Nature-Related Disclosures – Advancing Our Understanding of Physical Risk

Biodiversity loss and other nature-related issues are increasingly recognized as having an impact on supply chains and businesses globally. Organizations that take swift action to assess physical risk as it relates to nature and biodiversity, align with frameworks such as TNFD, and prepare for the upcoming SEC disclosure rule can proactively identify and mitigate climate- and nature-related risk, gaining a competitive edge. By adopting these practices, companies can position themselves to more effectively evaluate their business risk in the face of increasing volatility caused by nature-related factors, while increasing support from environmentally conscious shareholders.

The launch of the Taskforce on Nature-related Financial Disclosures (TNFD) draft framework in 2020 sparked heightened discussions on the importance of nature and biodiversity-related reporting in ESG disclosures. These discussions culminated with a landmark agreement at the UN Biodiversity Conference (COP15) in late 2022, where leaders of 188 countries adopted the Kunming-Montreal Global Biodiversity Framework (GBF) – an agreement that aims to set global goals for biodiversity with equivalent ambition to the Paris Agreement for climate change. This plan contains 23 targets to be achieved by 2030,[1] and its successful adoption will rely on a significant contribution from the private sector. For example, Target 15 aims to ensure that large businesses will regularly monitor, assess and transparently disclose their risks[2] as they relate to nature and biodiversity. The agreement has already influenced the approach of international disclosure frameworks:

- TNFD, which has been endorsed by large financial institutions and corporations, released the fourth and final version of its beta framework in March and has announced that the full framework will be ready for market adoption in September 2023.

- The Science Based Targets Network launched a science-based nature target setting framework in May 2023[3] outlining the first three of five expected steps to accurately track and act upon corporate nature-related impacts.

- The Corporate Sustainability Reporting Directive (CSRD), which came into effect in January of 2023 to strengthen and standardize sustainability reporting for EU companies, will be impacting companies domiciled outside of the EU, as well. One of the CSRD standards targets biodiversity and ecosystems and will require disclosures on companies’ nature-related risks and impacts.

- Lastly, the final version of the SEC’s climate-related disclosure rule for the U.S. issuers is expected in October. Although nature-related disclosures were not included in the previous versions of the rule, reporting on risk management in the potential ruling includes disclosures on physical and transition risk, which are related to nature and biodiversity – this may include reporting zip code level physical risk exposures, including location of assets in flood plains.

As the trend towards greater focus on nature-related risks continues, it is becoming increasingly important for companies to proactively assess the potential physical risks arising from biodiversity loss and nature degradation. Such assessments will enable effective risk management and ultimately prove beneficial for companies. This is especially crucial considering that our economy is intricately linked to the health of global ecosystems. According to a conservative estimate from a World Bank report, if select ecosystem services, such as pollination or timber from trees, were to collapse, global GDP would decline by $2.7 trillion annually by 2030.[4]

Designed with ease of adoption in mind, the TNFD framework emphasizes the urgency of integrating nature loss with climate change disclosures. To provide standardization across ESG reporting, 11 of TNFD’s 14 recommendations are directly aligned with Task Force on Climate-Related Financial Disclosures (TCFD). Hence, assessing biodiversity and nature-related risks is a natural extension of the existing approach of the private sector to disclose on climate strategy, risks and opportunities. Building the infrastructure for assessing and disclosing nature-related risk is both in line with investor expectations and can facilitate more comprehensive risk management.

By identifying and analyzing the physical risks that a company faces due to its nature dependencies, companies can implement well-planned mitigation strategies that address potential supply chain disruptions, fluctuations in prices, and potential fines or litigation. Furthermore, aligning with reporting frameworks and providing more transparent evaluation to investors can increase ESG ratings and prevent reputational damage. As nature-related reporting frameworks continue to emerge, it is anticipated that policies and regulations will likely follow, as the SEC’s climate-related disclosure rules sets out an accelerated pathway for environmental disclosures to be translated into legislation.

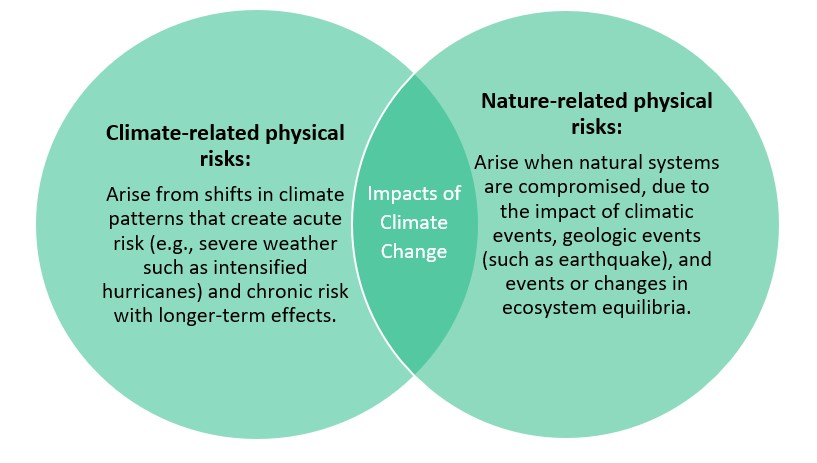

“Nature-related physical risks are a direct result of an organization’s dependence on nature. Physical risks arise when natural systems are compromised, due to the impact of climatic events, geologic events or changes in ecosystem equilibria, such as soil quality or marine ecology, which affect the ecosystem services organizations depend on… Physical risks are usually location-specific. Nature-related physical risks are often associated with climate-related physical risks.”

[Source: TNFD Framework]

Physical Risk

Organizations that align with the TCFD framework disclose climate-related risks and opportunities, including physical risk, which is further categorized into acute and chronic risk. Acute risks refer to event-driven risks such as extreme weather, while chronic risks are driven by longer-term effects of climate patterns. Both types of risks can have impacts extending beyond the organization’s boundaries and relate to the effects of climate change on the economy, humanity and ecosystems[5].

As the private sector begins to acknowledge biodiversity loss as one of the most severe potential risks for the next decade[6], responsible companies can strategically position themselves by expanding the scope of their current physical risk assessment under the TCFD recommendation to include nature-related risks and support early TNFD adoption efforts. Intrinsically, the evaluation of physical risks and impacts in TCFD coincides with the TNFD framework which explores the organization’s nature-related risks, including risks that arise from events or from the larger effects of climate change. Indeed, many rating agencies, such as S&P Global and Moody’s, have also expanded their capabilities in physical risk assessment and in quantifying physical risk scores for ESG credit ratings.[7]

According to the LEAP approach, which was developed by the TNFD to identify dependencies and impacts on nature, the first step for an organization to assess nature-related impacts is to locate its key operations and evaluate the direct dependencies on natural resources, such as water, forestry, minerals, and other raw materials. This process of examining the linkages between operational locations and their surrounding environments is comparable to the first phase in assessing climate-related physical risks, such as weighing the impact of regional extreme weather events on the organization’s assets and personnel. For example, an agricultural company heavily reliant on water resources is more vulnerable to natural disasters such as droughts, which can be considered as a physical risk that is both climate and nature-related. By locating and assessing their relationship with natural resources, companies will gain knowledge of how natural hazards and other extreme weather events may directly or indirectly affect their value chain and operations.

To capture the synergies between climate and nature- related physical risk, organizations need to expand the breadth of their data collection for the assets and key operations that are critical to their value chain. To identify the material risk topics that are prominent to a business, some of the variables to consider include:

