ESG+ Newsletter – 1st April 2021

Your weekly updates on ESG and more

On the first of April, we eschew jokes and instead take a look at how climate commitments continue to ramp up from the world’s largest investors and ask whether the same level of focus will be placed on debt markets this year. We also discuss the latest example of integration between remuneration and ESG; analyse what truly underpins a strong D&I strategy; review the latest developments in shareholder resolutions in the US, and consider whether ESG may hold one of the keys to building back better.

Climate commitments and green financing – what is next?

This week, it was announced that BlackRock and Vanguard, two of the world’s largest asset managers, were among a group of 43 investment firms that have signed up for the Net Zero Asset Managers initiative. This group, which represents more than $22.8 trillion of assets under management (AUM), has committed to cutting the net greenhouse gas emissions of their portfolios to zero by 2050 or sooner. Following this announcement, Net Zero Asset Managers Initiative, which was set up last year, now has a total of 73 signatories representing $32 trillion in AUM or roughly 36% of the global total.

As companies and asset managers the world over sign up to climate pledges, scrutiny will continue to grow in the burgeoning ESG debt financing market. Last year, ESG labelled bonds totalled $732 billion as companies capitalized on this growing financing trend. However, some investors are becoming increasingly concerned that they are not having sufficient impact. Mark Dowding, Chief Investment Officer at BlueBay Asset Management, stated that this type of financing is attractive to ESG investors “if the issuance leads to issuers actually changing their behaviour.”

While the Net Zero Asset Managers initiative is undoubtedly an important step in holding companies to account to ensure they are reducing emissions, we expect the scrutiny to increase on how the new “green” economy is being financed and whether investors, financiers and asset managers are able to use their considerable influence and resources to hold companies to account.

Mastercard to link bonuses to ESG goals

Reuters reports that Mastercard, which earlier this year pledged to achieve net-zero emissions by 2050, has joined the growing band of companies to link bonuses for its senior executives to ESG initiatives. According to CEO Michael Miebach, the purpose of this programme of incentivisation is to “encourage and reward performance that helps us achieve our goals — financial goals, of course, as well as strategic goals…We believe these ESG goals, which our senior leaders have the ability – and responsibility – to influence, will help our business grow and thrive for years to come.”

The incorporation of ESG measures into executive remuneration is a topic we have written about in the past. As one of our own colleagues put it this week in IR Magazine, “There is a market-wide trend [on integrating ESG measures] because, increasingly, every listed company either recognizes internally that this is key to its business strategy and risk, or it’s being told that by its largest investors.” Mastercard is just the latest business to communicate that.

Placing employee benefits at the heart of human capital strategies

In a bid to harness gender equality, and to attract and retain key talent, Swedish carmaker Volvo has indicated that it will give six months’ paid parental leave to its 40,000 employees worldwide. The company is looking to augment its standing with prospective workers in the highly competitive automotive industry. Under the plan, staff who have been with the company for at least one year will be entitled to 24 weeks of paid parental leave while receiving 80% of their base pay during the period.

According to CNBC, either parent will be eligible, and the leave can be taken any time within the first three years of parenthood. The “Family Bond” initiative will also cover employees who become parents through birth, adoption, permanent foster care and surrogates; as well as non-birth parents in same-sex couples. Many other companies may look to adopt Volvo’s approach ensuring that they retain their attractiveness as an employer. It is also further evidence of the growing sophistication of placing the ‘S’ at the core of business and ESG strategies. With this space perhaps associated with platitudes and ambition more so than others, the key to unlocking real diversity, inclusion and belonging may lie – in part – in intangibles, offering employees the real-life benefits associated with a “great place to work”. One would also be forgiven for wondering whether politicians might take note…

Executive remuneration and retention of top talent

The UK risks a post-Brexit exodus of top talent unless firms are allowed to pay bosses more without pressure from investors, according to the chairman of one of the world’s biggest gambling operators. Barry Gibson, chairman of Entain, whose brands include Ladbrokes and Coral, told the Daily Telegraph that “de facto caps” on executive remuneration set by influential shareholder advisory firms “have the right intention, but often the wrong outcome”. Furthermore, Mr Gibson believes that these pay caps could hinder business growth, highlighting that in a “post-Brexit world, there is vast potential for ‘Global Britain’ to thrive on the international business stage.” While it is true that the UK, and Europe more broadly, are leading other countries and regions in connecting strategy, ESG and pay; it may be too early to jump to the conclusion that this will lead to a “brain drain” of executive talent and that the UK’s bench strength should certainly not be underestimated. Mark Northway, chairman of influential shareholder NGO, ShareSoc, agreed that Britain had experienced a “migration of talent” to the US but “there are an awful lot of extremely talented chief executives in the UK.”

Europe’s greenwash-slayer becomes Trojan Horse

Recent leaks suggest that the EU’s taxonomy, designed to encourage European companies and financial groups to report on what proportion of their revenue and capital expenditure is “green”, is just not stringent enough. A recent Reuters Breakingviews article highlighted how a draft proposal would “allow investors to label more efficient new gas power stations as green until 2025,” affording leniency towards companies and industries that would otherwise be seen as some of the worst greenhouse gas emissions offenders. With these new proposals, it makes it harder to justify how the EU’s taxonomy is helping towards the goal of being fully decarbonised by 2050. The article goes on to suggest that countries like France and Germany may even be pushing for nuclear power and “dirtier forms of gas” to be determined as green under the taxonomy rules, making the taxonomy “green in name only.”

Bridging the ESG skills gap to ensure we build back better

A recent report by the UK’s Construction Industry Training Board (CITB) titled Building Skills for Net Zero, concluded that an additional 350,000 full-time equivalent workers will be needed by 2028. These workers, who will be mainly involved in delivering improvements to existing buildings that will reduce energy demand, will represent an increase of around 13% on the current size of the workforce. The report has been met with both praise and caution by the likes of Sarah Ratcliffe, Chief Executive of the Better Buildings Partnership. In an op-ed for the Estates Gazette, she notes that this represents a fantastic opportunity for the UK’s net-zero ambitions to “build back better, creating jobs and economic activity” but also warned that, while a number of important initiatives have been set out to provide guidance specifically for the real estate sector, the industry needs to move quickly to address the skills gap – particularly integrating ESG considerations into real estate education and professional training.

Hong Kong softens the G in ESG

A plan published on Wednesday and due to go before Hong Kong’s legislative council next month intends to give companies the ability to withhold details from the public about company directors. A recent article by Reuters notes that, while this is being presented as a data protection issue, the repercussions that this will have on improving governance and transparency are notable. For example, with tighter restrictions on specific identifiers, investors and banks, will find it a lot harder to carry out proper due diligence, making it a lot more difficult to know who they are dealing with. The article goes on to detail that, compared to the UK, it is already far harder to get such information in Hong Kong – with the data being openly available in the UK but requiring a small fee to access in Hong Kong. The new rules even “limit the reasons for granting access”, making it almost impossible for the likes of researchers or journalists to get information and running counter to the prevailing trends of greater openness and greater disclosure now seen as crucial for improving the corporate landscape.

Democrats seek to rescind controversial Trump Administration Shareholder Proposal Rule

Earlier this week, Democrats introduced a resolution to rescind a controversial SEC rule under the Trump Administration to increase the shareholder ownership and length of time criteria for shareholders to submit shareholder proposals at publicly listed US companies. The current rule, which was introduced in 2020, was applauded by Republicans who argued that the increased threshold requirements would induce significant time and cost savings for corporations to consider only those proposals with a higher minimum of shareholder support. However, Democrats, led most notably by now SEC Acting Chair Allison Lee, criticised the initiative as a ploy to undermine ESG shareholder proposals and related initiatives. Sherrod Brown, Chairman of the Senate Banking Committee, initiated the process to revoke the rule under the Congressional Review Act, a unique policymaking tool that requires only a simple majority vote in the US House and Senate to reverse recently finalized rules. However, it is unclear if the resolution will pass, as Democrats hold the slimmest majority in the Senate. Even one opposing vote would likely defeat the resolution.

In Case You Missed It

- The COVID-19 pandemic and climate change have ESG issues at the top of the corporate agenda, according to a research conducted by Willis Towers Watson. The research reveals that there is a heightened awareness of social issues and a sense of urgency to tackle climate challenges, as organizations strive to create long-term, sustainable value.

- Net new investment to ESG funds reached $51.1 billion in 2020 as the world reacted to Covid-19 lockdowns, social unrest, and ecological disasters. According to a Fortune article on ESG stock, the median sustainable fund has also outperformed its traditional peers by more than 4% in the US last year.

- With increased investor attention on ESG, US-based firms strive to advance diversity, inclusion and belonging. According to Nasdaq President and Chief Executive Officer, Adena Friedman, US companies can learn from Europe’s “mature” ESG movement to increase diversity and inclusion initiatives that focus on all stakeholders, including employees, suppliers, clients and local communities.

- The European ESG and sustainable fund market, based on SFDR definitions, could currently be worth as much as €2.5 trillion, according to new research by Morningstar. Based on its preliminary data, funds classified as Article 8 and 9 currently represent up to 21% of total European funds and up to 25% of total European fund assets.

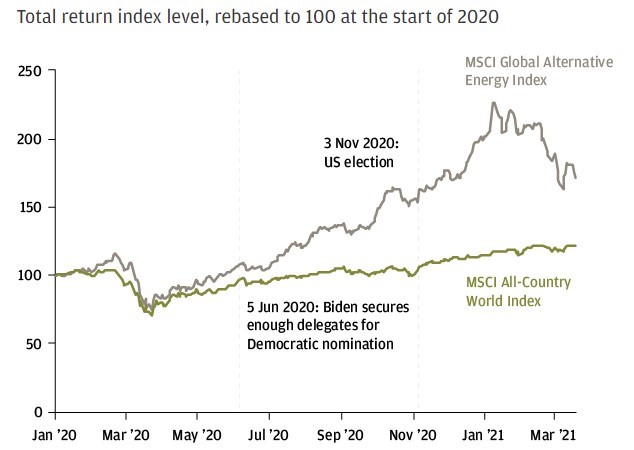

Charts of the Week

Source: MSCI, J.P. Morgan Asset Management. Indices shown are total return in local currency. Past performance is not a reliable indicator of current and future results. Data as of 18 March 2021.

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |