ESG+ Newsletter – 23rd September 2021

Your weekly updates on ESG and more

In this week’s edition, we look across the ESG spectrum, from whether sustainable finance is truly sustainable, to how health and wellbeing is rising up the agenda with diversity, and ask if additional reviews will delay the much-awaited EU Taxonomy. We also analyse the rise in green bond issuances and the risk of a bubble, before looking at whether the UN SDGs are destined for failure without a significant uptick in funding.

ETFs not helping the fight against climate change

According to data from Morningstar, the assets of “sustainable” funds have tripled between the end of 2018 to mid-2021. To most that are fighting for a cleaner future that appears to be quite a promising statistic. However, as reported by the Financial Times, statistics like that may be misleading on the true effect these funds have on fighting climate change and other environmental issues. A paper from Edhec, a French business school and think-tank, states that these ETFs are in fact starving the sectors that are most crucial to the transition to a cleaner economy. Edhec’s paper analysed Europe-listed ETFs and found that 35% of companies that have a deteriorating environmental performance have been rewarded with an increase in weight. The issue is that many of these ETFs only look at a singular “green” score, without adjusting for context or penalising companies. Additionally, in many instances, the weighting is determined by market capitalisation or emissions intensity, not overall environmental performance. Kenneth Lamont, a senior fund analyst at Morningstar, argues that there is a lack of consensus on what determines sustainable investing and that asset managers often make choices based on client demand, instead of what could be truly best for the environment.

A wake-up call on workforce wellbeing – WEF

Spurred on by global events ranging from the disruption of COVID-19 and mass social movements for social justice, 2020 was a wake-up call for employers. That’s according to Kelly McCain, Head of Healthcare Initiatives with the World Economic Forum. As many as 11.5 million workers resigned from their jobs between April and June of 2021 in the U.S. alone. The culmination of these factors means that boardrooms must respond, and workforce wellbeing is moving right up to the top of the priority list, particularly in sectors deemed to be an ‘employee’s market’. According to McCain, some companies are responding by appointing Chief Health and Chief Medical Officers to their boardrooms, with the mandate to build a culture of health in the workplace. For their feature, WEF reached out to six people in such roles to get their perspective. Among the key initiatives recommended are deploying extensive use of health technologies, informatics and analytics; the use of a wellbeing index to identify trends; shared initiatives between human resources and emergency management teams and internal wellbeing champions who can help drive cultural change and build workplace resilience through the day-to-day interactions at a team level.

Pressure on businesses to improve climate impacts and disclosures

With COP26 on the horizon, stakeholder expectations are rising, and the spotlight is on business. In the UK, the Competition and Markets Authority (CMA) has warned businesses they have until the New Year to make their environmental claims comply with the law. The CMA has released the “Green Claims Code” to assist businesses in compliance and to help communicate their green credentials while reducing greenwashing. The code focuses on six principles based on existing consumer law to ensure businesses are transparent and do not hide information but rather consider the full life cycle of products. The Science Based Targets initiative (SBTi) has called out companies for making empty and unmeasurable climate pledges and says only 20% of GT20 countries have committed to the initiative. Despite the upsurge in sustainability commitments we have seen over the past few years, a lot of the companies are not walking the talk according to Bloomberg. COP26 is going to further highlight any deficiencies in the ESG landscape and add pressure to businesses who are not integrating sustainability into corporate strategy and decision making.

It is for this very reason that we have invited the SBTi to detail their approach and how they are helping companies demonstrate real effort and change to all stakeholders. Details for the event on 14 October are at the beginning of the newsletter.

The SDGs face a funding shortfall and are set to miss the 2030 goals

The UN’s Sustainable Development Goals (SDGs), which are designed to help tackle poverty, inequality, injustice and climate change, are facing a funding shortfall. Reuters reports that the initiative faces a $100 trillion funding shortfall and will likely fail to meet the 2030 goals unless 10% of global economic output is directed to the UN targets every year between now and 2030. The SDGs have also been further hampered by the impact of the COVID-19 pandemic. After a slow start, the global finance industry has started to do more, with $9.5 trillion committed to 2030 and a record $2.1 trillion deployed in 2020. Nonetheless, the report – by the Force for Good Initiative – believes there are imbalances in the way the money is invested. Although there is a funding gap across all the goals, the funding is predominantly going towards climate change with human, economic and social goals receiving significantly less attention.

European Taxonomy at risk of significant delay

The European Taxonomy may experience delays as the Council of the European Union has requested a two-month extension to scrutinise an important piece of legislation which will add further details necessary for its implementation. The so-called Delegated Act (DA) delivers technical screening criteria for the first two environmental objectives of the EU Taxonomy (climate change mitigation and climate change adaptation). The prolonged period of review is likely to jeopardise the Taxonomy’s stated application date of 1 January 2023. The move has been spearheaded by a group of Member States led by France in an attempt to merge two separate Delegated Acts. It seems that the Member States in question are trying to leverage the discussions around the Delegated Act to influence negotiations on the controversial integration of nuclear energy and natural gas as environmentally sustainable activities in the Taxonomy. In this context, there is a risk that the negotiations might lead to a stalemate – potentially dealing a temporary blow to the Commission’s sustainable finance objectives and its broader green agenda.

As green bond issuances grow, does a bubble loom?

The Bank for International Settlements (BIS), the global watchdog for central banks, has warned that a green bond bubble may be emerging and that it could match the dotcom and sub-prime mortgage bubbles which precipitated the two most recent global financial crises. In its Quarterly Review, BIS argues that the scale and growth of ESG financing and green bonds is “comparable [with] the private label mortgage-backed securities” before the 2008 financial crisis, a similarity the BIS called “noteworthy.” The report went on to add that “ESG assets’ valuations may be “stretched” with evidence of a ‘greenium’ being a signal that the market is overheating and could lead to “large price corrections” which would be consistent with historical financial trends of previous bubbles.

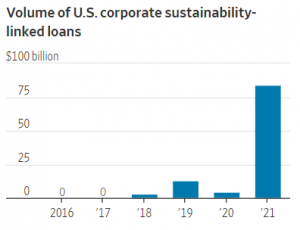

Despite this market speculation about a potential green bond bubble, companies and investors seem undeterred. Over the last 18 months, there has been exponential growth in green and sustainability linked loans, with the Climate Bonds Initiative projecting that the green bond market will set a new record for issuances, eclipsing $500 billion by year-end. The Wall Street Journal this week also highlighted that more companies are adding sustainability linked targets to capital and debt raises than ever before, with executives using these financial products as a way to highlight their sustainability initiatives to investors, customers and employees.

Despite growth in green bonds, there remains a lack of common global standards and data attached to them – a recurring theme across the ESG landscape. Additionally, there is no clarity on whether companies have paid a higher interest rate for missing their targets so far. However, as investors continue to pressurise companies to speed up their transition to a sustainable business model, these issuances will likely continue to grow, potentially fueling further speculation about a bubble.

Diversity at Board level – dismissed or dealt with?

Boards that are pale, male and stale may have had their day in the sun, but the realisation of true boardroom diversity may still be a distance away, as calls grow for boardroom diversity to extend beyond gender, bringing both ethnic and social considerations into the fold. Australia acts as a good case study, as it is deemed by the Sydney Morning Herald to have made meaningful progress on company boards “in a year when sexual harassment scandals shook federal politics”. While every company in the ASX 200 now has at least one woman director, women make up just 6% of CEOs at ASX 300 companies as of June 30 of this year – the same figure that was reported four years ago.

The SMH notes that a report by the Bankwest Curtin Economics Centre released last year showed that having more women on boards delivered greater company performance, profitability and productivity. There is no shortage of evidence on this, so it raises the question of whether those three ‘Ps; are really the core matter at hand, or whether for the pale, male and stale, it is about maintaining the status quo. In line with issues of gender balance in executives (as opposed to just non-executives), the Financial Times maps the growth of the Chief Diversity Officer and the extent to which diversity has increasingly featured on company earnings calls. Lanaya Irvin, chief executive of Coqual (a US non-profit think-tank that researches diversity and inclusion) told the FT that although “CDOs are in demand, companies may not be prepared to hear what they have to say, leaving some diversity heads feeling overwhelmed or sidelined.” The FT also alludes to how companies are broadening out the definition of diversity beyond “the pure HR end” to include a diversity of products, suppliers etc. Whether that waters down or replaces the push for diversity within the workplace is another question.

Finance industry urges regulator to revise crypto capital rules

The finance industry is pushing back on regulators’ proposed capital rules for crypto assets, arguing that they’re overly stringent and could deter banks from participating in crypto assets. The Basel Committee on Banking Supervision, in an attempt to address volatility and other risks associated with digital assets, has proposed that these assets be classified into two categories. Assets that are more akin to conventional securities, such as stock tokens and fully reserved ‘stablecoins’, would fall under modified existing rules on minimum capital standards. However, other assets, such as Bitcoin, would fall under a “conservative” regime which would see them treated equivalent to the highest risk asset classes. This would require banks to hold enough capital in reserve to cover any losses on those assets in full. A joint letter to the Basel Committee from several financial industry groups has requested greater flexibility, stating that these rules would act as a deterrent to banks and serve to drive crypto activity underground.

An additional conundrum is whether crypto can be considered a sustainable asset class. The UN has recognised that there are many social benefits associated with crypto assets, such as speedy and secure access to finance for disadvantaged groups and nations. However, the energy consumption associated with the generation of cryptocurrencies remains a concern, particularly the use of fossil fuels. Efforts are being made to address this by making the mining process more efficient and, as we discussed previously, by using greener energy sources. While there are many parties with a vested interest in the success of crypto assets, the road ahead remains uncertain.

In Case You Missed It

- A recent report by Refinitiv noted that member states of the European Union are leading the way in diversity and inclusion (D&I) practices. Eight European countries made it into the top 10 for the diversity singular score, headed by Denmark. The singular score for inclusion has a more varied top 10 composition, with South Africa on top, followed by Japan and Italy. – IR Magazine

- Bloomberg Green reports that Bill Gates raised more than $1 billion in corporate funding for Breakthrough Energy Catalyst Gates, which he established to accelerate the commercial viability of four key solutions to the climate crisis: green hydrogen, sustainable aviation fuel, long-duration battery storage and carbon capture from the air.

- Last week, Fitch Group announced the launch of Sustainable Fitch, which it says “will offer a comprehensive range of ESG Ratings products at both an entity and instrument level for all asset classes globally”.

Chart of The Week

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please click here to input your details or email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |