ESG+ Newsletter – 3rd June 2021

Your weekly updates on ESG and more

This week we examine contrasting global strategies to regulate proxy advisors; look at efforts to require corporations to back their pledges on racial equality with action; and, chart the latest ups and downs in Bitcoin’s fortunes courtesy of Tesla.

‘S’ pillar grows in significance – DWS

Research commissioned by DWS Asset Management continues to chart the rise of the ‘S’ in ESG as “an increasingly important driver of investment decision-making by pension funds, especially in light of the Covid-19 crisis” – something regular readers may recall we have highlighted previously. Carried out by UK research company CREATE, ‘Passive Investing: Rise of the social pillar of ESG’ surveyed 142 pension plans in 17 jurisdictions with a collective AuM of €2.1 trillion.

Reporting the findings, Institutional Asset Manager notes 66% of pension funds intend to increase their allocations to ‘S’ pillar passive funds over the next three years with 67% selecting their passive manager based on their track record of delivery of their client’s social agenda. While many respondents harboured doubts about the emerging stakeholder model of capitalism, the data suggest they are still prepared to “go with the flow”. While the signs are there for pensions funds that the ‘S’ pillar is gaining in importance it still lags behind ‘E’ and ‘G’, and the research argues that “the qualitative aspects of the social pillar-like health, welfare and education – are seen as generating positive externalities that are observable, not measurable. As such, they are ‘public goods’ that come under the realm of government responsibility, not capital markets”. As the world emerges from the pandemic and social contracts are already being forged between the business world and wider society, all sides would benefit from this maturing of ‘S’ picking up pace.

Companies under pressure to deliver on racial equity

Expect the spotlight to focus on companies who made pledges to act on racial injustice over the last year. Reuters reports that, on Tuesday, Joe Biden became the first sitting US president to visit Tulsa, Oklahoma to commemorate the hundreds of Black Americans who were massacred by a white mob in 1921. President Biden announced new measures that his administration is undertaking to narrow the racial wealth gap, which according to CNBC are focused on expanding equity and access to two key wealth generators for Americans: homeownership and small business ownership. As noted by Laura Morgan Roberts and Megan Grayson for Harvard Business Review, companies must do more than issue statements and make promises on racial equity: they “need to hold themselves accountable for action so they don’t simply maintain historical structures and cultures of racism” and that “some of the statements from last summer have already been met with scepticism from employees who claim that company proclamations of racial justice are hypocritical given the way they’re actually treated in the workplace.” Robert Johnson, founder of BET (Black Entertainment Television) agreed. Speaking to CNBC SquawkBox, he said companies need to be held accountable for the pledges they make for racial and economic equality and that “a pledge is meaningless if it’s not fulfilled.”

Governments actively reviewing Proxy Advisors’ rules and regulations

As the role proxy advisors play in capital markets remains under scrutiny, regulators are taking action to define an operating framework for the proxy advisory industry. In highlighting the need for more transparency among proxy advisors, the Australian government issued a Consultation Paper which closed on 1 June that proposed requiring proxy advisors to submit their voting report to issuers five days prior to publication to their clients. Additional proposals on more detailed disclosure around the voting process followed by superannuation funds, including the use of voting advice and independence requirement from proxy advisors, could impact the activities of the Australian Council of Superannuation Investors (ACSI). Representing and advising Australia’s retirement funds, which control on average 10% of all top ASX200 companies, ACSI is opposed to the government’s proposal stating that it has the “clear potential to impact the independence of advice, depending on the obligations that are imposed on researchers and the veto powers that are given to companies”. Local and international investors, including Dimensional Funds, also expressed their concerns on the potential for diminishing the shareholder voice and oversight of management.

The Australian government view contrasts with the new position taken by the US administration on the proxy advisor industry. Earlier this week, the US SEC announced that the restrictions introduced in 2019 and 2020 under the Trump administration, which required proxy advisors to disclose how their voting recommendations were made and submit their research to listed companies before their investor clients received it, will not be enforced. Taking on board the criticism of weakening investor power, the SEC will draft a proposal to revisit the rules giving some relief to proxy advisors – for now.

Bitcoin slumps on environmental concerns; some investors play the long game

Elon Musk, CEO of Tesla, recently announced that customers would no longer be able to purchase vehicles via Bitcoin, citing concerns over the “rapidly increasing use of fossil fuels for Bitcoin mining and transactions.” This decision, coupled with growing calls for greater environmental and regulatory scrutiny from China, Europe and the US, resulted in a 28% fall in Bitcoin’s value over the course of recent weeks. However, some investors remain undeterred by both the growing public scrutiny and the slump in value. Cathie Wood, the founder, CEO, and CIO of Ark Investment – one of the largest investors in Bitcoin and one of its most staunch public supporters – stated that, while environmental concerns might result in a brief pause in institutional buying of Bitcoin, she believed that regulators will “be a little more friendly over time.” This bullish long-term investor sentiment was echoed by Iris Energy, a Bitcoin mining business, who believe that cryptocurrencies will overcome ESG concerns in the long run. Iris Energy, which is reportedly considering options for a SPAC, stated that it should not be up to “any individual to decide where energy should be used” rather a “market-based decision.”

To attract more longer-term capital and mainstream investment, Bitcoin will have to answer its environmental questions and put a long-term sustainable plan in place for the mining of it. If not, many investors may continue to view it at odds with the principles of ESG.

Considerations for companies in the ESG goal-setting process

With momentum firmly behind the importance of ESG, boards are under increasing pressure to incorporate ESG goals and objectives into their decision-making process. A recent spate of academic studies has debated whether traditional corporate purposes – such as profit or market value growth – should be replaced by pursuing social goals, most recently in an FT Special Report, featuring research from University of Chicago Booth School of Business professor Luigi Zingales. In the article, Zingales suggests that companies “should embrace these objectives whenever it is good for business”. This approach implies that the execution of an ESG strategy may negatively impact the business’ bottom line – with Zingales stating that, where it does, companies need to “ask their shareholders how much of their profit to sacrifice — and for which objectives”. Taking action without such guidance is cast as “anti-democratic, dangerous and destructive.” These findings may provide some basis for government policy and regulation to push towards more supportive frameworks for shareholders in voicing their opinions.

ESG – Common knowledge or not?

Are ESG principles embedded in the consciousness of everyday Americans? A recent Gallup poll in the US would indicate so, with findings showing that the majority of US adults view “how well companies promote certain environmental and social goals, as well as whether they engage in good corporate governance, matters to them when choosing which companies to buy from.” The poll asked Americans how much each of five corporate actions matters to them when choosing whether to buy products or services. It revealed that 84% of respondents consider how a company treats its employees before becoming a customer; 81% said they value how a company impacts their local communities, and 75% factor in how a company impacts on environment. This follows on from a previous survey conducted by Gallup which found that 69% of US workers note a company’s environmental record as a factor when applying to jobs. However, despite valuing some of the central principles of ESG, 64% of respondents were “unfamiliar” with the term ESG’ While the term ESG may not be on the tip of the tongue of the US public, it is evident from this Gallup poll that many of the central ESG principles and objectives are clearly being factored into decision making. Companies should be cognisant of this, ensuring that its values, culture, and the transparency of how it interacts with stakeholders, are central to how the business operates and reflects the expectations of its customers.

Could a four-day working week slash our carbon emissions?

While previous studies into the four-day work week have focused on the potential benefits in terms of better work/life balance, improving workers’ mental and physical health, improved productivity and strengthen families and communities, a new report by environmental organisation, Platform London, argues that a four-day working week would reduce the UK’s carbon footprint. The report highlights that the UK’s carbon emissions would lower due to a reduction in the emissions from high-energy workplaces and commuting to work. Furthermore, the report also details that, when you give workers an extra day off, it invariably results in an increase in the amount of “low-carbon” activities they enjoy from rest to exercise, community-building to seeing family, helping reduce overall consumption. Laurie Mompelat, an environmental researcher at Platform London and author of the report, said that “a shorter working week without loss of pay is a crucial investment in human capital, at a time where everyone’s contribution, care and creativity is required to bring about a more sustainable society.”

In Case You Missed It

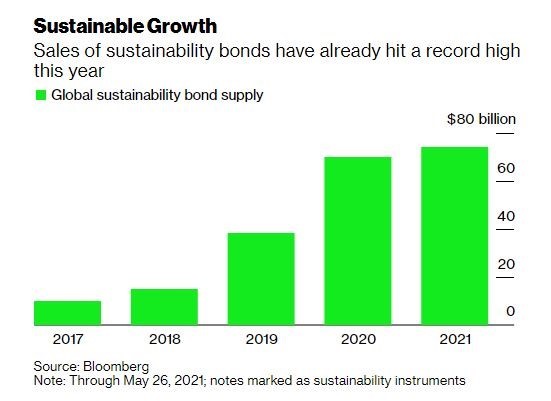

- Previously we have written about investors paying a perceived ‘Greenium’ for green bonds. However, Reuters published an article that suggests that the sustained increase in ‘green’ issuances is eroding the price differential with regular issuances. See more in our graph of the week.

- Earlier this week, the Investment Association (IA) called on the G7 to follow the UK’s example of requiring firms to be more transparent regarding their exposure to climate risks. The IA also demanded that the G7 issue sector-by-sector guidance to companies to help meet the Paris Agreement climate goals and transition to a more sustainable future.

- Staying on the theme of increased sustainable reporting transparency, Swiss financial watchdog, FINMA, issued an amended publication this week that will require Swiss banks and insurance companies to provide qualitative and quantitative information about risks they face from climate change. These changes will take effect from the start of July and follow similar moves by the European Central Bank.

Chart of the Week

As outlined, the sustained increase in ‘green’ issuances appears to be eroding the price differential with regular bond issuances. Our graph of the week illustrates the growth in sustainable bond issuances with 2021 already exceeding last year’s total issuance within the first five months of this year.

Source: Bloomberg

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |