M&A Policy Perspectives: Spotlight on D.C.

Senior Managing Director, Americas Head of M&A, Activism and Governance Communications

[email protected]

Mergers and acquisitions frequently attract the attention of both Wall Street and Washington, but perspectives on M&A from Washington D.C. policymaking elites are not often quantified.

As 2024 promises a rebound in M&A activity, the increased focus on antitrust among policymakers means that dealmakers must be able to follow where political winds are pushing this critical issue.

To better understand key stakeholder sentiment during this pivotal year, FTI Consulting Strategic Communications’ M&A and Activism practice conducted a poll of D.C. policy influencers to gauge their perspectives on M&A policy and the administration’s current regulatory frameworks.1

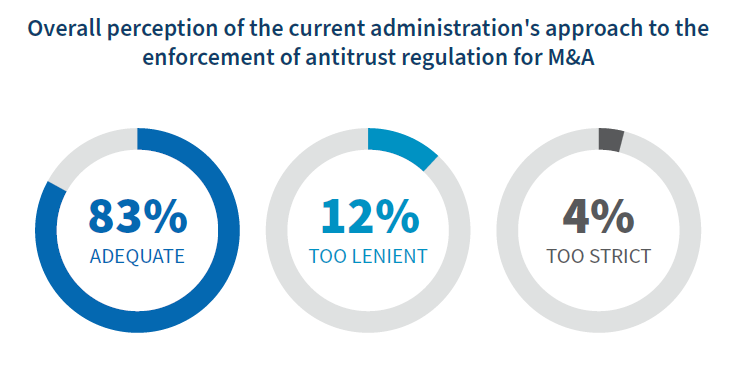

Policy influencers generally support the current approach to antitrust enforcement

As populism rises in both parties, antitrust enforcement has not yet resonated as a strongly polarizing issue. This could indicate that the administration will hold strong on its approach to regulate M&A or even lean into its existing approach, particularly during an election year.

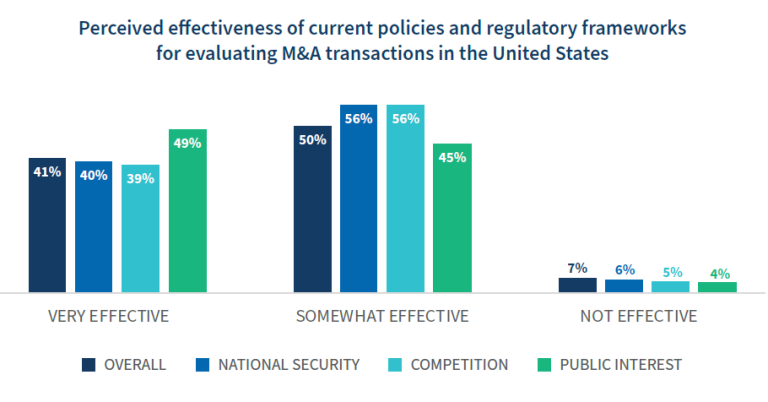

Policy influencers are broadly comfortable with existing antitrust regulations

This may indicate a relative lack of support for calls for legislative change and a recognition that the legal review of antitrust enforcement is working as it should.

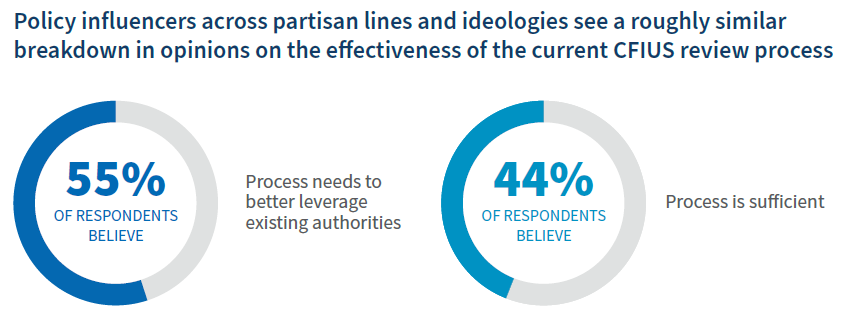

Survey results indicate policy influencers want to expand the CFIUS review framework

Slightly more than half of respondents believe that the Committee on Foreign Investment in the United States (CFIUS) review process needs to better leverage existing authorities to address how other nations are protecting their interests through merger controls.

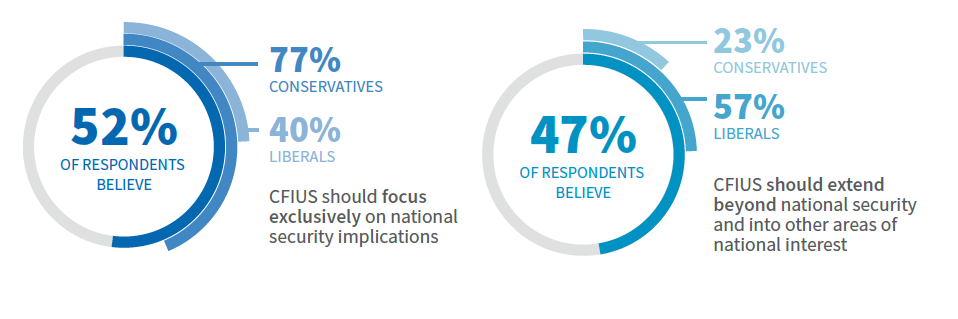

Opinion is split along partisan lines on whether CFIUS should focus exclusively on national security or extend beyond.

In December 2023, the FTC and DOJ unveiled their new Merger Guidelines, promising sharper scrutiny of mergers and acquisitions and a broader framework for merger evaluation.2 The administration’s new framework is already resulting in more frequent and thorough investigations of transactions, leading companies to factor more time needed for regulatory review, but the guidelines themselves are not law and are not binding in courts.

While D.C. stakeholders remain largely supportive of the current administration’s approach and appear unlikely to advocate for changes that narrow current frameworks, it remains to be seen how courts will consider the new guidelines as more cases are challenged and litigated.

Our Takeaway

Time and regulatory uncertainty can sour a deal’s future just as much as the courts ultimately tasked with ruling on antitrust challenges. Conducting M&A in this environment will continue to challenge dealmakers, and parties engaged in M&A must be prepared to defend the strategic merits of their merger beyond the traditional competitive lens. Ultimately, companies wishing to avoid the risk and cost of federal litigation must take a more calculated approach when evaluating and communicating mergers. With acceptance from policy insiders on both sides of the aisle growing, the current administration’s more aggressive approach of challenging mergers shows no signs of abating in the near term.

Interested in further discussions related to these findings or evaluating your communications strategy around transactions? Please contact us.

About FTI Consulting M&A Communications

FTI Consulting’s integrated transaction communications offering supports clients in realizing deal success by delivering investor support and approval, mitigating political risk for regulatory clearance and setting clients up for integration success. The team taps into global multidisciplinary expertise across FTI Consulting’s leading capabilities in corporate reputation, investor relations, public affairs, people and transformation and digital strategy. This work is complemented by FTI Consulting’s broader M&A advisory services, including merger integration, business transformation and strategic advisory work for chief financial officers.

[1] FTI Consulting surveyed N=209 D.C. policy influencers* who pay attention to and self-identify as knowledgeable of M&A policies and debates. The survey was conducted online between November 2nd, 2023 – February 11th, 2024. *Policy influencers are defined as those who currently hold paid positions at Congress, the White House, federal government agency, political party/campaign, Super PAC, think tank, trade associations, labor union, communications, or public relations or issue advocacy firm.

[2] “Merger Guidelines,” U.S. Department of Justice and the Federal Trade Commission (December 18, 2023), https://www.ftc.gov/system/files/ftc_gov/pdf/P234000-NEW-MERGER-GUIDELINES.pdf

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com