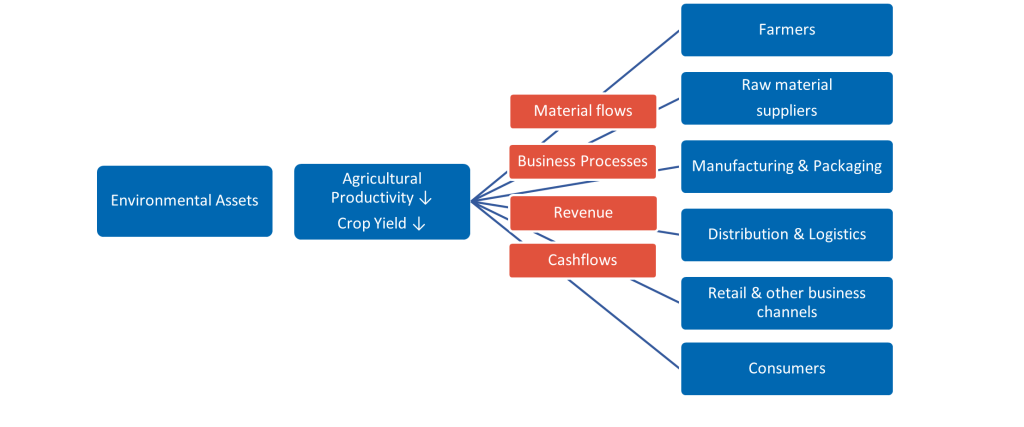

Examples of stakeholders who may be affected by decreased agriculture productivity:

Nature-related risk can have a ripple effect across the wider value chain. For example, a decrease in agricultural productivity due to nature-related physical risks, such as drought, flooding, or pest infestations, can have a cascading effect on every aspect of the value chain, from farmers to end consumers. A decrease in crop yield for farmers could mean reduced revenue from sales, leading to supply chain disruptions that can cause delays in production and potential revenue loss for manufacturing and packaging companies. Distribution and logistics companies may face increased costs from adjusting their routes and sourcing to accommodate the disruptions, and retailers may face shortages, price increases, and potential reputational damage from not meeting consumers’ demand. Consumers, in turn, may have to pay more for products or choose alternative options, leading to a shift in purchasing behaviors and increased market uncertainty.

Given the growing awareness and significance of nature-related risks, it is imperative that companies expand their risk assessments and enterprise risk management systems to account for the interrelated factors of the ecosystem. A critical first step in this direction is expanding the current physical risk assessment to include nature-related physical risks. By taking this approach, businesses can gain a deeper understanding of these risks and develop effective strategies to mitigate them, while also earning public recognition for taking proactive actions ahead of regulatory requirements. Ultimately, this can enhance companies’ resilience, ensure long-term sustainability, and create value for their stakeholders.

FTI Consulting has a deep bench of advisors with expertise spanning climate, ecology, geographic and risk analyses, value chain, carbon accounting, data management and sustainability reporting. If you would like more information on this or a related topic, please contact one of our experts.

[1] COP15 ends with Landmark Biodiversity Agreement. UNEP. (2022, December 20). [web log]. Retrieved April 13, 2023, from https://www.unep.org/news-and-stories/story/cop15-ends-landmark-biodiversity-agreement#:~:text=Currently%2C%2017%20percent%20of%20land,importance%20and%20high%20ecological%20integrity

[2] COP15: Nations adopt four goals, 23 targets for 2030 in landmark UN Biodiversity Agreement. Convention on Biological Diversity. (2022, December 19). [web log]. Retrieved April 13, 2023, from https://www.cbd.int/article/cop15-cbd-press-release-final-19dec2022

[3] The first science-based targets for nature. Science Based Targets Network. (2023, May 2024). Retrieved July 14, 2023, from https://sciencebasedtargetsnetwork.org/how-it-works/the-first-science-based-targets-for-nature/

[4] Johnson, J. A., Ruta, G., Baldos, U., et al. (2021). World Bank. The World Bank. Retrieved April 13, 2023, from https://openknowledge.worldbank.org/bitstream/handle/10986/35882/A-Global-Earth-Economy-Model-to-Assess-Development-Policy-Pathways.pdf;sequence=1

[5] Mazzacurati, E., Firth, J., & Venturini, S. (2018). Advancing TCFD Guidance on Physical Climate Risks and Opportunities., https://www.physicalclimaterisk.com/media/EBRD-GCECA_draft_final_report_full.pdf

[6] 2022 World Economic Forum Global Risks Report

https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf

[7] S&P Global News Releases, S&P Global Acquires The climate Service, Inc.

https://investor.spglobal.com/news-releases/news-details/2022/SP-Global-Acquires-The-Climate-Service-Inc/default.aspx

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com