ESG+ Newsletter – 15th July 2021

Your weekly updates on ESG and more

In this week’s ESG+ newsletter, we review the EU’s ’Fit for 55’ climate change legislation which looks to achieve net zero by 2050, and the cost of not achieving this goal. We examine the continued growth of ESG-linked financing across the global capital markets and the agribusiness sector, and Blackrock CEO, Larry Fink’s call-to-action to G20 Finance Ministers to further facilitate the transition to a green economy. Lastly, we consider how the COVID-19 pandemic has led to both an increase in cyber security issues due to remote working and a dramatic increase in global hunger.

European Commission publishes ‘Fit for 55’ landmark environmental legislative package

Yesterday, the European Commission published its comprehensive climate proposal ‘Fit for 55’ which sets out legislative initiatives that the EU wishes to achieve under its European Green Deal. The package seeks to ensure that EU rules are in line with the bloc’s new climate objectives, namely reducing greenhouse gas emissions by 55% by 2030 and reaching climate neutrality by mid-century. The Commission proposals would introduce a de facto ban on the sale of new petrol and diesel cars by 2035, raise the share of renewable energy to 40% of final consumption by 2030, expand the EU’s carbon market to cover maritime shipping and set up a separate emissions trading system for the road transport and buildings sectors. Moreover, a new mechanism would put a carbon price on imports to prevent ‘carbon leakage’, ensuring that emission reduction efforts in the EU do not push carbon-intensive production to jurisdictions with laxer environmental rules. The breadth and ambition of the package are such that the Commission is likely to receive significant pushback as it defends its views in negotiations with the Council and the European Parliament. Aware of the challenges, the Commission has proposed a new Social Climate Fund to help citizens finance investments in energy efficiency, new heating and cooling systems, and cleaner mobility. Announcing the package’s release, President of the European Commission Ursula von der Leyen, said that the “fossil fuel economy has reached its limits. We want to leave the next generation a healthy planet as well as good jobs and growth that does not hurt our nature. The European Green Deal is our growth strategy that is moving towards a decarbonised economy. Europe was the first continent to declare to be climate neutral in 2050, and now we are the very first ones to put a concrete roadmap on the table. Europe walks the talk on climate policies through innovation, investment and social compensation.” We will continue to share updates on this important topic.

‘Net Zero’ bill could be lower than expected but pathway required

Reports of continually rising temperatures in the Arctic have been compounded by western US and Canada struggles to bring wildfires under control. It is therefore unsurprising that coverage of the world’s ‘Net Zero’ endeavours has picked up the pace and David Smith of The Times has provided a breakdown of the costs associated with achieving this ambition. In his article, David reviews the cost of this transition published in the Office for Budget Responsibility (OBR) latest Fiscal Risks Report, which revealed that fiscal costs of achieving net-zero by the middle by 2050 is 21% of GDP to public sector net debt or £469 billion in today’s prices. While this appears costly, David highlights that is “somewhat smaller” than the debt accrued because of the COVID-19 pandemic, and the fact that it will occur over a much longer period. What’s more, the sooner this ambition is realised the better and cheaper according to the OBR, who notes that “early action” scenario costs more in the short term but significantly less in the long run. Under a delayed-action alternative, debt would be 44% of GDP higher by 2050 — 23% higher than acting early.

Despite the relative lower than expected costs to transition to net zero some, such as Pooja Khosla, Vice President Client Development at climate risk analytics company, Entelligent, have been critical of the progress to date, claiming that there is too much focus on the destination and too little focus on the journey. Khosla told Portfolio Adviser that “organisations and businesses are increasingly signing the net-zero pledges with very long-term goals, without setting quarterly targets, missing standardised measurement standards, with very restrictive definitions and without considering the capacity constraints”. Indeed, there has clearly been an explosion of such commitments by countries, companies, and financial institutions; however, it is clear that more must be done, and done quickly, to map out how to get there.

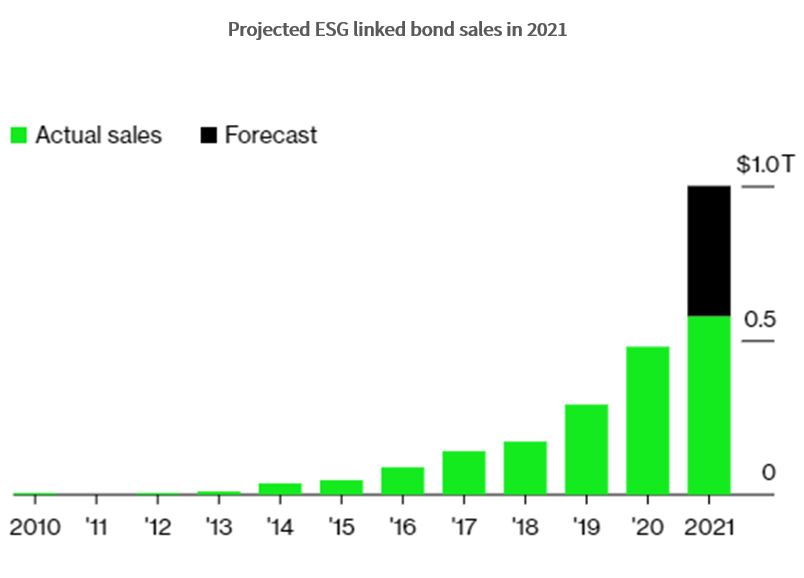

ESG financing heads towards $1 Trillion – can supply keep up?

Followers of our ESG+ newsletter will be aware of the substantial growth of green financing in the global capital markets, particularly green bonds, over the past 18 months. This growth look set to continue unabated, with data from Bloomberg revealing that global issuance of bonds for ESG-related financing has already topped $575 billion in the first half of the year – which is already $100 billion more than all of the issuance in 2020 – and projections have the market eclipsing $1 trillion during 2021.

With investor demand being at an all-time high for ESG financing, demand continues to outpace supply with Amy West, managing director and global head of sustainable finance and corporate transitions at TD Securities, stating that “we are seeing green bonds outperform non-green bonds in terms of being oversubscribed and in terms of pricing.” The lack of supply is not due to a lack of eligible projects constraining the market: Richard Sibthorpe, head of global debt capital markets at BMO Capital Markets, believes that ensuring that the appropriate sustainability frameworks are developed and aligned with the objectives of the many ESG financing options open to issuers are the main impediments to the deployment of capital.

The continued growth of ESG financing highlights the pressure that companies, financial institutions, and countries are under to embrace more environmentally friendly and sustainable practices and to transition to a clean energy future. Additionally, while investors faced the impact of “ greenium” to their investment – a price premium in ESG products due to significant demand – a reverse could also happen over time, with issuers facing an increase to the cost of capital for non-ESG related debt instruments.

Potential of green finance for the agribusinesses

Since their recent introduction, Sustainability-linked loans (SLLs) have attracted interest from both issuers and investors at an impressive pace. According to Bank of America research referenced in this Financial Times article, the SLLs market has grown from $50 billion of new issuance in 2018 to $300 billion in 2021. SSLs are gaining popularity among issuers for their flexibility in how the use of proceeds and terms of the loans are tied to the issuers ESG performance. In this way, companies can raise money for general business purposes but get better pricing if certain ESG performance targets are met. While SSLs are more common for companies operating in the renewable energy sector, they are gaining attention from industries under greater pressure for their impact on the environment, such as agribusiness. In June, the Climate Bonds Initiative released an update of the requirements that agriculture assets and/or projects must meet for their inclusion in a Certified Climate Bond. These include livestock criteria such as animal welfare and the provenance of feeds. A more regulated framework which imposes reporting requirements, third-party input on the selection of the ESG metrics, as well as third-party monitoring and verification of performance against ESG targets, is favoured by ESG investors who also appreciate the holistic approach of the debt facility, together with the disclosure commitment and accountability for their ESG performance. The combination of their advantages and regulatory safeguards to minimise “greenwashing” risks, makes the SLLs an alternative debt financing option with high potential in driving issuers sustainable focus and achieving promised results.

SDFR introduction delayed by a further 6 months

It was recently revealed that the European Union has once again delayed the second phase of Sustainable Finance Disclosure Regulation (SFDR) which aims to standardise the way that ESG factors are reported across the EU, making it easier for investors to identify those firms which are truly meeting their obligations when it comes to ESG. In a letter by John Berrigan, deputy director-general for financial stability, financial services and capital markets union at the European Commission, he stated that the further delay of six months to July 2022 would ensure a “smooth implementation of the standards by product manufacturers, financial advisers and supervisors”, while also negating last-minute rush for market participants. The delay comes against a backdrop where the volume of capital being deployed across ESG related financial products has never been higher and amid concerns that the prevalence of “greenwashing” is growing, with some even some arguing that it is the biggest challenge facing ESG investing. However, in drafting and implementing new legislation to standardise ESG reporting, it is important that the EU listens to all feedback from stakeholders and gets it right the first time and avoids having to revisit the legislation soon after its implementation.

