ESG+ Newsletter – 11th February 2021

Your weekly updates on ESG and more

This week, your update on ESG and plenty more looks inside Boardrooms and along supply chains before examining the growing benefits of ESG discourse. With further regulatory scrutiny on the horizon, we look at the enhanced disclosure being provided in the US following a year where societal pressures for inclusive growth strategies reached a crescendo. And as the latest edition of FTI’s Resilience Barometer launches this week, our global research show how COVID-19 has served to accelerate corporate action on ESG.

Will Increased Director Responsibility Result in Increased Liability Insurance?

Board and Director accountability has long been a hot-button topic across the corporate governance universe. While shareholders have often voted against Board members to highlight their dissatisfaction with the level of performance and oversight, regulators have previously complained about their inability to take enforcement action for business failures. This might be about to change, with the prospect of new reforms that could make Directors personally responsible for company scandals.

According to the Financial Times, UK Business Secretary Kwasi Kwarteng is looking at introducing new regulations which would hold Directors and Board members responsible for the accuracy of their company’s financial statements, with fines and bans for major failures. These new regulations, principally aimed at overhauling UK corporate governance and audit oversight, are scheduled to be published in a white paper in the coming days. However, these speculated regulations have already received pushback from within Kwarteng’s political party and from members of the business community, with both asserting that the proposed regulations “would hurt business growth” by placing the undue burden of new responsibilities and reporting constraints that could inhibit businesses from “taking the risks needed to start vital new businesses.”

EU proposal would develop company law to align with sustainability

As regulators and legislators across the globe attempt to play catch up with the market and societal expectations, earlier this week, the European Commission closed a public consultation on proposals to introduce tighter rules on how companies monitor human rights and environmental risks in supply chains, as a means of implementing “sustainable corporate governance”. The new rules aim to improve the EU regulatory framework on company law and corporate governance and enable companies to focus on long-term sustainable value creation rather than short-term benefits. The Commission plans to adopt the agreed proposals in the second half of this year, hoping to better align the interests of companies and their key stakeholders and spur better management of sustainability matters within their operations. The rules have so far had a positive response, with a recent article by Responsible Investor noting that Norges Bank Investment Management, one of the largest investors in the world, is the latest institution to come out in favour of the changes. This also follows positive feedback on the plan from the European Fund and Asset Management Association in October 2020. The focus on the “sustainable corporate governance” drives home the idea that the E, S and G are not competing factors in an effective sustainability strategy; instead, they must be thought about collectively in a holistic approach that aims to mitigate risk and uncover opportunity.

ESG enters the lexicon of CFOs with good reason

With their position as a company’s primary mouthpiece, it is natural that much of the public discussion on ESG has, to date, been led by CEOs. However, according to data from FactSet reported in the WSJ, CFOs are getting increasingly comfortable discussing the subject when engaging with investors. While investors expect far more than fleeting mentions of ESG or sustainability, the data appears to indicate that CFOs are increasingly seeing the tangible benefits of ESG integration, including reduced operating expenses such as the cost of carbon, water or other raw materials and the potential to make their businesses more resilient against the effects of climate change. Importantly, the focus also promotes access to growing ESG-focused capital pools and, with investors under pressure to prove their ESG credentials, companies will have to do likewise to avail of lower costs of capital. Still, advocates say there is room for improvement when it comes to integrating sustainability into the finance function. “I’m seeing a start of recognizing things like water or climate risks on balance sheets…but it is an area that needs far more integration and development,” said Mindy Lubber, president of sustainability non-profit Ceres.

FTI’s latest Resilience Barometer puts COVID-19, ESG in the spotlight

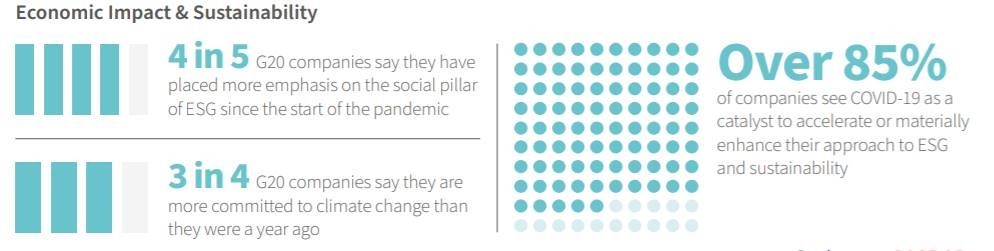

Speaking of resilience, this week sees the launch of FTI Consulting’s Resilience Barometer series which examines the impact of the global pandemic on businesses worldwide. Our research found that 85% of corporate leaders see COVID-19 as a catalyst in driving engagement on ESG and sustainability. The ‘E’ issue of combatting climate change, ‘S’ factors such as diversity and inclusion and the ‘G’ of management quality are all uppermost in business leaders’ thoughts. One notable statistic chimes with this newsletter’s recent reports on the rise of stakeholder capitalism: 82% of business leaders told us that companies should not be run solely in the interest of shareholders. The full report, including plenty of ESG insights in the section on economic impact and sustainability, can be accessed here.

Diversity disclosure on the increase in the US

Fresh analysis from Just Capital provides a snapshot of the response from corporate America to the push against racial injustices following the killing of George Floyd last year, suggesting that “Companies across all industries recognized that their existing, often siloed, diversity initiatives were insufficient to meet the moment.” Just Capital, which describes itself as “an independent research non-profit that is changing the relationship between the public and Corporate America”, has supported New York City Comptroller Scott Stringer in his efforts to urge companies to disclose data in the form of EEO-1 Data Collection to the U.S. Equal Employment Opportunity Commission, which they argue will allow investors to measure the success of companies’ diversity and inclusion frameworks. Many companies have made statements on, and commitments to, addressing racial inequality but few have reflected this in extensive regulatory disclosures. Just Capital does, however, point to a moving of the needle. While only 59 (6.3%) of the 931 companies reviewed provided the data as of January, that is up by 27 from December 21. The analysis also claims that “companies committing to this higher level of disclosure have continued to slightly outperform their industry peers that have not released any data” and are setting a “gold standard” by disclosing their EEO-1 diversity data.

The widening of expectations on diversity reporting and efforts that extend beyond the Board were also detailed extensively on a global basis by S&P, with valuable insights as to how impactful work-from-home and flexible hours can be in fostering more inclusive and diverse workforces.

Including stakeholders in inclusive growth strategies

Across the globe, regulators, trade associations and companies have consistently referenced the widening focus of their strategies to address the expectations and interests of a wider suite of key stakeholders. In this vein, a Harvard Business Review article discusses the rise in inclusive ecosystems: “Traditionally, firms have acted as independent agents jostling for a share of the customer’s wallet and attempting to extract the greatest profit from their industry’s value chain. Today, companies that want to meet both shareholder and societal expectations must work collaboratively with multiple and diverse players to implement “win-win” strategies that benefit all system participants.” In response, efforts have been made to enhance human capital strategies, improve supply chains and engage proactively with communities and governments; however, those strategies continue to be implemented under legal and accounting regimes that may not accurately depict performance in these areas. Companies that want to pursue inclusive growth strategies, the article goes on to say, “must overcome the limitations of their accounting and control systems that prioritize only financial outcomes.” One of the ways to do so is by shifting the meaning of performance from simply economic, to also include environmental and societal performance, replacing the “bottom line” with a “triple bottom line.” Nonetheless, even if the current reporting regime acts as an impediment, companies can use their internal business scorecards as a means of developing and incentivising inclusive strategies. Those same companies are likely to be best positioned to respond to regulatory updates or the eventual development of sustainable accounting standards.

Sovereign Wealth Funds urged to go from laggards to leaders on climate change

With more than $8.6 trillion in assets under management, Sovereign Wealth Funds (SWFs) have an outsized influence when it comes to the fight against global warming but have up to this point, with the exception of Norway, largely stayed out of the limelight when it comes to sustainability issues. This might be about to change however as earlier this week, a first of its kind report by the International Forum of Sovereign Wealth Funds found that only eight SWFs from a group of 34 have more than 10%of their portfolios invested in climate-related strategies. This “piecemeal response” as the FT puts it, raises questions about whether such funds are adhering to their fiduciary duty to invest and grow the wealth invested on behalf of future generations. Whether there are regional disparities that are unlikely to change quickly remains to be seen; however, as the risks of failing to integrate ESG and sustainability – at least to a certain degree – become clearer, we would expect change on this front, with issuers ultimately under the pump.

In case you missed it

- The interest in ESG shows no sign of slowing, says Bloomberg: Over $490 billion was raised by governments, corporations and other groups during 2020.

- Responsible Investment on the Rise in Latin America: As the focus on responsible investment continues to rise across the globe, the number of UN PRI signatories in Latin America has jumped significantly, from 28 in 2019 to 68 in 2020.

- KLM First Flight with Sustainable Synthetic Fuel: This week, KLM, the Dutch arm of Air France-KLM, flew the first passenger flight ever to be partially flown on sustainably derived synthetic aviation fuel. Fully synthetic propellants have taken longer to develop than plant-derived biofuels in the aviation sector, but they are seen as crucial to reducing emissions before electric or hydrogen power allows flying to full transitions to carbon free.

- Reaction to SFDR positive but more clarity wanted: The world of responsible investing has broadly welcomed the European Supervisory Authorities (ESA) Final Report and draft Regulatory Technical Standards (RTS) in enabling “consistent and comparable [ESG] data”, but asset managers have asked for greater clarity in relation to Articles 8 and 9 of the SFDR.

Chart of the Week

Source: FTI Resilience Barometer

Upcoming events

February 11: 2021 Season Preview with Glass Lewis – U.K. & ESG Initiatives

February 23-24: Baird Sustainability Conference

February 24-26: RBC Global ESG Conference

February 25: FTI Consulting ESG+ Webinar – 2021 AGM Season Preview

WEBINAR: The ESG trends arising, or accelerating, as a consequence of the COVID-19 pandemic

Hanson Search and FTI Consulting have joined forces to host a webinar to discuss the impact of COVID-19 on all things related to environmental, social and governance. A panel of industry experts will be discussing the trends arising (or accelerating) as a consequence of the COVID-19 pandemic and sharing the global mitigation measures they think will play out over the course of the year, affecting the longer-term landscape.

Date: Tuesday 9th March 2021

Time: 8:30am – 10:00am GMT

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |