ESG+ Newsletter – 29th April 2021

Your weekly updates on ESG and more

As calls for greater consistency in sustainability reporting grow across the globe, we look at the latest regulatory focus in the EU and the US, while in Australia superannuation funds are taking matters into their own hands. Those two major economies are also attempting to compete for greater impacts on emissions, albeit through different strategies. We also look at COVID’s potential impact on two contentious areas: executive pay and activism. Finally, while data seems to point to EU funds continuing to outperform US companies in terms of ESG ratings, the scrutiny on what is driving outperformance in this area continues…

European Commission moves to overhaul framework for corporate disclosures on ESG issues

Last week the European Commission published a package of measures to overhaul non-financial/ESG reporting to “channel money towards sustainable activities” and positively contribute towards “making Europe climate neutral by 2050”. The package included a proposal for a Corporate Sustainability Reporting Directive (CSRD), which will revise and extend rules initially introduced by the Non-Financial Reporting Directive (NFRD). The proposed Directive would require large EU companies, and companies listed on an EU-regulated exchange, to use the same set of standards to report on ESG matters every year with the intention to “create a set of rules that will – over time – bring sustainability reporting on a par with financial reporting”. This would repair a fundamental weakness of the NFRD according to Social Europe, which provides flexibility for companies around reporting and reduces “comparability”. In addition, companies would be required to report not only retrospectively but also set out their sustainability strategies and targets, and on their “due diligence” processes used to identify negative impacts and risks — including in their supply chains. The next step is for the European Parliament and Council to negotiate a final legislative text based on the Commission’s proposal. The average length of the EU legislative procedure is around 18 months, but this move by the Commission serves to highlight that mandatory sustainability disclosures will arrive sooner rather than later.

SEC public consultation on climate change – FTI’s take

From Europe to the US, in response to last month’s call from the Securities Exchange Commission (SEC) for public input on the current status of climate change disclosures, FTI’s latest insight offers the SEC some food for thought on their climate change consultation process – pointing out that the completion of this process, which is scheduled for the end of June, is unlikely to conclude the issue. Prior to the call for input, there was already a strong trend towards disclosure that is more thoughtful, data-driven, and in accordance with the idea of materiality set out by the US Supreme Court.

A key pitfall in the ESG reporting landscape identified is the absence of an SEC-designated standard-setter and a centralised body that highlights the value in each standard setters’ framework. In an effort to benefit corporate issuers and institutional investors, the following are practical steps for the Commission to consider:

- Determine which standard-setters are worthy of official designation (presumably, SASB, GRI, TCFD, and CDP);

- Develop a centralised oversight structure with authority to provide guidance to registrants on relevance, applicability, and implementation of designated standard-setters; Encourage further collaboration among designated standard-setters to enhance alignment and transparency; and

- Provide clear guidance to registrants on how designated standard-setters specifically overlap with a streamlined roadmap to enable relevant implementation.

Differing approaches, same emissions objective

On the back of Earth Day last week, an important milestone in the effort to reduce global emissions may have been reached. In the US, the Biden administration announced its commitment to cutting greenhouse gas emissions in half by 2030, part of the Paris climate agreement which the Trump Administration withdrew from. In Europe, the EU Commission reached an agreement to set into European law the bloc’s commitment to reduce greenhouse gas emissions by at least 55% over the next decade, with the goal of being carbon neutral by 2050. However, there are differing approaches, as set out in the Financial Times. The US will largely focus on investing in green technologies to combat their emissions, while the EU will adopt a multipronged approach which combines a mix of the “bloc’s regulatory might and investment in energy innovations, plus an advanced system of carbon pricing, to spur the consumer changes needed to drastically cut emissions”. Despite the differing approaches the ambition is clear, and the targets have been set, which will keep the objective of lowering emissions atop the agenda of regulators and investors across the world.

FTSE 100 companies avoid employee directors

Board Agenda carries coverage of the first deep dive into the use of workforce engagement provisions under the UK Corporate Governance Code. Despite workers on boards being a hot topic following the demise of BHS and the appointment of Theresa May as conservative leader, not a single FTSE 100 company has opted for an employee director as part of their implementation of the 2018 UK Code. While pointing to the flexibility of the provisions being appreciated by companies, the research found little evidence of how other means of engaging with employees fed through into Board decision-making, which is the ultimate goal of Provision 5 of the UK Code. As permitted under the UK Code, a substantial number of companies opted to go with their own engagement structures. With company commitments to ESG reaching higher levels almost daily, we wonder whether we will see the tangible actions to alter governance frameworks necessary for a real shift in company practice.

Could COVID see the end of LTIPs?

In April 2016, Chairman of FTSE 100 Weir Group, Charles Berry commented that long-term incentive plans (LTIP) did not work in volatile markets. The declaration came after the company’s shareholders voted down a proposal to replace the company’s performance-related pay scheme with one based on guaranteed awards of restricted stock. As the Financial Times reported this week, Mr. Berry may have been ahead of his time on this issue as many Boards around the UK are recently discovering that the COVID-19 pandemic has led to even greater scrutiny of remuneration awards. The Financial Times’ Helen Thomas notes that the factors that can make setting sensible LTIP targets difficult — such as volatility, structural sector upheaval, or just the need for a longer-term view — are likely to be more common in the post-pandemic world. Restricted stock plans, in contrast, tend to be longer term and paid over at least a five year term as against three years for a more traditional LTIP. ESG concerns may also be better addressed through long-term stock ownership than LTIP goal setting, as argued for by professor Alex Edmans. While these plans may not work for every company, shareholders will want to see a strategic justification for making a change in any remuneration award structure. Regardless, this will be a tumultuous pay season thanks to the pandemic which may well force a rethink in Boardrooms across the globe.

Boards need to be ready to deal with COVID-fuelled activist tactics – Nasdaq

While the levels of shareholder activism decreased in 2020, it is generally expected to rebound as the business world begins to re-open as we continue to exit the pandemic. Exactly how this unfolds is the subject of a Nasdaq article by Lawrence Elbaum of Vinson & Elkins, who argues that Boards will need to be ready for the new post-pandemic environment where new and evolving activist tactics can quickly overtake traditional ‘set play’ responses, potentially leaving unprepared companies “sluggish and vulnerable”. Prior to COVID-19, ESG levers were firmly in the mainstream of activist narratives and campaigns and the pandemic could offer investors the platform to pull them if they perceive poor ESG integration and performance. Now, with company social ‘profiles’ and credentials under fresh scrutiny, Elbaum warns that companies should not wait too long to tell their stories as those “facing activist scrutiny needs to view itself as a defendant in the court of public opinion”. A “golden decade” of activism followed the 2008 financial crisis. Could we see a repeat in the post-COVID world?

Tesla and Bitcoin – an ESG contradiction?

Earlier this week, Tesla announced its Q1 Results which beat expectations largely due to environmental credit sales to other automakers and the sale of 10% of its Bitcoin holdings. The bitcoin sale helped generate $101 million in income with Tesla CEO, Elon Musk, tweeting that the sale was to “to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet.” This sale followed on from Tesla’s decision in early February to invest $1.5 billion in bitcoin so that customers could use the cryptocurrency to pay for its cars and other products.

While some viewed Tesla’s decision as a potential game changer in legitimising cryptocurrencies among “blue chip” companies, others highlighted that the move was at odds with Tesla’s stated ambition to “accelerate the world’s transition to sustainable energy” due to cryptocurrencies’ extremely energy-intensive nature, and large carbon and environmental footprint.

Tesla’s move into bitcoin will likely challenge the company’s clean energy credentials and attractiveness for ESG investors, with many likely taking the view that they can’t keep the company in any ‘green’ portfolio while it is involved with bitcoin. For Tesla, it still holds 90% of its original Bitcoin investment and Musk has been a high-profile supporter of cryptocurrencies for some time, meaning Tesla is unlikely to change its position any time soon.

US ESG scores improving but still behind Europe

Data from Refinitiv shows that US companies’ sustainability improved in 2020, with the average ESG score, which is based on a 0-100 grading system, increasing to 44.2 in 2020 from 42.8 in 2019. The Refinitiv data, which is based on US companies with a market cap of at least $5 billion, further shows that the consumer discretionary, industrials, and technology sectors had the highest ESG scores last year, while the mining sector lagged behind. However, despite this improvement, Europe is still ahead of the ESG curve with an average score of 58 in 2020. Europe maintains its position as a pioneer in the ESG space and US companies will need to continue to improve sustainability disclosures to catch up. Additionally, these ESG scores from Refinitiv, and other data providers like MSCI, are crucial for companies because improved ratings can lower their cost of finance in the capital markets. Investors are now more frequently using these ratings in their analysis, with higher ratings also increasing a company’s chances of being included in a sustainability-focused indices and funds.

What underlies ESG fund outperformance

There is a growing number of academic studies dismissing the popular assumption that ESG strategies drive superior returns while doing good. According to Institutional Investor magazine, research from Scientific Beta, a smart beta index provider owned by Singapore Exchange, 75% of the outperformance of ESG strategies was attributable to a portfolio of higher quality companies. These findings point out that well-governed companies tend to be more sustainable over the long-term, generate higher fundamentals and therefore become more attractive for investors. Another conclusion is that strong performance of ESG strategies is driven by the increased focus on ESG investments which resulted in a higher money flows into certain stocks driving superior performance. On the other hand, the stock price alteration generated by the ESG momentum has been an opportunity for hedge funds to invest in stocks cheaper than their fundamentals such as “sin stocks” with the benefit of extra returns. While the value of ESG investing is undisputed, the new studies are suggesting that viewing outperformance as the main driver may misrepresent the true benefits of ESG strategies.

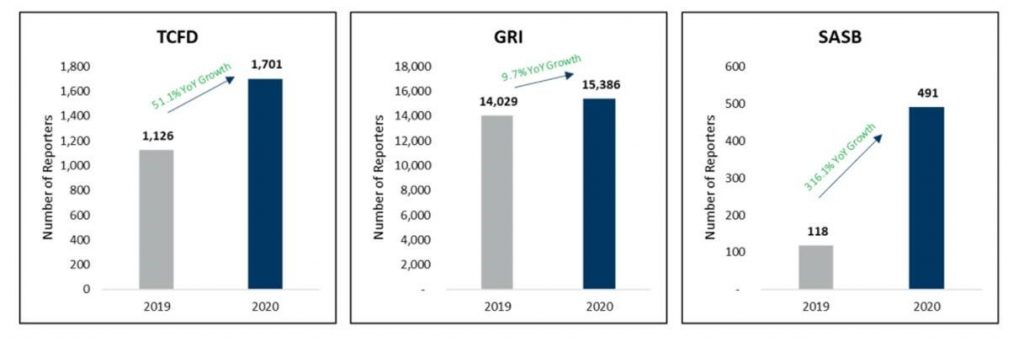

Chart of the week

Source: FTI Consulting Report

Source: FTI Consulting Report

In Case You Missed It

- Glass Lewis, a leading independent proxy adviser, published a special report on Racial & Ethnic Diversity in the Boardroom this week, which provides insights into why companies do (and do not) disclose racial & ethnic diversity and their processes for disclosing information regarding diversity policies and demographics. The report is based off feedback from their annual engagement programme with over 50 companies within the S&P 500 during Q3 and Q4 in 2020.

- In the first quarter of this year, investment into ESG ETFs took in a record $25.8 billion overtaking investment into all other ETFs which stood at $22.3 billion. This Financial Times article looks at the key drivers for this ESG investment trend, while also outlining why some are urging caution about potential “greenwashing” with these products.

- Recent CDP research report has highlighted that corporate accounting for the cost of carbon is rising, with 80% of the 6,000 companies surveyed confirming that they currently use an internal carbon price or plan to implement one within the next two years.

- The Australian Council of Superannuation Investors’ (ACSI) – a group of 37 Australian and international asset owners and institutional investors – has threatened to vote against the re-election of Directors of companies that don’t respond adequately to climate-related risks. Its new climate change policy aims at improving “how companies, particularly those which are highly exposed, approach climate risk for the long-term benefit of investors.”

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |