ESG+ Newsletter – 18th February 2021

Your weekly updates on ESG and more

In this week’s ESG+ we highlight a number of strategic climate-related announcements including BlackRock’s stewardship update outlining its expectations of transparent climate risk reporting and target-setting; moves by the Biden administration to model the cost of greenhouse gas emissions on human health and society; and how climate considerations are affecting the aviation sector. Also, in the spotlight: the growth of ESG investment; diversity and inclusion as a driver of voting decisions; and the investment implications of slowly evolving corporate governance in Japan.

Say on Climate is here as BlackRock expects rigorous targets

As outlined by ESG+ previously, following Unilever’s commitment to put its climate strategy to a shareholder vote, the Investor forum in the UK asked for mandatory climate votes for UK companies. While that has not been forthcoming, as is often the case in the sphere of governance and ESG, the voluntary practice may force the hand of regulators and peers. Just this week, Royal Dutch Shell announced its plans to hold a vote on its Energy and Transition strategy while Canada National Railway is doing something almost identical, holding a shareholder vote on its Climate Action Plan. Those putting their heads above the parapet are likely in a strong position; however, these latest steps will place increased pressure on the rest of the market to bolster their climate strategies.

And, regardless of whether shareholders are given a separate vote on climate strategies, the world’s largest asset manager, BlackRock, has announced for the first time its expectation that companies “disclose a plan for how their business model will be compatible with a low-carbon economy, i.e. where global warming is limited to well below 2°C.” In its investment stewardship guidance, (which cites 2018’s landmark climate report from the Intergovernmental Panel on Climate Change), Blackrock expects all investee companies to set “rigorous targets”, a step-change from the previous practice of a push for greater disclosure. A failure to meet the expectations of the asset manager or provide sufficient reporting for Blackrock to make a thorough assessment will result in votes against Directors. With Blackrock a shareholder at so many public companies, “Say on Climate” has arrived, in one form or another.

Social Cost of Carbon aims to calculate the true cost of emissions

As the issue of environment has risen to the top of the agenda for all stakeholders, so has the challenge of valuing risks and opportunities around climate change. The Social Cost of Carbon aims to measure the impact caused by emitting one extra tonne of greenhouse gas on the environment and human health, inclusive of non-market impacts. An idea that gained traction under the Obama administration, it is back on the agenda under President Biden, with Bloomberg reporting an interim report is imminent from that administration. The new approach has the potential to have wide-reaching effects for all industries, with any state investment assessed against the potential costs to the environment; and, reporting requirements for companies being impacted. Bloomberg also reports that, according to two prominent economics, the current approach is vastly underestimating the potential harm to the environment, arguing that it “It is a fundamental mistake to begin the analysis of climate change under the premise that, but for the mispricing of emissions, the economy is efficient.” Nonetheless, the number seems set to play a key role in the Biden administration’s approach to climate risk evaluations.

Norway’s oil’s fund goes public with diversity stance

With assets totalling $1.3tn and an average ownership stake of 1.4% of every listed company in the world, Norway’s sovereign wealth fund has considerable sway in public markets. Under new chief executive Nicolai Tangen, the fund has been further emboldened to use environmental, social and governance issues to protect and boost its returns. Earlier this week the fund published a position paper on gender diversity, a topic that up until now it had eschewed, reportedly due to fears that it would be seen outside Norway as imposing“Nordic values”. In keeping with a wider push for greater transparency at the fund this fear seems to have subsided: “As a sovereign wealth fund, we are careful about pushing issues that are seen as political. But this issue on gender balance isn’t political, it absolutely makes business sense,” Carine Smith Ihenacho, the fund’s chief corporate governance officer, told the Financial Times. Coming on the back of an announcement earlier this year that the fund will begin disclosing all its voting decisions five days ahead of annual shareholder meetings, we’ll be watching closely to see how commitments to diversity and inclusion impact voting and company practice.

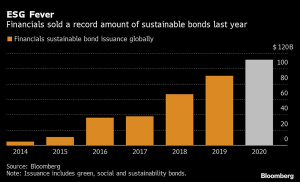

Rapid ESG inflows are causing strategy re-thinks

Investors poured record amounts of money into funds that apply ESG principles last year, more than doubling the prior’s year’s take. Those funds captured $51.1 billion of net new money from investors in 2020 — the fifth consecutive annual record, according to Morningstar. In 2019, investors funnelled roughly $21 billion into funds that apply environmental, social and governance principles. The growth comes as investors — primarily younger cohorts — have been animated by systemic issues like climate change and wealth inequality, according to Jon Hale, director of sustainable investing research at Morningstar. This has had a knock-on effect of prompting managers to change the strategy or investment profile of 253 European funds in 2020 according to the Financial Times. In addition to the repurposed vehicles, there were 505 new ESG fund launches in Europe over the year. This trend raises a fundamental question with the clamour to be an ESG though: can funds simply become ESG? The recent SFDR from the EU certainly aims to shine a light on the rigour of such pronouncements.

Pandemic prompts green rethink for the aviation sector

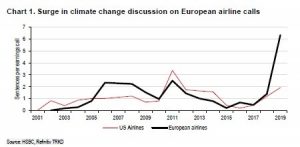

While some view the criticism that the commercial aviation sector receives as disproportionate to the 2-3% share of global human-induced carbon emissions, social movements such as flight shaming, or flygskam, and numerous Extinction Rebellion protests, have added to growing public pressure on the aviation sector to address its carbon emissions. This has now translated into increased investor scrutiny, with HSBC reporting a “spike in climate discussions in earnings calls, with emissions disparities between low cost and legacy carriers” in 2019, which is outlined in the table below.

With the IATA projecting that flying will only likely return to 2019 levels in three or four years, the aviation sector is likely to face continued scrutiny. Last year, various Governments around the world attached “green strings” to the various financial supports provided, forcing airlines to meet clear and quantifiable criteria to lower their emissions.

However, these measures will only affect a small number of airlines and Airbus and Boeing – the aircraft manufacturing titans at the heart of the commercial aviation sector – have both made commitments to produce net-zero-emission aircraft in the next fifteen years. Last week, it was reported that Airbus believe their hydrogen-fuelled turboprop aircraft could be in service by 2035 while in January, Boeing made a commitment to delivering a commercial airplane that could fly entirely on biofuels. As highlighted in last week’s newsletter, KLM, the Dutch arm of Air France-KLM, flew the first passenger flight ever to be partially flown on sustainably derived synthetic aviation fuel.

Uncovering the issues Japanese corporate governance reform

Following Japan’s recent efforts to improve its approach to corporate governance and ESG, a recent report published by the Asian Corporate Governance Association bumped the nation ranking from a lowly seventh to fifth in Asia, along with Malaysia. This has been described as “underwhelming” by the Financial Times, predicting that Japan “will struggle to rise further” until more stringent plans are put in place to improve the countries’ corporate culture. Exhibit A: the resignation of Yoshiro Mori, president of the Tokyo Olympics committee, after he made sexist remarks that women did not belong on Committees because they talked too much. The incident highlights deeper issues in corporate Japan according to the FT, which revolve around “ingrained gender inequality, invisible networks that support the incompetent, excessive deference to authority, opaque habits of governance and other stabilisers of the unacceptable.” The example of Japan is indicative of the wider aims of strong governance, its increasing role in a company’s – or a country’s – ability to attract capital.

UK Living Wage report highlights the impact of low pay during the pandemic

The impact of low pay during the pandemic has been highlighted in a new report by the UK Living Wage Foundation, with two-thirds of workers who earn below the “living wage”, which it calculates to be the minimum required earnings to support the cost of living, suffering a drop in income since the pandemic began. The 2020 figure is £9.30 across the UK and £10.75 in London and one in four workers who earn less than this reportedly had to skip meals during the pandemic. According to the Foundation, there are nearly 7,000 Living Wage Employers in the UK, including two-fifths of the FTSE 100 and household names including Ikea, Aviva, Nationwide and Everton FC.

Australia second country in the world to attract MSCI

Australia has become only the second market in the world, behind India, where MSCI plans to build a set of domestic indexes. An article in the Financial Review puts this down to two key reasons; a sharp rise in its superannuation sector, Australia’s mandated retirement savings system, and the country’s shift towards ESG investing, making it a highly attractive market for MSCI. Australian super funds, which are moving towards more in-house investment teams to manage them, are searching for indexes that can reflect their developing investment philosophies, in particular on ESG strategies and climate change, given many funds have now committed to being net-zero by 2050.

Meta-analysis points to long-term benefits of ESG

This week, the NYU Stern Center for Sustainable Business, in collaboration with Rockefeller Asset Management, published findings from a new meta-study examining the relationship between ESG activities at organizations and their financial performance.

The study, which surveyed more than 1,000 peer-reviewed papers over the last five years classified organisations based on whether they focused on corporate financial or investment performance, found that ESG activities drive better financial outcomes. For the corporate studies, 58% of the organisations examined found a positive relationship between ESG and financial performance, with only 8% showing a negative relationship. Similarly, for investment studies, 59% showed similar or better performance relative to conventional investment approaches while only 14% found negative results. However, the research was also clear in pointing toward “material” ESG issues, as opposed to a scattergun approach (see takeaway number six below). The key findings from the study were:

- Improved financial performance due to ESG becomes more noticeable over longer time horizons.

- ESG integration as an investment strategy performs better than negative screening approaches.

- ESG investing provides downside protection, especially during a social or economic crisis.

- Sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and more innovation.

- Managing for a low-carbon future improves financial performance.

- ESG disclosure without an accompanying strategy does not drive financial performance.

In case you missed it

- TikTok is shaping how Gen Z sees ‘sustainable’ fashion, according to the Financial Times. With more than 760m video views, the hashtag #sustainablefashion is shaping how Gen Z thinks about the impact of their wardrobes, with videos encouraging users to buy vintage fashion and lot of DIY and upcycling projects.

- Almost a third of small and medium firms in the U.K. have no plans to implement a sustainability strategy: A survey of 1,021 firms, conducted by YouGov for energy firm World Kinect Energy Services, found that while 40% of U.K. small and medium enterprises (SMEs) don’t yet have a sustainability plan in place, 30% don’t have any intention of adopting one.

- Jaguar is to become a fully electric car manufacturer within four years, as reported by The Times. The move will involve scrapping the current Jaguar range, as an effort for the brand to recreate itself as the Tesla of the West Midlands.

- Institutional Shareholder Services (ISS), has updated its proxy voting policy to include changes that allow it to recommend votes against company directors who fail to address the climate crisis. The policy shift, which came into force on 1 February, will influence voting recommendations across the 44,000 company reports produced by ISS each year.

Chart of the Week

Secondary source

Upcoming events

February 23-24: Baird Sustainability Conference

February 24-26: RBC Global ESG Conference

February 25: FTI Consulting ESG+ Webinar – 2021 AGM Season Preview

March 4: Canaccord Genuity ESG Conference

March 9: FTI and Hanson Search Webinar: The ESG trends arising, or accelerating, as a consequence of the COVID-19 pandemic

If you would like to receive our weekly updates via email, please click here to input your details.

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |