ESG+ Newsletter – 19th August 2021

Your weekly updates on ESG and more

To add to the increased pressure faced by companies at AGM time, a new breed of activist investor is also leveraging ESG issues. We also cover a fresh call for more research on the impact of policy choices to address gender gaps in the boardroom and take a look at the uncertain futures facing the worlds of fast-fashion and office-based working. Meanwhile in the U.S. the stage is set for a showdown between the SEC and American business over how explicit proposed new rules on workforce disclosure should be.

ESG activism – the new breed of activist investor?

Activist investors – often viewed as ‘corporate raiders’ – appear to be transitioning to a new form of activism – forcing companies to address their environmental and social impact rather than the traditional focus of altering strategy, shedding assets or re-engineering balance sheets. A recent Fast Company article looked at this new breed of activist investor that has entered the market and who are putting pressure on companies to embrace stakeholder capitalism. Included are notable examples of where activist funds and investment vehicles have been specifically launched with the objective of trying to force companies to prioritize long-term value, as well as to develop a plan to address climate change and reduce their carbon footprint. In other instances, activist investors are leveraging ESG issues to bring about wider changes in a more traditional sense. That brings with it an added layer of pressure and complexity for boards and management who must already contend with growing discontent articulated by large institutional investors at AGM time.

The Wall Street Journal highlighted last week that BlackRock funds voted against the election of board directors at 10% of the more than 6,500 director election proposals. BlackRock also backed 64% of environmental proposals at company AGMs, up from 11% in 2020. How successful these funds and investment managers will be in influencing change across a company’s strategy and business operations will only become clearer over time. However, both activist investors and large institutional investors are taking a longer-term view and are more willing to engage companies across a variety of ESG-related campaigns.

The financial and environmental cost of sustainable fashion

Swim and activewear made from recycled bottles have emerged as a significant trend with the volume of these garments advertised on UK and US platforms more than doubling in the year to June 2021. Many clothing manufacturers, particularly footwear and even couture designers, are using these materials to bolster their green credentials. However, these materials carry a financial cost for fashion brands because sourcing the specific plastic they need is expensive. This plastic (rPET) is already in high demand for consumer goods packaging, and supply is tight generally because of low plastic recycling rates – as low as 14-18% according to the OECD. The high cost associated with recycled plastics is particularly problematic for fast fashion brands where low prices are key to their business model.

However, the problems with recycled polyester aren’t just financial. As it cannot currently be recycled further, it typically ends up in landfill and washing these garments produces microplastics which end up in the water system. The answer to the recycling problem is the use of chemical recycling, already an area of investment for several petrochemical companies. This is not a panacea though, as these operations are likely to be expensive and will also carry a large carbon footprint. The solution to the sustainable fashion conundrum seems to be some distance off.

New energy rules may erase 10% of London office stock

As the post-COVID return to the office gathers pace, some workers and employers may find themselves back working from home thanks to new rules on energy efficiency for non-domestic settings. The 2023 rules are part of the UK’s move towards carbon neutrality and state that for offices to be leased they must achieve an energy rating of at least an ‘E’ – with ‘A’ being the highest and ‘G’ being the lowest rating. Further legislation proposed for 2030 would mean that offices would need a rating of at least a ‘B’.

A study by Colliers found that 20 million square feet of office space in London, accounting for 10% of the overall stock, currently falls short of the 2023 targets. In fact, only 20% of offices in Central London currently have ‘A’ and ‘B’ classifications. This could lead to a significant portion of London office stock lying idle. This means that many landlords and developers will need to invest in potentially costly refurbishment in order to bring their offices up to standard. According to Colliers, this refurbishment could cost developers approximately £200 per square foot, compared with £300 for a new build. However, they advise that landlords should invest now in long-term energy improvements highlighting that, by delaying, landlords may find themselves falling short of even stricter environmental regulations in future.

SEC and corporate America debate merits of workforce disclosure

The U.S. Securities and Exchange Commission (SEC) is preparing for a showdown with public companies over how much information they are required to disclose about their employees. An analysis by Reuters maps out how pressure from progressive Democrats, unions and investors is sharpening the regulator’s focus on implementing a rule that will require public companies to disclose more information on their workforces – such as data on attrition, staff composition, compensation, skills and development training, benefits, and health and safety. As we have highlighted throughout 2021, the COVID-19 pandemic has seen a significantly higher value placed on worker wellbeing as well as so-called ‘bread and butter’ employment conditions such as pay and work/life balance. According to Reuters, concerns have been expressed within corporate quarters that companies will be open to targeted campaigns and reputational damage, should the SEC opt for prescriptive metrics rather than ones that allow for a degree of flexibility. However, it appears that SEC Chair Gary Gensler has already made his mind up in this regard. George Georgiev, a business law professor at Emory University told Reuters that specific disclosure requirements could provide “consistent, comparable and reliable information that current disclosures do not exhibit” and that Gensler, who “has a history of taking on business interests” is not considered likely to provide for too much flexibility.

Gender gaps in the boardroom: Quota or disclosure?

As Bloomberg reports that women now hold at least 30% of seats on a majority of S&P 500 boards for the first time, a new blog post hosted by the Principles for Responsible Investment (PRI) weighs up the two most commons means of correcting boardroom gender imbalance. In light of a growing number of countries considering potential board gender policies, Harvard Business School’s Shirley Lu provides an overview of a study she conducted in 2019 on the different effects on board gender diversity from implementing a quota versus a disclosure policy. Lu gathered up the different policy announcement dates in 12 European countries from 2006 to 2015 and compared the board gender ratio for each country before and after the policy announcement, and relative to other European countries that did not change policy in the same year. Lu’s work produced three key findings. Quota firms experience higher growth in board female ratio relative to disclosure firms after a policy announcement. However, this is caveated by the second key result, which revealed that this higher growth only occurred in sectors with high supply constraints and that it can be useful to separate supply and demand-side frictions. Finally, quota firms recruit more female directors from a foreign nationality, with no prior public board experience, and with a PhD degree. This, Lu claims, illustrates “the difference between a quota and disclosure policy as a trade-off between enforcement and market discipline in the presence of female-director supply constraints.”

Changes to PRI reporting requirements deferred

Following feedback from more than 1,700 of its 4,000 signatories that a pilot exercise demanded too much time to complete and resulted in data gaps and errors, the PRI will delay a planned overhaul of its reporting requirements until 2023. This means that the annual process of delisting signatories identified as not meeting the minimum requirements will also be deferred. Speaking to Environmental Finance, Chief Executive of the PRI Fiona Reynolds, who is set to leave to organisation next year said: “In hindsight, I think that we’ve bitten off more than we could chew in trying to make as much change as we were in one reporting cycle.” While the delay is unfortunate from the standpoint of the PRI, an anonymous signatory told Environmental Finance that the process for reporting on linking ESG to executive remuneration and data assurance was “very good”. The extent to which the PRI is prepared to take on-board the concerns of its signatories is also a welcome sign.

Assessing the Merit of Net-Zero and Offsets

In April, Mark Carney announced that Brookfield Asset Management was operating at net-zero because its renewable energy portfolio balanced the emissions of its non-renewables portfolio. Days later he rescinded his statement because it was inaccurate, illustrating the deeply concerning but alarmingly common misconceptions surrounding the concept of carbon offsetting. But these initiatives that collectively comprise ‘Emissions Accounting’ can, according to Federated Hermes, be inconsistent, inaccurate, and imply that climate change can be reduced to a book-balancing process. Indeed, it is pointed out that to recognise that reducing carbon emissions via renewables in one portfolio does not necessarily balance out non-renewables in another. This is because decarbonisation pathways are not always defined and remain dependent on other business segments, for instance reducing one carbon budget depends on the budgets of other sectors. Investors should remain vigilant when assessing the merit of firm net-zero commitments, for such practices could give rise to the kind of accounting scandals that the finance sector is all too familiar with.

The Importance of science when it comes to target setting

Staying with the issue of net-zero targets, Alberto Carrillo Pineda, the recently appointed managing director of the Science-based Targets Initiative (SBTi) stated that the organisation has the science behind them and the necessary tools to build a better, greener society. He elaborated on the purpose and said that goal of the organization is to “accelerate the domino effect of corporate climate ambition and to mainstream corporate action that aligns with the 1.5 degree limit of the Paris Agreement.” By setting goals verified by SBTi, firms’ GHG reduction strategies are directly aligned with the science and the consensus of actions needed to mitigate climate change. Notably, 2021 has been the year of net-zero commitments and there has been a surge in companies looking to reduce GHG emissions in a method that is tied to science through using SBTi’s framework.

Overall, while there are many strategies companies can incorporate to minimize reductions, those that are closest to the science, such as the SBTi framework, are seen as the most effective and guided by the evolving recommendations of climate experts.

In Case You Missed It

- PepsiCo has announced its ambition to become “Net Water Positive” by 2030, aiming to replenish 100% of the water used at company-owned and third-party sites in high-water-risk areas. The PepsiCo Foundation is also launching a new $1 million programme with leading NGO WaterAid to bring safe water to families in Sub-Saharan Africa and an investment of $53 Million to their Safe Water Access Program.

- This week, JP Morgan, the world’s largest underwriter of green bonds, announced plans to significantly expand its ESG investment products. This decision comes on the back of the continued growth in demand for ESG financial products over the past year and a half.

- AXA Insurance announced a plan in Ireland to spend €6m to offset the carbon impact of insured drivers, by buying 100% of carbon offsets produced by all new and existing cars customers for a year, as part of their Carbon Neutral Car Insurance offering. According to the company’s calculations, the programme will see it offsetting the equivalent of 1 million tonnes of carbon dioxide. It is planning to do this by spending €2 million to finance the planting of 600,000 trees across 200 hectares.

- Man Group Plc, a quant focused investment firm with $135 billion AUM revealed it has adjusted traditional models to attempt to capture the risks inherent in ESG investing. Man claims that because ESG investing is still in its infancy, this makes it difficult to develop good probabilities of what the future holds. To attempt to resolve this, humans need to be more involved in the process to understand and predict ESG risks.

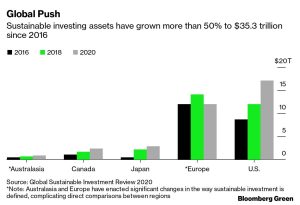

Chart of the week

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please click here to input your details or email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |