The CSRD Will Have Far-Reaching Sustainability Reporting Requirements for Companies in Europe & Beyond

Download a PDF of this articleThe European Union (“EU”) has recently issued the Corporate Sustainability Reporting Directive (CSRD)[1] to standardize and enhance corporate sustainability reporting. The aim of this directive is to promote the European Commission’s broader Sustainable Finance strategy. The CSRD replaces the Non-Financial Reporting Directive (NFRD) with new, strengthened, and standardized requirements.[2] Importantly, this new legislation means that companies domiciled outside the EU may have to report and disclose against its standards, depending on their sales, assets, and/or employees inside the bloc.

To comply with the CSRD, companies are required to report sustainability information within management reports following the guidance provided by the European Sustainability Reporting Standards (ESRS).[3] The CSRD uses a double materiality approach that considers the impacts of environmental, social, and governance factors on a company’s performance, as well as society and the environment.[4]

Although there are similarities, the scope of the CSRD is broader than the NFRD. Approximately 50,000 companies will be required to comply with the mandatory reporting guidance over the next few years in a phased approach. This is a significant increase from the 11,700 companies required to comply with the NFRD today.[5] Many of the companies required to comply with the CSRD will come from outside the EU, and notably, the scope of the CSRD extends to privately held companies, including those held by private equity firms.

Privately held and PE-backed companies will likely contend with some of the largest incremental gaps in public disclosures and reporting processes. The CSRD will shift priorities for some private companies from a focus on minimizing reporting costs and operating as efficiently as possible to a more rigorous, compliance-based reporting approach. These companies should investigate the revenue thresholds and geographic attributes that will determine their reporting timelines and begin addressing these gaps.

Frequently Asked Questions on CSRD

Below, the authors present answers to common questions about the CSRD, why it is significant, and what to expect from this new regulation.

Which companies are required to comply with the CSRD?

The scope of the CSRD introduces requirements for all large companies in the EU, companies listed on EU-regulated markets, and non-EU companies with subsidiaries or branches in the EU.[6]

- Large EU companies currently covered under the NFRD will be required to comply with CSRD reporting in 2025 for the financial year 2024[7] and are defined as:

- EU-listed companies with more than 500 employees

- Designated EU public-interest entities (PIE) such as banks and insurers with more than 500 employees[8]

- Remaining large EU companies and EU subsidiaries are required to comply with CSRD reporting in 2026 for the financial year 2025[9] and are defined as companies located in the EU or with securities listed on an EU exchange having at least two of the following:

- Over 250 employees

- Net turnover greater than €40 million

- Assets greater than €20 million[10]

- EU listed small- and medium-size enterprises (SMEs) are required to comply with CSRD reporting in 2027 for the financial year 2026 with an option to opt out until 2028[11] and are defined as satisfying two or more of the following criteria:

- More than 10 employees

- Balance sheet total asset values exceeding €350,000

- Net turnover exceeding €700,000[12]

- Non-EU companies located outside of the EU, are required to comply with CSRD reporting in 2029 for the financial year 2028[13] and are defined as having one of the following:

- Net turnover greater than €150 million in the EU

- A large or listed EU subsidiary or branch in the EU generating revenues greater than €40 million[14]

The CSRD allows companies to consolidate the reporting at group level, exempting subsidiaries from publishing individual reports. The relevant information must however be included in the consolidated report and it must be highlighted individually if the subsidiary has a different risk profile.[15]

What does the directive require?

The CSRD introduces, for the first time, mandatory standards to provide capital markets and society with relevant, comparable and reliable information about companies’ sustainability performance. The EU aims to achieve in sustainability reporting what was achieved over decades in financial reporting and establish ‘generally accepted’ rules.[16]

Required disclosures cover companies’ risks and impacts in the field of sustainability as well as how sustainability is integrated into companies’ business strategy—and how the companies’ performance is affected as a result. Furthermore, externalities and impacts on nature and society must be disclosed even if the company does not internalize them and does not affect the company’s performance (‘double materiality’). CSRD-compliant reports must also include forward-looking information and cover impacts, risks and opportunities across the entire value chain.[17]

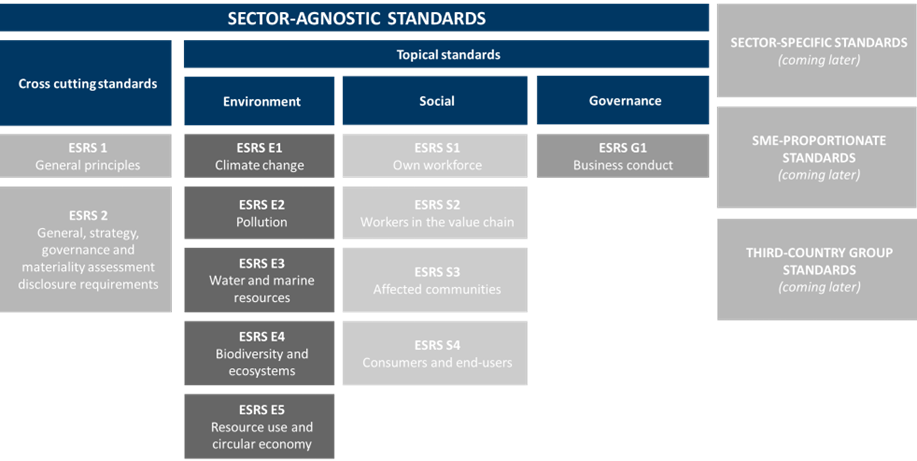

The spectrum of topics covered by the ESRS spans broadly across Environmental, Social, and Governance (see figure 1) including detail on a company’s climate transition plan, impacts from pollution, chemicals added to products, channels for affected communities to raise concerns, and workforce characteristics among other topics.[19] Many data points must be disclosed regardless of their materiality, and KPIs aligned with the EU Green Taxonomy of sustainable economic activities must also be included by all companies in scope. A description of the materiality assessment process is also part of the required disclosures, as well as disclosures covering the governance and internal controls established for sustainability reporting. Additionally, the report must be digitally tagged with the European Single Electronic Format (ESEF) to make reports machine readable.[20]

How will the requirements of the directive be enforced?

A company’s sustainability disclosures will be integrated into its regulatory reporting via the (consolidated) management report. It will therefore be subject to the same penalties and collective responsibility of those charged with governance, as required for financial reporting today. The responsibility of the Board and the Audit Committee will thus be extended to sustainability, as well as the role of competent public authorities. The statutory auditor will have to provide assurance on the sustainability report integrated into the audit report. The level of assurance will be limited until 2028 and then increased to a level of reasonable assurance (i.e., the same threshold used for financial reporting) thereafter.[21]

What are the next steps?

The European Financial Reporting Advisory Group (EFRAG), the independent body responsible for developing the reporting standards, is expected to finalize the ESRS by June 2023, potentially providing additional guidance on important aspects such as the double materiality assessment and a definition of the value chain, and the European Commission is expected to adopt ESRS into law in June 2023.[21]

EU member states are required to transpose the CSRD requirements into national law by June 6, 2024, no later than 18 months after the directive took effect in January 2023. As EU countries individually codify the CSRD, more information will become available regarding country-specific requirements along with the penalties for non-compliance.[22]

Additionally, EFRAG is expected to publish sector-specific and third-country guidance although delays to the sector-specific standards, originally set to take effect in 2026, have been announced without further updates on timing.[23]

What can companies do in the meantime to prepare?

Companies should begin preparing now, as there will be limited time between the adoption of the standards in June 2023 and their initial application in January 2024. Companies can take several steps now to strengthen their understanding of the impending regulation and begin compiling the resources and disclosures needed to meet the new reporting requirements. This may include, but not be limited to the following:

- Monitor updates to reporting standards and implementation timelines.

- CSRD reporting timelines vary based on geography and revenue.

- Despite the stated timelines listed above, recent delays to the sector-specific standards call into question whether additional delays or shifts to reporting timelines are possible.

- Review entity structures to understand how organizational boundaries, subsidiaries, and operations located in the EU affect your reporting options.

- The decision to report at the consolidated parent company-level or the subsidiary-level could shift a company’s required reporting timeline between 2026 and 2029 for entities domiciled and listed outside of the EU.

- Assess current gaps and identify information and internal controls necessary for CSRD compliance.

- Refresh company materiality assessment to align with the CSRD’s double materiality approach and specific ESRS topics.

- Assess the availability, tracking, cleansing, assignment of owners, and implementation of internal controls around data needed to meet ESRS disclosure requirements.

- Strengthen alignment with the recommendations of the Taskforce on Climate-Related Disclosure in preparation for future disclosure requirements around climate transition plan under ESRS E1 – Climate change.

- Identify gaps and risk associated with new information required under CSRD compared to information included in past public disclosures. Prepare messaging to accompany new disclosure requirements to position the company’s sustainability performance accurately and authentically.

How Can FTI Consulting Support Your Efforts to Prepare for CSRD?

Our broad range of expertise supports a unique combination of services related to CSRD preparedness that can be tailored to your company’s needs. Our capabilities span:

Get in contact with one of our experts to learn more about how FTI Consulting can support your ESG reporting, program development, and CSRD preparedness efforts.

[1] “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union (December 16, 2022), https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022L2464&from=EN.

[2] “Corporate sustainability reporting,” European Commission (last accessed April 13, 2023), https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en.

[3] “First Set of draft ESRS,” EFRAG (last accessed April 25, 2023), https://www.efrag.org/lab6

[4] Kolja Stehl, Leonard Ng, and Matt Feehily, “EU Corporate Sustainability Reporting Directive—What Do Companies Need to Know,” Harvard Law School Forum on Corporate Governance (August 23, 2022), https://corpgov.law.harvard.edu/2022/08/23/eu-corporate-sustainability-reporting-directive-what-do-companies-need-to-know/.

[5] “Corporate sustainability reporting,” European Commission (last accessed April 13, 2023), https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en.

[6] “Council gives final green light to corporate sustainability reporting directive,” European Council of the European Union (November 28, 2022), https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/.

[7] Ibid.

[8] Nora Hahnkamper-Vandenbulcke, “Briefing Implementation Appraisal: Non-financial Reporting Directive,” European Parliament, p. 3 (January 2021), https://www.europarl.europa.eu/RegData/etudes/BRIE/2021/654213/EPRS_BRI(2021)654213_EN.pdf.

[9] “Council gives final green light to corporate sustainability reporting directive,” European Council of the European Union (November 28, 2022), https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/.

[10] “Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting,” European Commission, p. 7 (April, 21, 2021), https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52021PC0189&from=EN.

[11] “Council gives final green light to corporate sustainability reporting directive,” European Council of the European Union (November 28, 2022), https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/.

[12] “Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting,” European Commission, p. 7 (April, 21, 2021), https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52021PC0189&from=EN.

[13] “Council gives final green light to corporate sustainability reporting directive,” European Council of the European Union (November 28, 2022), https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/.

[14] Kolja Stehl, Leonard Ng, and Matt Feehily, “EU Corporate Sustainability Reporting Directive—What Do Companies Need to Know,” Harvard Law School Forum on Corporate Governance (August 23, 2022), https://corpgov.law.harvard.edu/2022/08/23/eu-corporate-sustainability-reporting-directive-what-do-companies-need-to-know/.

[15] Article 29b, “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union (December 16, 2022), https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022L2464&from=EN.

[16] Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union (December 16, 2022), https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022L2464&from=EN.

[17] ‘First Set of draft ESRS,” EFRAG (last accessed April 25, 2023), https://www.efrag.org/lab6.

[18] “Draft European Sustainability Reporting Standards: ESRS E5 Resource use and circular economy,” EFRAG (November 2022), https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2F12%2520Draft%2520ESRS%2520E5%2520Resource%2520use%2520and%2520circular%2520economy.pdf.

[19] First Set of draft ESRS,” EFRAG (last accessed April 25, 2023), https://www.efrag.org/lab6.

[20] “Corporate sustainability reporting,” European Commission (last accessed April 13, 2023), https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en.

[21] Article 1, “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union (December 16, 2022), https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022L2464&from=EN.

[22] Article 29b, “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union (December 16, 2022), https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022L2464&from=EN.

[23] “Council gives final green light to corporate sustainability reporting directive,” European Council of the European Union (November 28, 2022), https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/.

[24] Mairead McGuinness. “Opening address by Commissioner McGuinness at the launch of 2023 PwC CEO Report – Europe,” European Commission (March 21, 2023), https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_23_1812.

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com

![Figure 2: The guidance outlined with each ESRS standard is detailed and prescriptive and covers material impacts, management, policies, targets, action plans, performance measurement, and EU taxonomy aligned activities.[18] (Click to enlarge)](https://fticommunications.com/wp-content/uploads/2023/05/CSRD-Picture-2-1024x576.png)