BlackRock CEO Calls for Stronger Climate Plan

Blackrock CEO, Larry Fink spoke at the Venice International Conference on Climate at a meeting of G20 Finance Ministers on 11 July and highlighted three “critical” issues that are needed to facilitate the transition to a sustainable ecosystem. First, private companies need to be under the same amount of pressure as public companies to share information on their sustainability efforts. Secondly, governments need to create more demand for greener products and services by lowering their costs. Finally, global financial institutions such as the World Bank and the IMF need to be more proactive in encouraging private sector capital to fund the transition to sustainable investments in emerging markets. Fink’s assertions follow BlackRock’s public actions on climate change last year, when it voted against the board management of 69 companies for inadequate oversight and reporting of climate-related risks. Given the bottom-line incentive as well as growing pressure from large investors such as Blackrock and other financial institutions, companies and investments could well follow BlackRock’s lead in embracing a sustainable, climate friendly future.

Working from home leads to escalation in cyber-attacks against the financial sector

According to a report from the Financial Stability Board (FSB), cyber-attacks against financial institutions have increased dramatically as employees have shifted to working from home. The report, which details the lessons learnt from the COVID-19 pandemic, details that incidents such as phishing and ransomware have increased from 5,000 per week in February 2020 to more than 200,000 per week in April 2021. Working from home presents multiple cybersecurity challenges such as how to deploy software patches and employees using unsecured Wi-Fi connections. There are also operational headaches such as how employees should handle confidential information while at home. The pandemic has also accelerated the adoption of remote working tools and infrastructure, sometimes without due consideration of the cyber risks involved that may be involved. The report recommends that financial institutions review their processes around cyber risk management, incident response and reporting, and the management of third-party service providers such as cloud services. While productivity and collaboration have been touted as the main challenges of the more permanent trend towards remote working, security may need to be moved to the top of the list.

Pandemic and food prices leading to increase in global hunger

A perfect storm of rising food prices and falling household incomes as a result of the COVID-19 pandemic is fuelling a sharp rise in hunger according to a UN report on the global state of food security and nutrition. Nearly a third of the world’s population did not have access to adequate nutrition in 2020, a year on year increase of 320 million which is equivalent to the previous five years combined. Several factors have led to the increase in food prices, including weather disruptions, shipping costs, and food stockpiling. An article in the Financial Times also outlines that the IMF is warning that, while developing countries are experiencing increased food prices now, more developed economies will feel the effects of the increases towards the end of this year. Food insecurity and hunger can often lead to wider geopolitical implications as it fuels conflict and instability which in turn leads to increased migration to richer countries. The economic fallout from the pandemic is continuing to be felt, with the potential for deeper social problems on the horizon.

In Case You Missed It

- As 2020 marked a benchmark year for the FTSE 350 for achieving a minimum 33% representation of women on board, Glass Lewis has published a new report, “Gender Diversity in the FTSE 350” which discusses the background to the introduction of the minimum requirement and the progress to date under the UK’s gender diversity initiatives. The report also highlights indicative gender diversity statistics from the FTSE 350 covering 2018 to 2020 and compares the UK gender diversity framework with that of its European peers.

- The Bank of England has removed restrictions on bank dividends and share buybacks imposed during the pandemic, the Financial Times reported. As the UK economy recovers from the COVID-19 crisis, the bank judged the sector to be resilient enough to absorb any further COVID-19 related economic shocks, and the Bank of England’s decision follows similar actions taken by the US Federal Reserve and the European Central Bank.

- According to a new report by Runnymede Trust, a race equality think tank in the UK, racism is systemic in England and impacts Black, Asian and minority ethnic groups (BME) enjoyment of rights. The report, which was submitted to the United Nations Committee on the Elimination of Racial Discrimination, details that the disparities facing these groups in England are sustained across health, housing, the criminal justice system, education, employment, immigration, and political participation, with BME groups consistently more likely to live in poverty and to be in low-paid precarious work.

Chart of the Week

Source: Bloomberg

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please click here to input your details or email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |