Amendments to SEC Accelerated Filer Definitions: Companies seeking to reduce disclosure burden must consider costs, benefits, and potential implications

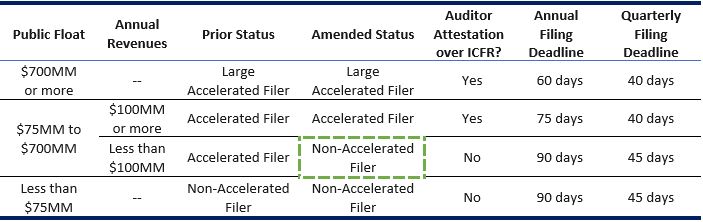

In April the SEC amended its definitions of accelerated and large accelerated filers, the thresholds that trigger the external auditor attestation requirement over internal control and financial reporting (ICFR) under Section 404(b) of the Sarbanes-Oxley Act.

These lowered limits, when combined with the market disruptions caused by the COVID-19 pandemic, mean that many companies may now qualify as non-accelerated filers. However, before jumping to abandon the audit requirements of accelerated filers, companies should carefully consider the consequences.

What is Changing?

Following the adoption of the amendments[1],the SEC has effectively lessened the reporting requirements for certain smaller companies in an effort to reduce compliance costs. However, before adopting these changes it is imperative that companies consider the broader implications and potential benefits provided by maintaining auditor attestation over ICFR. To summarize, the amendments affect two categories of publicly traded firms, namely:

- The addition of a revenue test, with those who previously qualified as accelerated filers (public float exceeding $75 million) shifting to non-accelerated status if having annual revenues below $100 million.

- The transition thresholds have increased, with accelerated filers able to shift to non-accelerated status upon having a public float below $60 million (up from $50 million), and large accelerated filers able to shift to accelerated status upon having a public float below $560 million (up from $500 million).

The COVID-19 pandemic undoubtedly has increased the amount of companies qualifying as potential non-accelerated filers that will not be required to have management’s assessment of the effectiveness of ICFR attested to, and reported on, by an independent auditor.

Why Does it Matter?

The costs of complying with Sarbanes-Oxley’s internal controls audit requirement are well known. Columbia Law School recently estimated the cost of compliance to be “a 25 percent SG&A premium and a 50 percent audit fee premium for compliant companies relative to exempt companies.” While these costs are an important consideration, there are a handful of concerns that point to why the maintenance of these disclosures is worth the cost.

Erosion of Investor Confidence

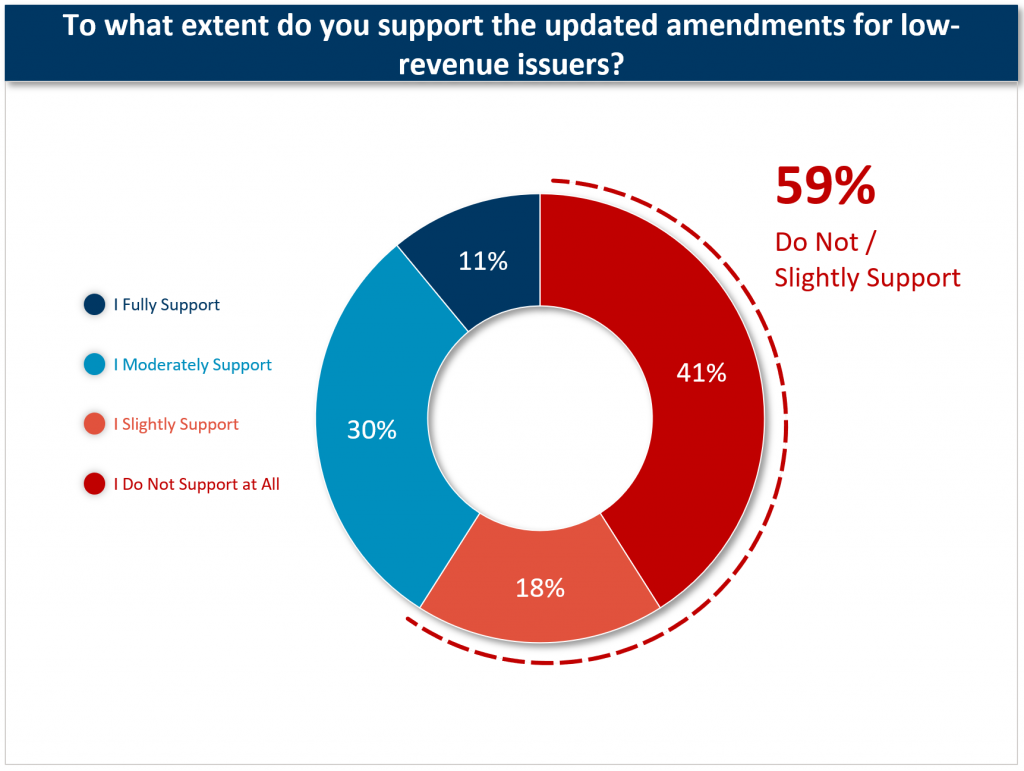

To further understand the potential implications of the SEC amendments, FTI Consulting conducted an online survey with 109 institutional investors.

Our findings confirm that investors largely do not support the new amendments. The results show that 59% of investors either do not support or only slightly support the updated rule.

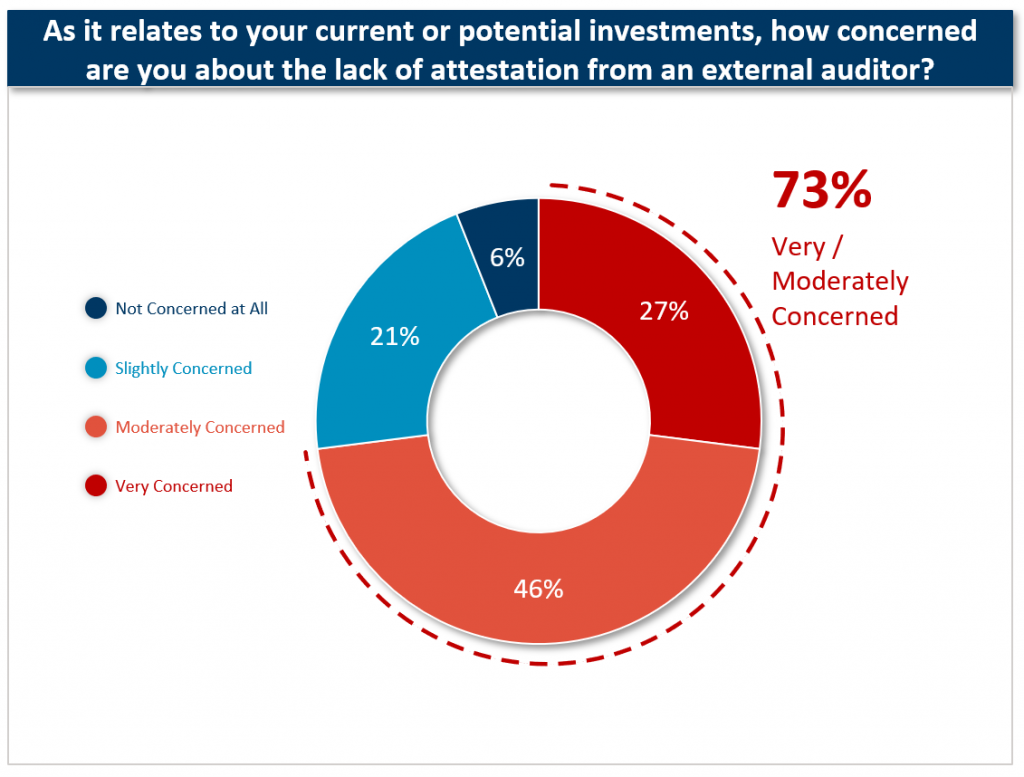

Our results also show 73% of investors would be either ‘very concerned’ or ‘moderately concerned’ about the lack of auditor attestation.

More specifically, institutional investors who participated in the FTI Consulting survey expressed the following concerns:

“I’m not a fan of stripping away a layer of investor protection. I get that it will reduce costs, somewhat, but at what ultimate cost(s)? The reliability of reporting is an absolute must for investors in the public space. Burden or not, the attestation gives some level of comfort and confidence in the numbers.” – Small Cap Investor, US Focused

“I’m a big believer in having third parties confirm information. There are too many cases of reporting abuse and auditors serve an important role in validating financials.” – Small Cap Investor, US Focused

“Always helpful, at least psychologically if nothing else, to believe someone is looking over the numbers that is biased or financially incentivized to the outcome.” – Small Cap Investor, US Focused

“When I perform due diligence on an investment, I check to see if there are any internal control issues that have been raised, and I attempt to understand them if there are. Without auditor attestation, I believe the internal control report is less trustworthy and hence less valuable, and that in turn makes the actual audited financials less trustworthy, to some degree.” – Small Cap Investor, US Focused

“The SEC cited cost savings as the primary benefit of the rule change. We do not think the cost savings will be very significant and certainly not enough to encourage more small companies to go public. On the other hand, auditors tend to focus more sharply on areas requiring their attestation. Lack of internal controls had led to significant fraud among companies in the past and removing this as an area of auditor focus may lead to more missed signals and investor harm.” – Small Cap Investor, US Focused

Reduction of Sell-Side Analyst Coverage

A company’s relationship with sell-side analysts or its ability to attract new sell-side coverage may be negatively impacted by a company’s decision to not maintain auditor attestation.

Sell-side analysts depend on the accuracy and validity of company financial statements to forecast and value companies they cover. If a company were to decide to no longer maintain auditor attestation, covering sell-side analysts might reduce the equity rating on the company or drop coverage entirely. The impact would likely be even more pronounced among equity analysts that have not yet picked up coverage given the heightened risk of reporting inaccuracies and potentially worse, fraud.

Equity analysts continue to serve as a third-party validator for companies they cover. They also play an important role for companies in attracting and retaining quality institutional shareholders. Accordingly, it is critical for equity analysts to maintain the trust and confidence of the market that their reports and insights are factually correct and well-informed. By removing auditor attestation, a company is implicitly asking these analysts to take on additional risk.

The stakes are even higher in a post-MiFID II environment, where small and mid-cap companies are finding it increasingly difficult to expand and secure sell-side coverage.

Heightened ESG Risk

Environmental, Social and Governance (ESG) is becoming increasingly important to institutional investors, especially from a risk management perspective. Removing auditor attestation would negatively impact the governance ratings of companies from proxy advisors like ISS or Glass Lewis. These proxy advisors want to ensure that the financial statements presented to investors portray an accurate picture of a company’s financial position. Specifically, they focus on a company’s system of internal controls that have been put in place to prevent or detect a material misstatement on a timely basis. By removing the auditor attestation, these proxy advisory firms may conclude that a company has ineffective internal control over financial reporting or that the audit committee has failed to provide sufficient oversight over the financial reporting process at the company.

Importantly, heighted risk and lower corporate governance ratings would negatively impact a company’s ability to retain and attract institutional investors, who are increasingly directing more of their investments towards companies with strong ESG programs and high ESG scores. We would anticipate this trend accelerating as institutional investors look to capitalize on the roughly $30 trillion of wealth transfer from Baby Boomers to the Millennial generation. Institutional investors understand that millennials are more likely to embrace ESG issues as long-term value drivers, and therefore are shifting their focus to providing ESG-focused investments.

Conclusion

The new amendments to the SEC’s accelerated filer definitions enable certain companies to “decelerate” their filer status, and as a result, opt out of providing auditor attestations. On the surface, this might appear appealing as it would reduce audit expense. However, we encourage these companies to consider the full suite of effects associated with this decision. Ultimately, we believe it is in a company’s best interest to continue to provide independent, auditor attestations because it enhances the confidence and trust among institutional investors and sell-side analysts, while also minimizing ESG risk, particularly in corporate governance. This will benefit a company when raising capital, expanding its sell-side coverage universe, and engaging with critical ESG stakeholders, including proxy advisory firms.