The Decade of Disputes: Spotlight on Environmental Litigation

Download a PDF of this articleMisleading product claims, ESG disclosure and funding of group actions are all factors that increase the likelihood of environmental disputes in Europe.

In 2019 FTI Consulting undertook research surveying 2,000 businesses on their expectations of the corporate environment in the years ahead. This research found that business leaders were anticipating an increase in litigation in the years ahead – in other words a “Decade

of Disputes”.

In our 2023 update, the team at FTI Consulting analyses the increasing prominence of environmental litigation in Europe, presenting a new range of reputational challenges for businesses facing claims for failing to mitigate impacts on the environment, as well as for failing to close the gap between bold assertions on sustainability that may not be seen as misleading – more commonly known as greenwashing.

FTI Consulting has sought out the views of business leaders, investors and the general population on perceptions of greenwashing, combining this with data analytics of the global media conversation around the issue. The analysis highlights an urgency for businesses to align their action on sustainability with societal expectations while providing consistent clear communications on the subject matter, with

scientific backing.

Awareness of “Greenwashing” goes mainstream

It has become clear that while “greenwashing” was once a term used predominantly by climate activists, it is now part of the mainstream media conversation in the business, political and consumer media landscape.

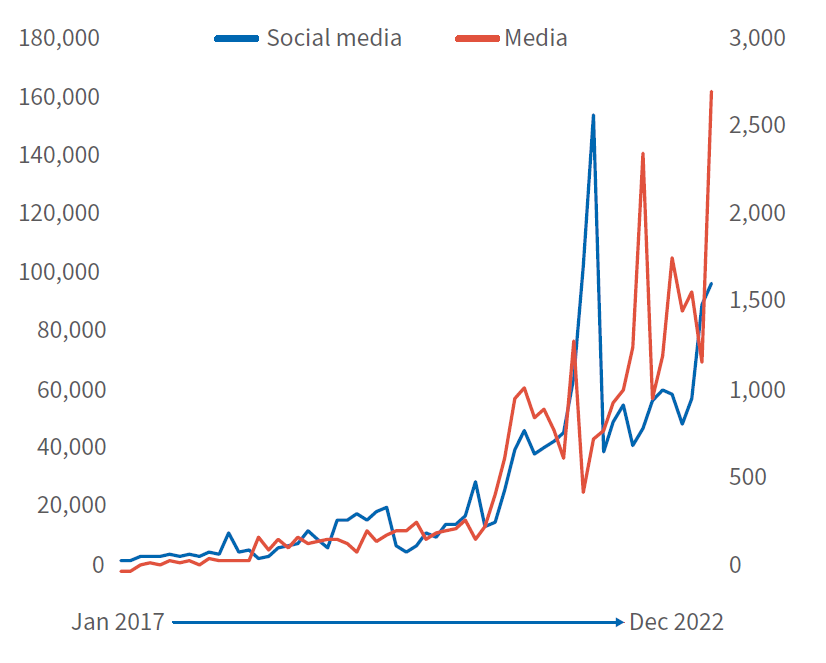

FTI Consulting research shows an increase in mentions of the term “greenwashing” in traditional and social media, with a 78% increase in media coverage of the topic from 2021 to 2022, and an 85% compound average annual average increase over the past three years.

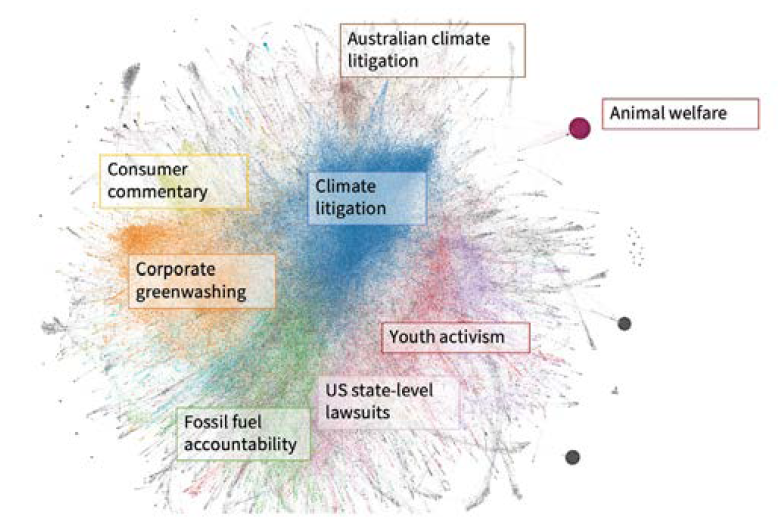

Picking through the many disparate conversations mentioning the term “greenwashing”, overlap can be identified in a number of areas where litigation is foreseeable such as water pollution, environmental harm, animal welfare and consumer activism. These are mostly found in regional-specific clusters of conversations, particularly prominent in the US, Australia and Europe.

An audience map of this conversation illustrates a media landscape that includes claimant law firms clearly front-and-centre of the media coverage of these claims, often alongside established climate NGOs and attracting the attention of politicians, consumers and investors.

Three areas for environmental disputes – investors, regulators and class actions

Greenwashing can take a number of forms, but recent developments in the legal and regulatory landscape significantly increase the prospect of environmental litigation against large businesses:

- Shareholder litigation for financial misstatement on ESG disclosure

- Consumer protection and competition regulators investigating misleading product claims

- A rise in third-party litigation funding for group actions on environmental harm

The investor view

With a rise in ESG disclosure – both voluntary and required by regulation – and a growing view that such information can materially affect an investment decision, there is a widespread expectation of a rise in shareholder class actions for financial misstatements on greenwashing. In the UK, section 90 of the Financial Services and Markets Act has provided a route for shareholder litigation for failure to disclose misconduct and civil fraud. Meanwhile the European Union is driving towards standardised transparency requirements for environmental claims, including the Sustainable Finance Disclosures Regulation introduced in 2021 to improve transparency around sustainable investment products.

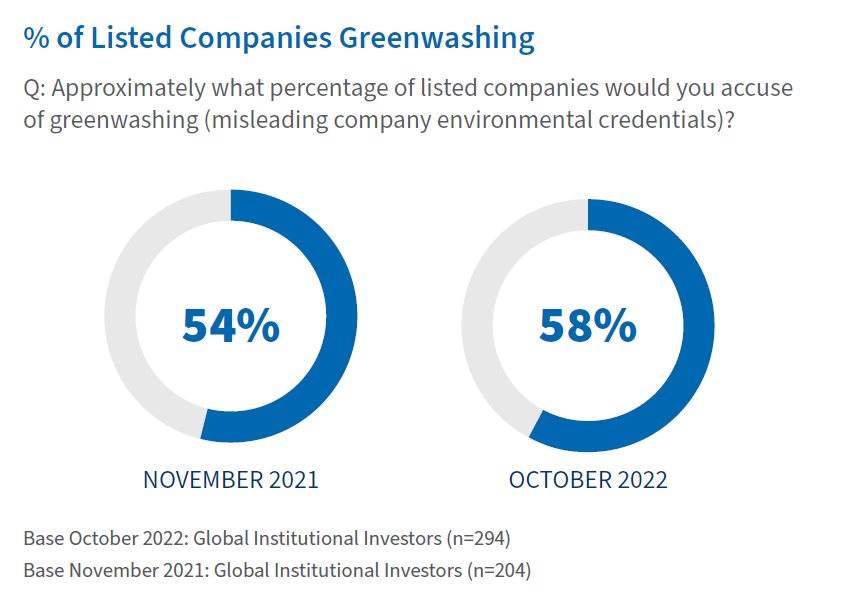

With ESG seen as equally material information, the same principals may apply to misinformation on environmental disclosure. The extent of this possible route to damages or restitution is highlighted in FTI Consulting’s research, showing that consistently over the past two years the majority of institutional investors surveyed hold a view that the majority of listed companies could be accused of greenwashing.

The regulatory risk

In light of the increase in awareness of greenwashing among the general population, and the inclusion of the topic in recent political discourse, it is unsurprising to see regulators now looking to take action on the subject.

At the start of the year, the Competition and Markets Authority in the UK announced that it will seek to examine the accuracy of sustainability claims made by companies to ensure that consumers are not being misled, kicking-off with a formal investigation into three fashion brands to scrutinise their ‘green’ claims. This followed the introduction of the EU Taxonomy Complementary Climate Delegated Act, which sets out the conditions which must be met for an economic activity to be considered as being “environmentally sustainable”.

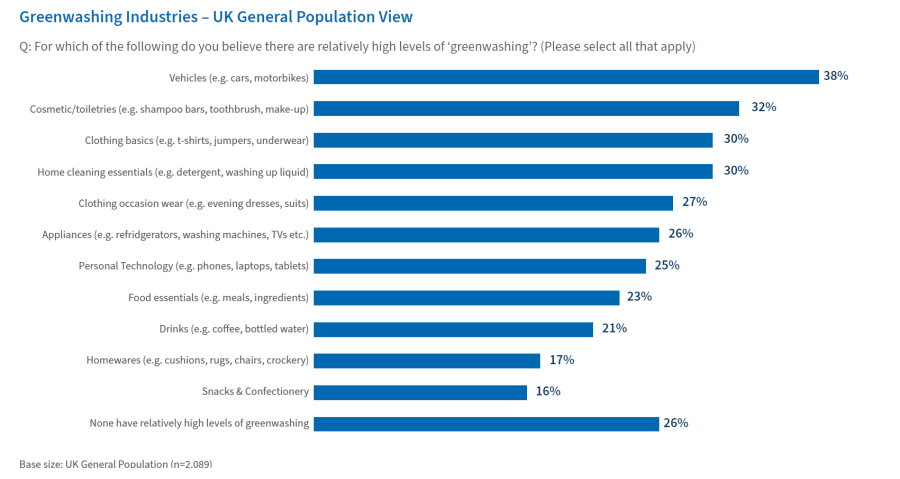

FTI Consulting sought to assess the likely areas that consumers anticipated being misled on environmental claims – identifying motor retail, fashion and home essentials as the most prominent categories of goods, followed by home appliances and consumer technology.

The research also sought to qualify the extent that greenwashing harms a brand, finding that the lost consumer trust ranks somewhere between a negative review online about a product or brand, and a negative review from a friend or close connection.

The business perspective

It should be unsurprising that large corporations may occasionally find themselves facing environmental litigation. High profile examples, such as ClientEarth of bringing action against the Shell alleging a breach of the duties imposed by the UK Companies Act 2006 for failing to take sufficient steps to reduce emissions, illustrate the legal possibilities in this area. Notably, Deutsche Bank’s DWS supervisory board launched a review following allegations by its Chief Sustainability Officer that investors had been misled about the ESG credentials of its products, leading to police investigations and the resulting departure of the DWS CEO. At COP 27, the United Nations High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities published a report entitled ‘Integrity Matters” to draw a red line around greenwash and to set clear recommendations on green claims.

While the risk of environmental litigation may be well understood by boardrooms across the globe, FTI Consulting’s research identifies some of the driving factors behind its continued prevalence. Chief among them is the inherent tension between profit-making organisations and environmental sustainability. Of the 600 large businesses surveyed (employing a combined 7 million people) one quarter of respondents believe that their company does not financially benefit from being more sustainability focussed. A greater proportion (28% of respondents) stated that they struggle to implement real improvements on sustainability.

With that backdrop, is it any wonder that one-in-five of business leaders believe that the majority of their company’s communications on the environment is simply greenwashing?

Unsurprisingly, environmental litigation is the spotlight for the decade of disputes.

Methodology

FTI Consulting’s proprietary research with the two audiences:

1 – Business leaders in Europe:

Online research from 20th to the 27th of January 2023 with n=600 C-suite and senior leaders in large companies (n=200 in each of UK, France and Germany). Respondents were randomly selected to have a representative sample by industry in each country. To emphasise the importance of these respondents on behalf of these companies they employ a sum in excess of 7 million and over £/€1 trillion revenue globally.

2 – UK General Population:

Online research from the 7th to the 12th September 2022 with the n=2,089 respondents from the UK adult general population (i.e. aged 18+ yrs. old). Results were weighted in terms of age, gender, location and voting behaviour to ensure representativeness. Due to the convention of rounding, not all results will sum

to 100%.

For more information on the research methodology: [email protected]

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals. ©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |