentations, organizations must have a consolidated viewpoint, a centralized distribution mechanism for information, and an official voice to convey a clear point of view.

- Temporary disruptions may become permanent realities. Organizations should not assume that once this crisis passes, things will go “back” to normal. Customer bases that migrate online or shift behaviors during the COVID-19 pandemic may not resume “pre-crisis” engagement styles. There has never been a better time for organizations to heavily invest in their digital infrastructure and communications in order to maximize stakeholder engagement. Rather than seeking to “weather the storm” of a temporary crisis, organizations should consider this as an opportunity to innovate and adapt in order to increase resilience.

- Taking care of people has never been more important. While the previous crises of September 11, 2001 and 2008 had dramatic impacts on both the individual and society-wide levels, neither incident necessitated the prolonged, society-wide individual sacrifice required to stem the spread of COVID-19. And neither presented the probability of such a long tail of human suffering that combines mortality with financial loss. With its potential to last several months, the COVID-19 pandemic will fundamentally change how we live as individuals, work as organizations, and function as a society. How society treats our most vulnerable, how companies communicate with their stakeholders, and how we help our neighbors and colleagues – these actions will have a material impact for years to come.