LNG By Rail: Meeting the Natural Gas Infrastructure Challenge

Key takeaways

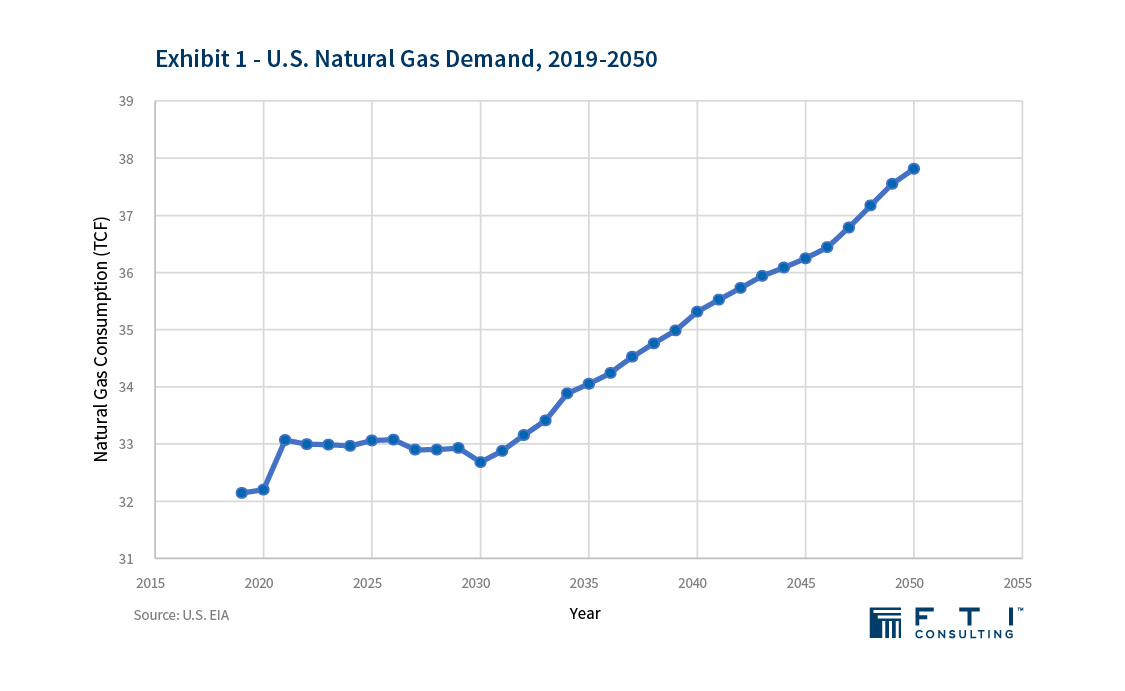

- Already the top fuel for U.S. power generation, natural gas demand is projected to increase 18 percent by 2050.

- Infrastructure constraints, including pipeline opposition and federal shipping laws, are already disrupting the flow of natural gas to utilities, residential customers, and other end users.

- To date, LNG by rail has only been used in limited cases, owing to costs and other factors. But growing demand and the increasing difficulty in building new pipelines could change the cost calculus over the longer-term.

- American railroads have a long history of safely transporting energy products, including hazardous materials.

Abundant supplies of natural gas unlocked by the shale revolution have slashed energy prices in the United States, which in turn allowed natural gas to surpass coal as the largest source of power generation in the United States, accounting for 38% of the fuel mix in 2019. The permitting and construction of several new liquefied natural gas (LNG) export facilities have fundamentally changed not only the U.S. energy landscape but also the global market. Although uncertainty around COVID-19 and a downturn in the market may shift expectations, some analysts project the United States will be the largest LNG exporter within a decade.

However, logistical and regulatory constraints are starting to take hold. Opponents of natural gas have targeted pipelines as a key part of their “Keep It In the Ground” strategy, and have successfully blocked or delayed crucial natural gas pipelines, particularly for markets along the East Coast. Opposition to the PennEast pipeline rose all the way to the Supreme Court. After a lengthy legal fight, the $8 billion Atlantic Coast Pipeline was recently canceled as opponents committed to near-endless delay tactics. And the developer of the now-canceled Constitution Pipeline has announced it will cancel yet another project local utilities say is critical for meeting demand in New York City and Long Island. The increased delays and cancellations have gotten so severe that the New York Times recently ran a story entitled, “Is This the End of Oil and Gas Pipelines?” The answer to that question is “no,” but the mounting roadblocks to energy infrastructure are raising costs and forcing suppliers to rethink how to deliver fuel to market.

Despite these hurdles, the regions that would be served by these projects continue to increase their use of natural gas. The result is predictable: supply constraints and higher prices. Massachusetts, for example, was forced to import cargoes of LNG from Russia due to inadequate pipeline infrastructure. At times in recent years, natural gas prices in the Northeast have spiked to among the highest in the world. Worse still, federal laws such as the Jones Act effectively prohibit U.S. LNG from moving between American ports, creating additional roadblocks for U.S. communities to access domestically produced natural gas.

Another Option?

Markets across the country – particularly in the Southeast and along the East Coast – could face severe energy shortages if new infrastructure is not developed. Oil producing regions dealing with excess supplies of associated gas also need more infrastructure to get that fuel to market, particularly given growing concerns over flaring. With nationwide demand for natural gas projected to increase 18% by 2050, alternative options to pipelines may need to be considered. One of those potential options is shipping LNG by rail, which benefits from an already proven and well-established infrastructure network – one that the Pipeline and Hazardous Materials Safety Administration (PHMSA) explains “can be both competitive and complementary to the truck and pipeline networks.”

A 2019 report from PHMSA concluded that “demand exists for shipping LNG by rail,” adding that “LNG has been transported safely by rail with no incidents to date” in other countries. In June 2020, the U.S. Department of Transportation (DOT) and PHMSA, in consultation with the Federal Railroad Administration (FRA), issued a final rule authorizing the transportation of LNG by rail. The rule added a number of new safety requirements, including increased outer shell thickness for tank cars and real-time tracking of pressure and location. As U.S. Transportation Secretary Elaine Chao noted, the new rule “carefully lays out key operational safeguards to provide for the safe transportation of LNG by rail to more parts of the country where this energy source is needed.” It is worth noting, of course, that the rail industry already has a long and well-documented history of safely transporting other energy products, including hazardous materials.

Previously, LNG by rail was only allowed via a special permit from PHMSA and the Federal Railroad Administration (FRA). To date only three such permits have been granted – all since 2016. And until recently, the absence of a federal regulatory regime for rail tank cars carrying LNG was a potential risk for opponents to exploit, suggesting that transporting LNG by rail is unsafe due to a lack of rules.

A Proactive Communications Strategy is Critical

A recent special permit granted to ship LNG from Pennsylvania to New Jersey attracted national attention from opponents. On June 11, 2020, federal lawmakers on the U.S. House Committee on Transportation and Infrastructure introduced a bill that would further complicate the issuing of permits to transport LNG via rail. As noted by the Association of American Railroads, this could curtail the ongoing modernization of U.S. railroad infrastructure while constraining the industry’s ability to adapt in the future. There will likely be additional opposition in the future.

A smart strategic plan will not only identify where new projects make sense, but also how to proactively communicate with the elected officials, regulators, and the general public – particularly local communities along the route – to ensure any new projects avoid the delays and other challenges that have followed some pipelines in recent years. If successful, the plan will bring the community, lawmakers, and other key stakeholders into the network of informed advocates.

- A community advisory committee that gives local stakeholders not only an opportunity to directly interface with the developer, but also a legitimate say in how the project is developed.

- It should be noted that railroads shipping LNG will be using the Rail Corridor Risk Management System (RCRMS), a 27-factor tool that allows railroads to select the best routes based on safety and security. Much of these route selection data are considered security sensitive, and thus not released to the public, although AAR provides a general overview of the tool on its website.

- Early outreach to local officials (elected and not elected) to inform them of the planning process, such that local lawmakers do not first hear of the proposed project in the news.

- Regular contact with local media, which is part of the broader goal of transparency and open engagement with the community.

- Integrating social and digital media into the broader communications strategy, including a website that can serve as an accessible hub with easily understood but thorough information for the public and responsive social media channels to expand dialogue opportunities with the community. Social media also provides a rapid response tool to answer and address questions and concerns and also clarify misinformation or other allegations.

Although LNG by rail is unlikely to become a significant source of transportation for natural gas in the near-term, there are some regional applications – beyond where it is being used already – where it may be cost-effective today, including oilfields like the Bakken and Permian Basin, which produce large quantities of associated gas that are currently being flared. Importantly, if bottlenecks continue in the Northeast, industry will need to explore alternative transportation options to connect natural gas from the Marcellus Shale region to urban demand centers along the East Coast. Given the dramatic increase in projected demand for natural gas alongside the anti-pipeline efforts already underway (and the likelihood for additional constraints in the future), now is the time to consider what those options may be – and prepare accordingly.