Navigating the Psychedelic Investment Landscape: A Transatlantic Perspective

Scientific research into psychedelic drugs has enjoyed a revival in recent years following decades of neglect. This area of drug discovery has long been considered taboo by the healthcare industry because of the association with recreational drug use and the scheduling and legal status of these substances posing significant challenges to research. It is now, however, widely accepted that these compounds have the potential to become approved, highly effective pharmaceutical medicines that could transform the lives of patients with few treatment options.

Today, research in the psychedelics sector extends beyond well-defined compounds like psilocybin and MDMA, to a broader array of lesser-understood molecules. It is growing fast, too, with more than 30 clinical trials in psychedelics in Phase 2 and Phase 3, in indications such as addiction, eating disorders, PTSD and depression.[i]

Although the sector has come under pressure from macroeconomic headwinds affecting the wider markets, it does mean that growth has normalised to more sustainable levels following a surge in the number of psychedelic companies coming to market between 2020-2021. Public valuations and private fundraises in 2022 and 2023 have been more prudent, with the notable exception of Compass Pathways’ recent private funding round of up to $285m.[ii]

Companies in the space are also being more realistic, taking a diversified approach to business development and prioritising their cash runways through strategic reviews, pipeline rationalisation and workforce reductions. Tighter funding and shorter cash runways are also leading to consolidation in the sector. For instance, Cybin acquired Small Pharma in August, [iii] and Otsuka Pharmaceutical bought Mindset Pharma shortly thereafter.[iv] The hope is that the lull in valuations won’t be too protracted so that companies, academics, organisations and advocates will still be able to secure the necessary funding to unlock and accelerate the science of psychedelics.

In July, FTI Consulting co-sponsored PSYCH Symposium 2023, Europe’s largest investment conference for psychedelic medicine. At this event experts from across the psychedelic and biotech industries, academia, regulatory bodies, buy-side and sell-side had the opportunity to share ideas, discuss the challenges and delve deep into the transformative potential of psychedelic medicines.

Ahead of this event, FTI undertook a comprehensive international survey to understand the sentiments of institutional investors towards this nascent sector. The survey spanned more than 100 institutional investors from the UK and the U.S., with total assets under management exceeding $10 trillion. The findings were presented at PSYCH Symposium and unveiled geographic disparities, but also common concerns. Here is a summary of the survey:

Divergent levels of interest and knowledge

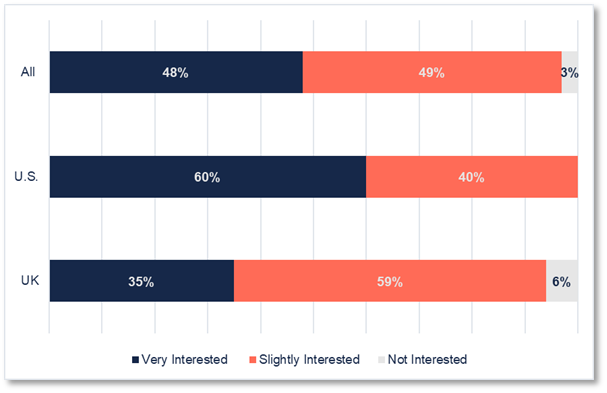

Nearly two-thirds of US institutional investors (60%) expressed a strong interest in learning more about the psychedelic medicine sector, compared to a more reserved 35% in the UK [Figure 1]. This highlights the difference between regions and subsequently, the pressing need for region-specific communication activities and investor relation approaches.

Perceived barriers: A shared concern

Investors across the UK and the US cite a lack of clinical data as a primary barrier to investing. This clinical data ‘gap’ will need to be bridged to attract a wider investor base and ensure there is sufficient funding to further research these potentially life-changing treatments and bring them to patients in need.

Outside the need for more clinical data, the regions’ concerns diverged. US investors felt the long-term horizon, quality of company management and negative media coverage of the industry (28% each) were significant issues which prevented them from taking a position in psychedelic medicine companies. UK investors, on the other hand, were most apprehensive about the general public’s limited understanding of the area of medicine as well as stock illiquidity (33% each).

The investment tipping point

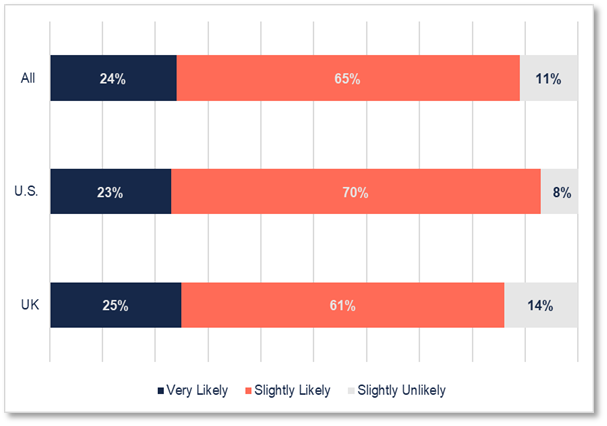

Across the two geographies, 24% of investors were ‘very likely’ to invest, 65% remained ‘slightly likely’ to invest, 11% were ‘slightly unlikely’ to invest and no respondents said they were ‘very unlikely’ to invest [Figure 2]. Converting the significant ‘slightly likely’ segment could catalyse a meaningful and much-needed shift in investor momentum.

Reasons for investing

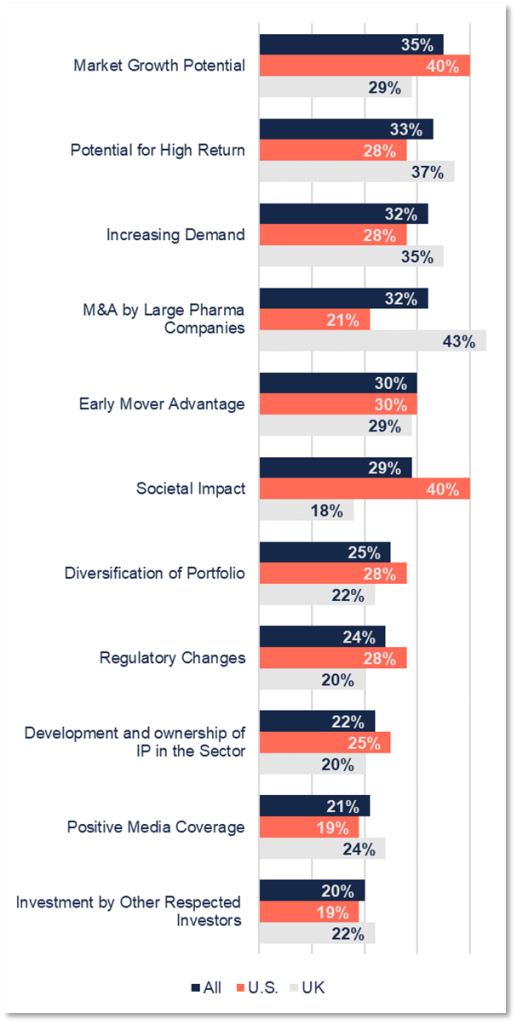

US investors said they were motivated by market growth and societal impact (both at 40%). UK investors were less likely to be swayed by social impact, with only 18% saying it would encourage them to invest.

They were, however, interested in the potential for M&A in the sector and the possibility of larger pharmaceutical companies buying smaller psychedelic biotechs (43%). 37% said the potential for high returns would encourage them to invest [Figure 3].

Charting the way forward

When asked about the priorities for the sector, the dominant theme from investors was the need to increase public awareness and knowledge of the sector to debunk common misconceptions about psychedelics. While US respondents primarily advocated for knowledge-building (49%), UK investors saw potential in high-profile partnerships and general public engagement campaigns (49%). This calls for a dual approach: bolstering scientific credibility through rigorous research and disseminating this through a variety of channels to ensure it reaches a wide range of stakeholders, from investors and patients to medical professionals, politicians and the general public.

Engaging stakeholders: A unified vision with targeted tactics

The psychedelic medicine sector is transforming as our understanding of how these compounds work and the benefit they could bring patients increases. The potential is huge, but significant barriers to success remain and several of these challenges stem from an ‘image problem’ around psychedelic drugs. Companies navigating this complex landscape will need to craft tailored communications strategies to attract investors and educate the general public, while the wider sector will need to unify behind joint messages, visions, practices and standards.

If the above is of interest, or you would like to see a copy of our research presentation, please do not hesitate to get in touch to see how FTI Consulting may be able to help you tailor your communications and achieve your goals. You can reach us at [email protected].

Research methodology:

FTI Consulting conducted an online quantitative survey with n=104 institutional investors located in the U.S. and the UK from the 29th to 30th June 2023. A quota-based random selection process from the online panel was adopted to ensure representativeness and a similar number of respondents from each country was achieved. The online approach allowed respondents to participate at a time and via a digital device most convenient to them. Please note, that the general convention for rounding was adopted, so not all sums add up to 100%. For more information on the methodology please contact [email protected].

[i] Psychedelic Alpha (2023) Psychedelics Drug Development Tracker. Available at: https://psychedelicalpha.com/data/psychedelic-drug-development-tracker [Accessed September 2023]

[ii] COMPASS Pathways plc (2023) COMPASS Pathways Announces Up to $285 Million Private Placement Financing Joined by Leading Healthcare Investors. Published 16 August 2023. Available at: https://www.globenewswire.com/en/news-release/2023/08/16/2726398/0/en/COMPASS-Pathways-Announces-Up-to-285-Million-Private-Placement-Financing-Joined-by-Leading-Healthcare-Investors.html [Accessed September 2023]

[iii] Cybin Inc. (2023) Cybin to Acquire Small Pharma Inc. Published 28 August 2023. Available at: https://www.businesswire.com/news/home/20230828350890/en/Cybin-to-Acquire-Small-Pharma-Inc. [Accessed September 2023]

[iv] Mindset Pharma Inc. (2023) Otsuka Pharmaceutical to Acquire Mindset Pharma. Published 31 August 2023. Available at: https://www.newsfilecorp.com/release/179197 [Accessed September 2023]

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |