ESG+ Newsletter – 18th November 2021

Your weekly updates on ESG and more

This week’s ESG+ Newsletter begins by asking whether gender diversity in the boardroom is being affected by the ongoing fallout of the COVID-19 pandemic. The edition also looks at a new innovative form of ESG financing via the world’s first sustainability re-linked bond; whether executive bonuses can be used to reduce emissions; and, on the back of recent comments made by the Australian Prime Minister, we reignite our previous debate on who should lead when it comes to the climate crisis – governments or the capital markets? And don’t forget, tomorrow is the last week of our COP26 review, wrapping up an eventful month in Scotland’s largest city.

Board gender diversity at risk due to a pandemic-linked shortage of talent

Achieving board gender diversity may become more challenging due to a lack of women in senior executive positions. While data analysed by Bloomberg shows that the average number of female directors at Stoxx 600 companies has remained unchanged at four, further analysis indicates that these female directorships are being drawn from a small pool of women. The problem may be exacerbated by the ongoing fallout from the COVID-19 pandemic which has seen women drop out of middle management roles as a result of the stress of juggling work with home life. According to Bank of England policymaker Catherine Mann, women who opt to work from home may also be harming their career progression as they’re missing out on in-person interactions which play an important role in recognition and advancement. Given the clear link between gender diversity and profitability, the progress made in recent years will prove illusory if it cannot stand its first real test, all of which should serve as a call to action for companies to ensure that female talent is being nurtured and supported, regardless of their place of work.

Sustainability re-linked bonds represents new ESG financing innovation

At the end of the last month, Bank of China announced plans to issue the world’s first sustainability re-linked bond transaction, with the landmark sustainability bond offering being comprised of $300 million sustainability notes, maturing in 2024. These notes have been dubbed as ‘sustainability re-linked notes’ as the proceeds will be used to finance, and/or refinance, sustainability linked loans (SLLs) of the bank to various companies across the world. The most interesting aspect of the transaction is the re-linking mechanism, which allows for the coupon of the notes to be adjusted in accordance with the performance of the sustainability performance targets of the underlying SLLs. As Bloomberg highlights, this step down clause could result in bondholders losing money if the loan borrowers tied to the debt manage to exceed their sustainability targets.

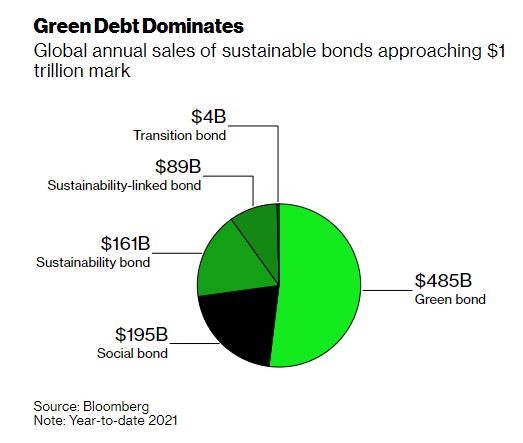

This new sustainability linked loan represents another addition to the plethora of ESG financing options. As we have discussed previously, the ESG financing market has grown exponentially over the last number of years, particularly as companies look to transition to a sustainable business model and capitalise on investor demand to deploy capital into ESG assets. With Bloomberg outlining that global ESG bond sales are approaching the $1 trillion mark this year, almost double the $493 billion for the whole of 2020, it looks as if issuances will only continue to grow, with further financial innovation, like the re-linked bonds, likely to follow.

Investors and auditors urge the government to rethink corporate governance reform

Reports emerged last week suggesting that the UK government was going to scale back corporate governance reforms, including in relation to directors taking on greater responsibility for company accounts. This week, investors and audit groups urged the UK governments to rethink plans to scale back corporate governance and audit reforms. Both groups believe any reforms will increase corporate scandals, while auditors also believe that they will face the brunt of the backlash if directors are not made more accountable. Investors believe watering down this legislation will increase the risk of fraud and misstatements, while also noting that the UK will fall back solely on the corporate governance code, “which the good follow and the bad neglect”. In contrast, companies are arguing that the move to drop the legislation on internal controls is welcomed, as it carried increased burden and cost which was unnecessary in an economy trying to rebuild from the pandemic.

SEC reversal leads to more ESG proposals

The SEC, led by Gary Gensler, has reversed course from the Trump administration and stated that it will be more likely to require companies to hold shareholder votes on public policy issues. Therefore, companies that want to avoid shareholder votes on ESG issues will face greater hurdles in attempts to have the SEC grant their requests. The SEC will allow proposals on “issues of broad social or ethical concern” regardless of their direct economic effects on the company. This policy shift means that activist investors will now have the power to bring forward ESG proposals before the next proxy season gets underway in April. One law firm, Gibson, Dunn & Crutcher LLP, commented on the new guidance and said that it creates an “open season for environmental and social proposals” and that, unlike previous SEC legal bulletins, this guidance from the SEC staff was not previewed or discussed in advance at stakeholder meetings.

Is incorporating ESG measures into executive pay plans a solution to reduce emissions?

“As climate change has advanced up the boardroom agenda, so, inexorably, it has started to find its way into the incentives of senior executives” notes the Financial Times in their recent article on executive pay. As companies embed ESG objectives and strategies across their business, ESG targets are also being added to short and long-term incentive compensation plans. While the absolute numbers of companies may appear relatively low – 24 companies in the FTSE100 and only 20 in the S&P 500 – those numbers have more than doubled, according to ISS data. Consumer companies have taken the lead to integrate wider ESG targets into pay plans, but the oil and gas sector has become the sector with the highest number of companies that have incorporated climate targets into executive pay, reflecting investor pressure and public scrutiny that the heavy emitting sector continues to receive. While the argument that “whatever gets measured gets managed” and linking ESG to executive compensation will support the change in perspectives on climate change and increase board accountability, there are concerns on whether a structural economic change is required to make this transformation more effective. Greater attention must be placed by shareholders on boards when they are deciding which metrics to select, how they align with strategy, the level of stretch of these targets, and, most importantly, their long-term alignment with the nature of companies’ environmental goals.

Just this morning, the UK’s Investment Association published their 2021 principles, which includes more detailed guidance on the integration of ESG criteria into pay structures.

Australian PM says tackling climate crisis is responsibility of companies not governments

Australian Prime Minister, Scott Morrison, came under fire during COP26 for not setting sufficiently ambitious climate commitments. Australia’s goal to reduce emissions by 26% by 2030 is consistent with 4°C of warming, according to the Climate Action Tracker. This is incompatible with the Paris Agreement to limit global warming to 1.5°C. The Australian Prime Minister has consistently refused to increase the targets of Australia’s climate pledges, despite continued pressure from other world leaders to increase their level of ambition. Towards the end of COP26, the Australian government sought to shift the responsibility for acting on the climate crisis away from the government and instead onto the private sector. Scott Morrison stated that “the government cannot solve the challenge of rising emissions and bring them down through mandates or by fixing a price on carbon. The world’s companies are going to solve this problem because they’re the ones who make electric cars.” This oversimplification of the climate crisis contrasts starkly with other developed nations who are implementing legislation to support a low carbon economy and recognising the role of the private sector and government in the net zero transition. Perhaps the Prime Minister is just being candid about the lack of appetite from politicians to tackle the issue, a gap that has led to large investors claiming they will take on the role of policymakers, not just on climate, but in other areas like providing for employees retirements.

Previously, we have covered the debate regarding who should lead in combatting the climate crisis – governments or the capital markets/corporate sector, with Tariq Fancy, former CIO for sustainable investment at BlackRock, arguing strongly that governments should not abdicate responsibility and should take a leadership role, similar to the COVID-19 crisis.

Wasted opportunity – Why wasn’t food higher on COP26 agenda?

Despite the organisers of COP26 ensuring that 80% of the food served at the conference was seasonal and locally sourced, there was a distinct lack of action on the environmental impacts of global food systems, according to food distribution charity Fareshare. According to the charity, “Even if you take all the other big emitters out of the picture, food production alone would push the earth past 1.5 degrees of warming – yet food waste has effectively been frozen out of talks at Cop26.” There was speculation ahead of the conference that global diets, food waste and methane emitted during food production would be addressed during the talks. In an Op-Ed, former UN Secretary-General, Ban Ki-moon, highlighted that “food systems account for more than a third of global greenhouse emissions, with far-ranging environmental effects. Agriculture is also extremely vulnerable to shifts in temperature and rainfall.” When countries return to negotiations next year at COP27, they will be an expectation to produce revised and ambitious Nationally Determined Contributions (NDCs). To achieve the target of limiting global heating to 1.5°C, these NDCs must include action on food systems.

One of the key outcomes of COP26 was a commitment by 100 world leaders to end and reverse deforestation by 2030. Agriculture is the main driver of deforestation so the legislation will be critical in ensuring these commitments can be achieved. This week the EU sent a clear message that agricultural products linked to deforestation will not be accepted in the single market, by proposing legislation to ban imports of agricultural commodities from areas at risk of deforestation.

In Case You Missed It

- UK government has been urged by unions and business lobbies to introduce mandatory ethnicity reporting, the Financial Times reports. City regulators hope that plans to bring diversity targets will boost representation, and while many companies are on board, some said that although many firms already provide such reporting, many also said there are difficulties in gathering accurate data as they cannot force their employees to provide their ethnic classification.

- Business groups joined climate activists in expressing frustration that national governments were not moving aggressively enough to tackle climate change after the COP26 agreement was watered down in the final minutes. The Financial Times reported that although global executives broadly welcomed the deal, many said it did not go far enough.

- Advisers are now beginning to exclude specific sectors for their client portfolios when it comes to ESG requirements, the Financial Times reported. Since the launch of the exclusion filters in March, exclusions from portfolios have increased nearly four-fold, with the most frequently excluded industries being tobacco (19%) and small arms (15%).

- Saudi Arabia plans to enter the market for green bonds, as it tries to recast itself as a viable target for capital in a world increasingly shaped by environmental concerns. Bloomberg reported that sustainable investors are sceptic, with some investors saying it represents an encouraging step for the oil Gulf state to plot a path away from fossil fuels while others are asking for credible evidence the debt will genuinely be green.

Chart of The Week

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please click here to input your details or email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |