Carbon Capture M&A Is Accelerating – Here Is a Quick Guide for Interested Parties

Senior Managing Director, Energy & Natural Resources, Public Affairs

[email protected]

Carbon capture is no longer a niche industry. With companies’ net zero goals inching ever closer, interest in carbon capture and sequestration (CCS) is increasing across a range of industries. Multiple, nine-figure deals in the past year involving CCS indicate that industry sees this as a critical part of their future business, particularly as they are setting their own emissions and sustainability goals.

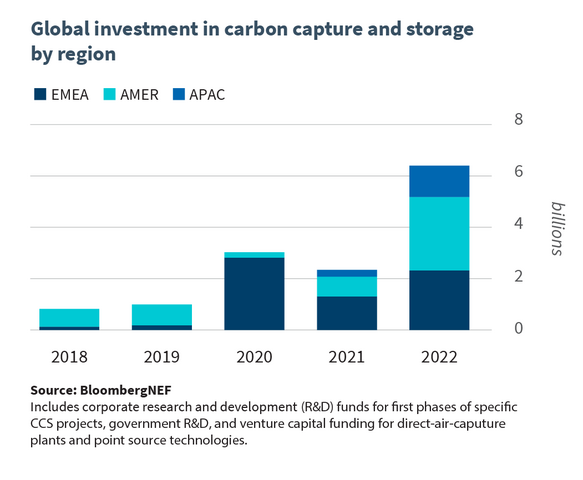

As a backdrop, global investment in CCS has more than doubled since 2021, reaching $6.4 billion in 2022, with the United States accounting for 45 percent of the global CCS investment, according to BNEF.[1] Looking ahead through 2035, BNEF projects CCS will grow at an 18% compound annual growth rate – again led by the United States.[2]

Source: BloombergNEF [3]

This quick guide is for companies exploring deals in this space, including key issues to take into account and how they need to communicate their efforts to investors, local communities, the media, and other stakeholders.

1. Prepare for Competitive Bidding as Demand Is Outpacing Supply

The biggest carbon management acquisition in 2023 was ExxonMobil’s purchase of Denbury for $4.9 billion.[4] But as Bloomberg reported in August 2023, there were nearly 30 potential buyers that were lined up and talking to Denbury, including several large international energy companies.[5] What this suggests is that there are dozens of large companies looking to make big purchases in carbon management, and as of today, based on our experience, there are only a handful of companies that own and operate these assets – many of which are energy companies that will be looking for more ways to leverage that infrastructure.

The upshot? There is high demand and low supply, which means firms looking for acquisition targets need to be prepared for a competitive process, including paying a premium, which will need to be carefully messaged – especially to investors who may be concerned with overvaluation and how linked these investments are to federal policy.

2. Proper Valuation Requires Understanding Availability of – and Eligibility for – Federal Incentives

The Bipartisan Infrastructure Law (BIL) of 2021 provided $6.5 billion in new carbon management funding over five years, with an additional $11.5 billion for related carbon capture pilots and hydrogen hubs.[6] A year later the Inflation Reduction Act (IRA) dramatically increased the size of the 45Q tax credit – a critical piece of policy support for CCS in the United States – from $50/ton to $85/ton for CO2 captured and permanently sequestered. The IRA also increased the credit for CO2 injected for enhanced oil recovery as well as direct air capture (DAC).[7]

Together, both laws provide a robust foundation of federal policy support for carbon management technologies, helping de-risk private investing to scale up and reach widespread deployment across the United States in the long-run.

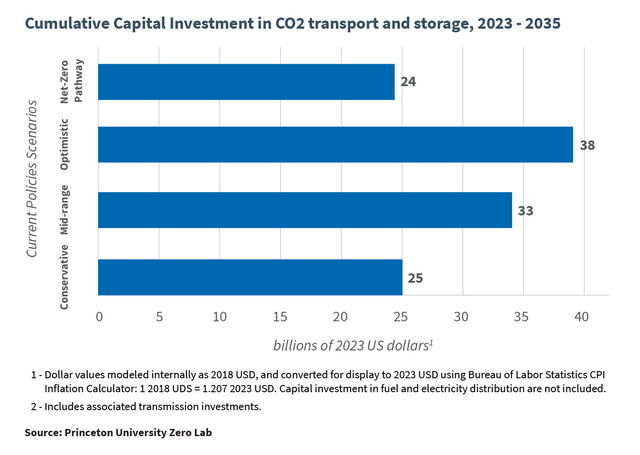

BIL and IRA are expected to spur over a trillion dollars in additional capital investment in energy supply related infrastructure through 2035, per a Princeton University analysis of the long-term impacts of both policies. For instance, investment in CO2 transport and storage could reach a cumulative total of $38 billion by 2035.[8]

Source: Princeton University Zero Lab[9]

Subsequent federal announcements have provided clarity on the kinds of projects that are eligible for federal dollars. For instance, the U.S. Department of Energy recently announced $444 million to support 16 selected projects dedicated to CO2 storage infrastructure.[10] Based on analysis such as from Princeton University, we believe funding of CO2 transport infrastructure is facing similar bullish conditions.

The sheer volume of these options means many firms could be overlooking available dollars that could materially impact valuation for a given project.

3. Premium Will Be Top of Mind for Shareholders

As noted earlier, companies should expect to pay a premium as they explore acquisition targets in the CCS space. In a competitive landscape where revenue is driven by federal incentives, it will be crucial for companies looking to acquire CCS infrastructure to carefully justify that premium, valuation, and business case to investors. On the other side of the transaction, firms exploring a sale will need to make a careful but convincing argument on why that premium is justified.

While these sorts of transactions are often justified by larger oil and gas majors to help meet carbon neutrality goals, companies will need to paint a clear picture of ROI, bear, bull, and base case assumptions for federal incentives, and impact to their consolidated financials. This is particularly relevant if additional infrastructure, and therefore capital expenditure, is needed to make the partnership work to the fullest extent.

4. Community Engagement Can Make or Break a Project

CCS projects across the country – from CO2 pipelines to injection wells – are being challenged by local governments, community members, and even national environmental groups. In addition to carefully assessing a dynamic policy environment at the federal level, companies looking to buy into the growing carbon management space need to develop a robust community engagement plan prior to acquisition.

Similarly, companies need to understand what kind of community engagement the acquisition target currently has in place. Did they establish strong local support that can be built upon? Or did they prioritize speed over local outreach? Companies that acquire a carbon management project also acquire its reputation in the community, and an asset that did not prioritize proper communications could quickly become a liability. Acquiring assets where community engagement was not prioritized will require a complex strategy to re-introduce the project to the community.

Even with the strong incentives in the BIL and IRA, multiple carbon management infrastructure projects have been canceled[11] or delayed[12] due in large part to local opposition. In some cases, that opposition was fueled by national environmental groups that are using local chapters to oppose CCS.[13] While some firms may believe that CCS is a “slam dunk” investment to improve their environmental profile, many environmental groups have come out in opposition to carbon capture on the basis that it provides a “lifeline” to continued fossil fuel development and use.[14]

Companies need to understand this complex landscape so they can effectively engage stakeholders and be prepared to counter misinformation when it surfaces.

Next Steps for Companies Interested in Carbon Capture M&A

As investment in CCS has accelerated, so too has the level of local opposition, which is looking for any avenue to undermine a project. As CCS assets are already attracting a premium, this can create a complex challenge: if there is no plan to effectively address local opposition and the value of the project is not adequately communicated, investors and shareholders are unlikely to accept the risk.

FTI Consulting has a team of experts who can help firms interested in this space in the following ways:

- Develop tailored communications materials across all stakeholder groups (investors, employees, regulators, customers, etc.) that clearly articulate the strategic rationale for the deal;

- Support through deal close including any regulatory, shareholder or local government approvals;

- Identify federal funding opportunities – including available incentives for CCS – based on the specific details of their operations;

- Provide strategic guidance on how companies can develop a robust community engagement plan to win support among local stakeholders.

[1] “Carbon Capture Investment Hits Record High of $6.4 Billion,” BloombergNEF (February 15, 2023), https://about.bnef.com/blog/carbon-capture-investment-hits-record-high-of-6-4-billion/

[2] Brenna Casey, “CCUS Market Outlook 2023: Announced Capacity Soars by 50%,” BloombergNEF (November 9, 2023), https://about.bnef.com/blog/ccus-market-outlook-2023-announced-capacity-soars-by-50/

[3] See supra note 1.

[4] “ExxonMobil completes acquisition of Denbury,” ExxonMobil (November 2, 2023), https://corporate.exxonmobil.com/news/news-releases/2023/1102_exxonmobil-completes-acquisition-of-denbury#:~:text=ExxonMobil%20now%20has%20the%20largest,markets%20for%20CO2%20emissions

[5] Kevin Crowley, “Denbury Entertained 28 Potential Buyers Prior to Exxon Deal,” Bloomberg (August 29, 2023), https://www.bloomberg.com/news/articles/2023-08-29/denbury-held-talks-with-28-potential-buyers-prior-to-exxon-deal

[6] “Fact Sheet: The Infrastructure Investment and Jobs Act – Opportunities to Accelerate Deployment in Fossil Energy and Carbon Management Activities,” U.S. Department of Energy, Office of Fossil Energy and Carbon Management (last accessed February 6, 2024), https://www.energy.gov/sites/default/files/2021-12/FECM%20Infrastructure%20Factsheet.pdf

[7] “Fact Sheet: The Inflation Reduction Act and Carbon Management Opportunities in Western Tribal Nations,” U.S. Department of Energy, Office of Fossil Energy and Carbon Management (May 4, 2023), https://www.energy.gov/fecm/articles/fact-sheet-inflation-reduction-act-and-carbon-management-opportunities-western-tribal

[8] “Climate Progress and the 117th Congress: The Impacts of the Inflation Reduction Act and Infrastructure Investment and Jobs Act,” Princeton University Zero Lab (July 2023), https://repeatproject.org/docs/REPEAT_Climate_Progress_and_the_117th_Congress.pdf

[9] See supra note 7.

[10] “Biden-Harris Administration Invests $444 Million to Strengthen America’s Infrastructure for Permanent Safe Storage of Carbon Dioxide Pollution,” U.S. Department of Energy (November 14, 2023), https://www.energy.gov/articles/biden-harris-administration-invests-444-million-strengthen-americas-infrastructure

[11] Jack Dura, “Navigator cancels proposed Midwestern CO2 pipeline, citing ‘unpredictable’ regulatory processes,” Associated Press (October 20, 2023), https://apnews.com/article/carbon-dioxide-pipeline-co2-navigator-canceled-73dee04da685b512d6aefa01302cdae3

[12] Kim Chipman, “Summit Carbon Pipeline Gets Delayed Until Early 2026, CEO Says,” Bloomberg (October 18, 2023), https://www.bloomberg.com/news/articles/2023-10-18/summit-carbon-pipeline-gets-delayed-until-early-2026-ceo-says

[13] “Say NO to CO2 pipeline projects proposed in Iowa!” Sierra Club Iowa Chapter (last accessed February 5, 2024), https://www.sierraclub.org/iowa/carbon-dioxide-pipelines

[14] “New Data Reiterates Carbon Capture Is A Lifeline for Fossil Fuels, Not Climate Action,” Oil Change International (November 29, 2023), https://priceofoil.org/2023/11/30/new-data-reiterates-carbon-capture-is-a-lifeline-for-fossil-fuels-not-climate-action/

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals. ©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |