2023 Look-Back, 2024 Look-Forward: Trends in M&A, Activism, Governance and Beyond

Dealmaking saw a slow start in 2023, with ample uncertainty around the global economy, rising geopolitical tensions, soaring interest rates and political and regulatory scrutiny that continued throughout the year. Yet, the second half of the year saw several high-profile deals announced across the energy, consumer and healthcare spaces, with an increasingly confident market environment that indicates the dealmaking landscape is primed for a progressively busier 2024. As we head into the new year, we reflected on some of the major trends across the M&A, activism and governance spaces in 2023, and offered predictions for what could be to come in the new year.

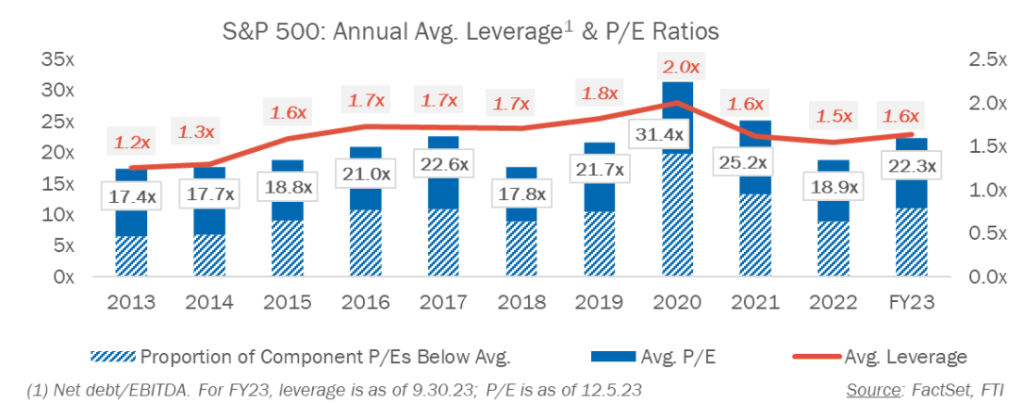

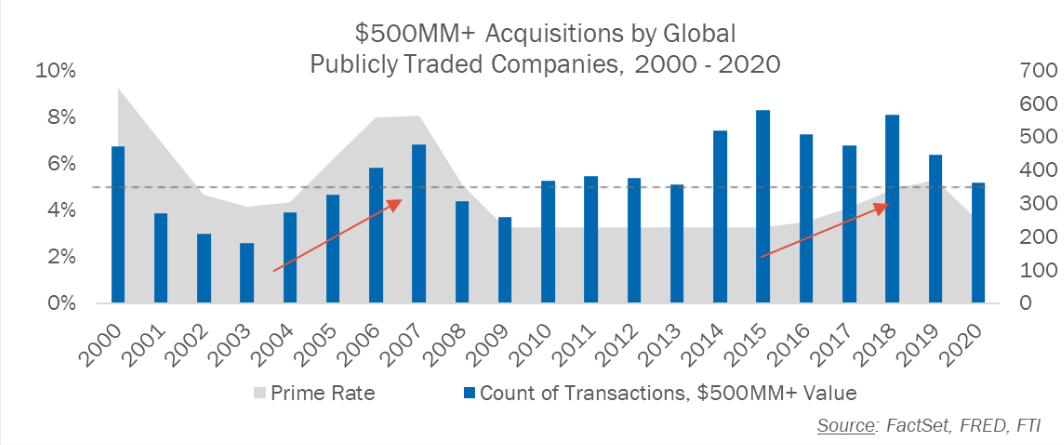

1. M&A Market Ripe for Deals – As indicated by the below charts, the M&A market is ripe for deals heading in 2024. Large-company leverage ratios continue to hold well below pre-pandemic levels, and multiples have contracted from 2020 highs; meanwhile, over the two decades prior to the pandemic, public companies historically became more acquisitive as rates approached or eclipsed 5%. With balance sheets flush, valuations more reasonable and management teams inclined to alternatives as higher interest rates stifle organic growth, strategics are primed to be more active in M&A next year.

2. Elections to Cool CEO Confidence – The upcoming presidential election in the U.S. will likely cool CEO confidence, which has the potential to impact U.S. M&A markets both for deals announced and deals currently in talks. Recent momentum in M&A activity and a positive dealmaking environment may only last into the first half of 2024 if CEOs become concerned with potential policy shifts that could impact the M&A landscape. This will also likely impact European markets, with a UK election likely to occur no later than January 2025.

3. Narrative Bump for Regulators? – 2023 was a tough year for antitrust enforcers, with several major losses and a growing scrutiny from media and politicians despite a number of merger challenges. This led to the dealmaking community feeling increasingly comfortable that big talk from regulators hasn’t yet translated to big changes. With a few major trials still pending going into 2024, big wins could yield a perception shift on antitrust for an administration heading into an election year.

4. Labor Continues to Flex its Muscles – Unions have recently been galvanizing and winning large concessions from their respective industries, with Starbucks facing a proxy contest initiated by the SOC after repeated failed engagements for improved working conditions, and multiple unions’ vocal opposition the Kroger-Albertsons merger. In 2024, unions will continue to be a major stakeholder to consider in M&A, both in the U.S. and globally –, with increased labor scrutiny playing an outsized role in a deal’s public perception and its ability to close.

5. Long Term Value Key to Pension Funds – Traditional fund managers are being challenged as the kingmakers in M&A, with more patient pension money taking a different and longer-term view on value. Where offers pitched at a 30% premium were once considered sufficient, that’s increasingly not enough for pension managers who are backing their own views on long-term value. For example, in 2023 FTI worked on defense mandates where premiums of over 50% were turned down. This is especially true in the energy sector, where pension funds have signaled patience while the transition to renewables plays out. A recent notable example was a large Australian pension manager voting down Brookfield’s offer for a listed energy company, arguing the long-term value was greater, despite a +60% premium offered.

6. Activist Focus on the Big Guys – While the M&A landscape is anything but certain heading into 2024, we expect activists to remain primarily focused on strategy and operational improvements, compared to calling for transformational deals or large-scale board upheaval. Activists have demonstrated they have the most to gain upmarket, and large cap companies are the most likely target of activists’ concerted push for portfolio simplification.

7. Russell 3000, Meet Shareholder Proposals – The anti-ESG movement led to a reevaluation of ESG, with E&S shareholder proposals seeing record low levels of support in 2023. This trend has contributed to proponents filing shareholder proposals on E&S topics at smaller companies and in new industries that have rarely or never faced proposals, instead of targeting the same mega cap companies over and over again.

8. Anti-ESG to Continue in the US – While the ESG environment will continue to evolve, the anti-ESG movement continued to pick up steam in the U.S., with investors and politicians alike finding it to be a highly effective, expedient and disruptive message. With the upcoming U.S. election in 2024, anti-ESG criticism will likely continue to be a unifying factor among Republicans, raising the possibility that companies will increasingly be singled out in the crosshairs.

9. Distressed Debt Investors on the Rise – Distressed debt and special situations funds are increasingly active in change of control situations, a trend only expected to continue into 2024. As corporates come under increasing financial pressure, these funds are stepping in and buying their debt at deep discounts, and seeking control via debt for equity swaps. As short-term owners of assets, the fund managers are then driving more asset sales and mergers.

10. Evolving Investor Sentiment – Heading into 2024, equity markets have outpaced CEO confidence and commentary, with November delivering the second best S&P results over the last 20 years and consensus outlook for the market calling for continued strength. The financial markets are expecting a better 2024 earnings cycle than most corporates and current fundamentals suggest, which will increase pressure on management teams to deliver.

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com