Neither Fight nor Flight: The Case for Corporate Derisking in Populist Latin America

Unorthodox, sweeping policies from populist governments in Latin America are hindering, if not outright harming, investors. Should they fight? Or take flight? We suggest a third way: finding a new balance between legal defense and stakeholder engagement through derisking strategies for corporates and investors.

Sweeping winds of policy change are blowing across Latin America. Mexicans, Colombians, Brazilians, Salvadorans, and Argentinians, just to cite a few, have all witnessed presidentially-espoused attempts to upend economic and political frameworks.[1] Many of those have failed– true.[2] But, the fact that these reform proposals are being driven by the countries’ most powerful leaders, often with widespread support in the public opinion, should make investors take heed. Political risks in the region are rising, deepening and broadening.[3] At this point, does anyone paying close attention to Latin American politics still dare to claim that radical political positions announced in electoral campaigns are only rhetorical?

Get our 2024 Latin America Insights in your inbox – Subscribe Now

Whether emanating from populist leaders that identify with some form of leftist politics, or with a radical right, they have proven to be much more than mere gusts. They are prevalent.[4] More often than not, when one key proposal for regulatory change is stopped, two disruptive legislative bills in the same sense emerge. When these fail, constitutional reforms are drafted. The cycle starts again. A new government comes in, but only to push a new revisionist campaign.

This is a new normal for Latin America. Yet investors and corporates still often disregard the growing pile of evidence that proves that issues management and public affairs strategies have, unfortunately, not kept up. It is all too common to find corporate issues management teams – whether with a legal, government relations or communicational bent – insisting on unnuanced deference or deterrence tactics. Across the board, cases abound of corporates that become too friendly towards those in power,[5] compromising shareholder value and setting a target on themselves vis-à-vis the political opposition. Or too adversarial,[6] risking retaliation that can eventually compromise business continuity. Even worse, sometimes they swing between the two approaches.

To capitalize on Latin America’s abundant investment opportunities, consider stakeholder derisking as a more sustainable approach to issues management for public affairs strategy.

To capitalize on Latin America’s abundant investment opportunities,[7] there is a more sustainable (and precise, and context-driven) stakeholder derisking approach. This requires advancing two seemingly contradicting ideas at once:

In the face of governments (and other stakeholders) that are increasingly adversarial to private investment, litigation and arbitration ultimately constitutes the only material lever of substantive value defense. It is often the only source of real influence to advance negotiations. No relationship-building efforts should jeopardize legal defense strategies.

All-out conflicts with any host government (and/or full divestment from the country) typically results in loss of value. Even if some form of compensation is eventually awarded, companies that have openly antagonized governments are seldom made whole in terms of missed opportunities and wasted time and resources.

The way to make them compatible – the derisking path in the face of sweeping policy changes – is to strike a delicate balance. While delving deeper on the technical detail of a specific critical issue that harms an investor (often to present a legal claim that can eventually turn into leverage), the public, political scope of a conflict either at company or industry level needs to be proactively limited. This means that, as conflict with a government over a specific policy or action progresses, relationship preservation efforts need to be redoubled without surrendering the possibility of taking legal action. Relationship-building efforts, in fact, should be used to advance technical and legal actions while mitigating the risks of complete relational destruction and potential retaliation.

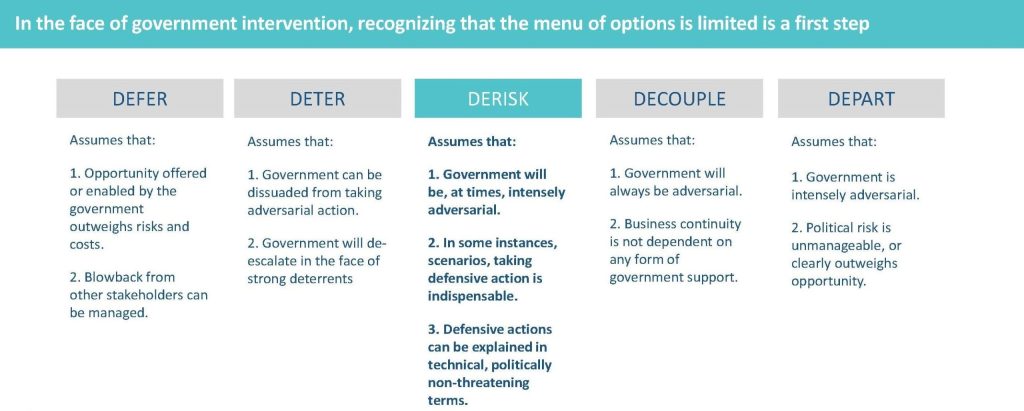

In short, within this derisking framework, it is essential to strategize for different levels to be better prepared for shifting political contexts. Counterintuitively, this starts with recognizing that the range of strategic responses from corporates and investors (individually or as an entire industry) to adversarial government action are actually limited.

In Focus: Mexico

President Andrés Manuel López Obrador has sought to shake-up the status quo in unorthodox ways. He has, for instance, used his presidential prerogative to introduce constitutional reform bills to Congress, some of which would have a negative impact on the business environment.[8] So far, the most controversial have not been approved by the legislative branch.[9] But the lack of support in both chambers notwithstanding, he aims to lay out his agenda and force political actors – within and outside his party – to take a stance on hot-button issues,[10] contributing to uncertainty for business operations.

Taking the energy industry as an example, President López Obrador has sought to bring the sector under state control using numerous instruments throughout his term.[11] This has resulted in regulating agencies rulings[12] against some of these attempts, and myriad legal challenges[13] – most notably against the President’s reform to the Electricity Industry Law (LIE), which seeks to rollback previous reforms that opened the industry to private investments and favored power generation from renewable sources.[14]

The originally expected avalanche of arbitration and international litigation from investors demanding compensation from the Mexican government has not yet materialized. That said, the US and Canada have requested consultations over Mexico’s energy policies under the United States-Mexico-Canada Agreement (USMCA),[15] which could lead to a dispute settlement panel. However, instances in which companies (at an individual or industry level) have used a derisking approach – taking critical issues to courts while proactively engaging with the government – have been the most successful in overcoming policy and regulatory challenges.[16]

Democratic checks and balances – with a key role of the judiciary – have ultimately stopped the proposed regulatory changes that contravene the constitution and the Mexican legal framework more broadly.[17] Nevertheless, the president’s initiatives, along with executive actions, smaller policy changes and a hostile narrative towards private investment in critical industries,[18] have already altered the range of possibilities in mainstream politics.

This situation entails short-term challenges for investors and corporates, as the latest reform package[19] the President introduced to Congress (to be discussed in Congress over the next months) reveals. Among other dispositions that would undermine competitiveness and the rule of law more broadly, the reform package includes proposals to eliminate regulating agencies, transform the judiciary, change the rules for water concessions and – once again – favor the national utility company (CFE) over private electricity producers.

There are also longer-term risks for shareholder value across industries as the president’s agenda and narrative will likely continue to drive uncertainty into the next administration for investors and corporates,[20] especially in extractive industries. This is particularly the case since the President’s party will likely remain in a strong position after the June general elections[21] and, thus, continue to push for core pieces of his platform and use similar rhetorical tactics in this endeavor. Therefore, it remains essential for investors and corporates to think strategically about legal pathways for value defense all while creating the conditions for strong business operations under a new government.

Our Takeaway

The end of López Obrador’s tenure, the government transition period and the consolidation of the upcoming administration will put companies’ issues management teams to the test as they try to navigate a volatile business environment. Their ability to identify not only immediate but longer-term risks, key stakeholders, critical legislative and bureaucratic procedures, along with relevant political trends, will be essential to build sustainable business strategies, leverage options, maximize shareholder value and capitalize on the myriad opportunities[22] the country has to offer.

The Mexican case illustrates the time and resources lost for companies fluctuating between deference, deterrence, decouple and departure tactics to try to conduct business under a populist government[23] instead of using a more sophisticated derisking one to build a robust, comprehensive risk management strategy. Under this approach, the strategic use of legal defense, relationship-building efforts and ‘corporate diplomacy’ is essential to enable substantive value defense and, thus, ensure successful business operations even in contexts in which governments are, at times, strongly adversarial.

[1] Natalie Alcoba, “Year of the underdog: How ‘outsiders’ upended Latin America’s elections,” Aljazeera (December 30, 2023), https://www.aljazeera.com/news/2023/12/30/year-of-the-underdog-how-outsiders-upended-latin-americas-elections

[2] Juan Carlos Echeverry, “Ungovernable governments,” El País (April 7, 2023), https://english.elpais.com/opinion/2023-04-07/ungovernable-governments.html

[3] Isabella Cota, “Political turbulence limits Latin America’s economic prospects,” El País (October 20, 2023), https://english.elpais.com/economy-and-business/2023-10-20/political-turbulence-limits-latin-americas-economic-prospects.html

[4] James Bosworth, “Latin America’s Incumbents Will Have a Good 2024. Democracy Won’t,” World Politics Review (January 2, 2024), https://www.worldpoliticsreview.com/mexico-elections-venezuela-el-salvador/

[5] Michael Sttot, “Latin America’s private sector is failing the region, economist Mazzucato warns,” Financial Times (February 10, 2024), https://www.ft.com/content/7634a92f-ef08-4416-824a-f1baba39bd31

[6] Michael Stott, “Latin America is beating the world at wasting opportunities,” Financial Times (May 10, 2023), https://www.ft.com/content/fed9e922-7f80-4555-ab89-35c936085009

[7] Daniel Salazar Castellanos, “Top Latin American Countries for Investment in 2024, According to Experts,” Bloomberg Línea (September 7, 2023), https://www.bloomberglinea.com/english/top-latin-american-countries-to-invest-in-2024-according-to-experts/

[8] “Ocho iniciativas que ponen en riesgo la competitividad de México,” Instituto Mexicano para la Competitividad (IMCO) (February 6, 2024), https://imco.org.mx/ocho-iniciativas-que-ponen-en-riesgo-la-competitividad-de-mexico/

[9] “Mexican president fails in bid to limit foreign energy firms,” Associated Press (April 18, 2022), https://apnews.com/article/business-mexico-caribbean-bae2c34ccdf63cdbdbf66512280d9f39

[10] Guillermo Molero, Max de Haldevang, and Maya Averbuch, “AMLO Proposes Reforms to Energize Base Before Election,” Bloomberg (February 5, 2024), https://www.bloomberg.com/news/articles/2024-02-06/amlo-unveils-slew-of-reforms-to-corner-opposition-energize-base

[11] “Is Mexican energy policy on the verge of a profound change?,” BNamericas (July 13, 2023), https://www.bnamericas.com/en/interviews/is-mexican-energy-policy-on-the-verge-of-a-profound-change

[12] “COFECE files a constitutional controversy against the Decree that reforms several provisions of the Electric Industry Law,” Federal Economic Competition Commission (Cofece) (April 22, 2021), https://www.cofece.mx/wp-content/uploads/2021/04/COFECE-012-2021_ENG.pdf

[13] Daniel Amézquita and Iván Valdespino, “Power Struggles: Latest Developments in Mexico’s Energy Sector Litigation Landscape,” Chambers and Partners (November 15, 2023), https://chambers.com/legal-trends/mexicos-new-energy-reform

[14] Alejandra Ibarra Chaoul and Kevin Sieff, “Mexico’s electricity reform draws opposition from investors, U.S.,” The Washington Post (April 16, 2022), https://www.washingtonpost.com/world/2022/04/16/mexico-electricity-reform-amlo/

[15] Karin Dilge, “US Has a Strong Case Against Mexico’s Energy Policies,” Mexico Business News (October 19, 2023), https://mexicobusiness.news/energy/news/us-has-strong-case-against-mexicos-energy-policies

[16] “How the lawsuits against Mexico’s 2021 electricity reforms are shaping up,” BNamericas (May 7, 2022), https://www.bnamericas.com/en/interviews/how-the-lawsuits-against-mexicos-2021-electricity-reforms-are-shaping-up

[17] “A Big Win for Markets in Mexico,” The Wall Street Journal (February 2, 2024), https://www.wsj.com/articles/mexico-supreme-court-strikes-down-electricity-law-andres-manuel-lopez-obrador-9193f48d

[18] David A. Gantz, “AMLO Is Undermining What’s Left of Mexico’s Favorable Investment Climate,” Baker Institute for Public Policy (July 6, 2023), https://www.bakerinstitute.org/research/amlo-undermining-whats-left-mexicos-favorable-investment-climate

[19] “Mexico’s president seeks broad constitutional reforms ahead of June elections,” Reuters (February 5, 2024), https://www.reuters.com/world/americas/mexicos-president-lays-out-constitutional-reforms-2024-02-06/

[20] Alejandra Soto, “AMLO’s Forever Agenda,” Americas Quarterly (June 20, 2023), https://www.americasquarterly.org/article/amlos-forever-agenda/

[21] Carin Zissis, “Poll Tracker: Mexico’s 2024 Presidential Vote,” Americas Society/Council of the Americas, https://www.as-coa.org/articles/poll-tracker-mexicos-2024-presidential-vote

[22] Noe Torres, “Mexican businesses warmed by glow of ‘nearshoring’ dawn,” Reuters (November 6, 2023), https://www.reuters.com/world/americas/mexican-businesses-warmed-by-glow-nearshoring-dawn-2023-11-06/

[23] David Marcial Pérez, “De la sintonía con Slim a los roces con la patronal: los contrastes de la relación de López Obrador con los empresarios,” El País (March 5, 2022), https://elpais.com/mexico/2022-03-05/de-la-sintonia-con-slim-a-los-roces-con-la-patronal-los-contrastes-de-la-relacion-de-lopez-obrador-con-los-empresarios.html

Pablo Zárate

Senior Managing Director, Mexico Public Affairs

Pablo Zárate is a senior managing director within FTI Consulting’s Strategic Communications segment, based in Houston and Mexico City. He is a leader of the segment’s Latin America Public Affairs practice and focuses on developing and overseeing issue management programs to address high-stakes corporate challenges such as acute political risk, disputes, complex financial transactions, regulatory issues, and reputational crises.

Alejandra Soto

Director, Mexico Public Affairs

Alejandra Soto is a Director in FTI Consulting’s Government and Public Affairs practice based in Mexico City. She has 10 years of experience advising companies across industries with operations and investments in Mexico, Central America and the Caribbean on how to successfully navigate complex political, regulatory and security environments. She is a leading expert on Mexico, strategic intelligence and risk analysis.

Related Insights

About Our Latin America Practice

FTI Consulting advises companies doing business across Latin America to navigate the stakeholder dynamics around high profile corporate events, from transactions and market entry to crisis, disputes and litigation. We help clients anticipate critical political, policy and reputational risks and effectively overcome them, unlocking long term opportunity. Our Latin America practice works in a coordinated manner through our offices in Mexico City, Bogotá, and São Paulo, as well as with our teams in Washington D.C., Brussels, Madrid, Houston, Miami, and other important hubs. Through our vast network of strategic partners, we have coverage on all Latin American countries.

Washington D.C. | Houston | Mexico City | Bogotá | São Paulo

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals. ©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |