Hydrogen hubs: A historic opportunity for net-zero investment in the United States?

WHAT is a hydrogen hub?

- The U.S. government is set to invest $9.5 billion in hydrogen technologies.

- The Infrastructure Investment and Jobs Act (IIJA) provides for $8 billion towards the development of at least four regional clean hydrogen hubs to demonstrate the viability of the entire hydrogen value chain, including production, processing, delivery, storage, and end use.

- The U.S. Department of Energy (DOE) defines a hydrogen hub is “a network of hydrogen producers, potential or actual hydrogen consumers, and connective infrastructure located in close proximity.”

- An additional $1.5 billion will be spent on electrolysis and clean hydrogen manufacturing and recycling research, development, and demonstration.

This effort presents a once-in-a-generation opportunity to advance hydrogen technologies and thereby the energy transition required to meet long-term climate goals. However, the road to deploying these funds in a thoughtful and impactful manner will be long and complex.

WHY invest in hydrogen now?

- A clean and versatile energy carrier, hydrogen is enjoying positive bipartisan attention in the U.S. because of its potential as a unique decarbonization solution for heavy industry, transportation and gas-fired power, as well as its ability to serve as a long-duration energy storage solution enabling further build out of renewables in the grid.

- In the spirit of the Bipartisan Infrastructure Deal, U.S. government action on hydrogen is expected to spur private investment and thereby create new economic opportunities as well as address local and regional environmental issues, while repurposing existing energy infrastructure and transitioning skilled workers to new technologies.

- The federal government package opens opportunities for state, industry, and other players to reach climate goals by investing in diverse hydrogen technologies that utilize regional strengths.

- With this action, the U.S. joins more than 30 countries globally that have put in place dedicated strategies and/or funding schemes to help advance the scale-up of hydrogen technologies as important components of national decarbonization strategies.

WHEN will the hubs be announced?

- The DOE – specifically its newly created Office of Clean Energy Demonstrations – has been tasked with leading the hub implementation program.

- Existing teams such as the Hydrogen and Fuel Cell Technologies Office will provide much needed issue expertise and manpower, especially until new personnel is in place.

- The process has started and is expected to proceed in three steps:

- A request for information (RFI)[i] on the Regional Clean Hydrogen Hubs Implementation Strategy was due March 21, 2022, asking for input on several categories:

- Regional Clean Hydrogen Hub (H2Hubs) provisions and requirements.

- Solicitation process, Funding Opportunity Announcement (FOA) structure and implementation strategy.

- Equity, Environmental and Energy Justice (EEEJ) priorities.

- Market adoption and sustainability of the hubs.

- Any other input or information that would be valuable in developing a Regional Clean Hydrogen Hub FOA,

- A draft FOA is expected to open for feedback and public comments in June 2022. The draft will provide insight into how the DOE is planning to implement the hub program.

- The final FOA is expected to be released by later this year with the full hydrogen hub program and implementation strategy finalized.

- A request for information (RFI)[i] on the Regional Clean Hydrogen Hubs Implementation Strategy was due March 21, 2022, asking for input on several categories:

As the DOE evaluates input provided via several hundred RFI submissions and prepares for the FOA, a lively debate is underway regarding the best way to invest allocated funds. Views range from prioritizing a limited number of larger investments in already existing hydrogen ecosystems led by proven players to placing bold strategic bets and keeping options open to a wider pool of parties.

Notably, this process is set against a backdrop of rapidly growing attention to and scrutiny of hydrogen technologies in the U.S. – the carbon impact of various production methods, viability for certain use cases, investment needs to reach mass-scale volumes etc. This is only expected to intensify alongside the hubs process and could seriously impact its success.

HOW will hubs be chosen?

The IIJA has established the following minimum criteria for the hub program:

- On the supply side: one hub producing hydrogen from fossil fuels (likely natural gas); one from nuclear energy; and one from renewables.

- On the demand side: diverse end uses including one for power generation; one for industrial decarbonization; one for transportation; and one for commercial heating.

Going beyond these basics, what are the likely keys to a successful hub strategy?

Regional energy resources

New hydrogen production facilities utilizing a variety of production processes and feedstocks will be required throughout the country. Regions with abundant primary energy resources such as biomass, wind and solar, low carbon nuclear electricity or natural gas complemented by CO2 sequestration sinks, have a natural advantage in the production of hydrogen. For example, an analysis by the Great Plains Institute shows the enormous potential for hubs in the Gulf Coast, Midwest & Illinois Basin, and Rocky Mountain regions of the United States.

Full value chain approach

The ability to demonstrate a full value chain approach with sufficient hydrogen off-take, however, will be a key success factor. To keep costs down, the co-location or clustering of supply and demand is a core hub strategy, especially for regions with large end-use facilities in industrial sectors such as refining, iron and steel, petrochemicals, and ammonia, that can substitute fossil sources with clean hydrogen. The Gulf Coast region for example is a natural early candidate for a large-scale hydrogen hub. This region contains a high concentration of large industrial emitters in these sectors, well developed transport and electric infrastructure, gas pipeline networks, geological storage for CO2 and hydrogen, and low-cost renewable energy. Additionally, the clustering of producers and consumers of hydrogen allows for economies of scale in common infrastructure development such as hydrogen (and CO2) pipelines, compression and storage, as well as product transport.

State-level incentives

In the transportation sector, state and local incentives such as the Low Carbon Fuel Standard, adopted by California can further spur regional hydrogen production and fueling infrastructure development, especially for heavy trucking, marine and aviation. For example, the Port of Long Beach Hydrogen project is a key node in the developing hydrogen fueling station network in California, and intended to substitute diesel demand for heavy port handling equipment and drayage trucks on site. Increasing the network density of hydrogen fueling infrastructure lowers the cost of delivery which in turn feeds a positive ongoing development dynamic. State-level action therefore, could be a critical factor towards a successful hydrogen hub development.

Unique value-add

In the power sector, the Advanced Clean Energy Storage (ACES) project in Delta, Utah, recently the recipient of a $504M DOE loan guarantee, is a mega scale green hydrogen hub development. The project will produce 100 metric tonnes of hydrogen per day from a 220-MW alkaline electrolyzer bank, which is then stored in two salt caverns of a combined energy storage capacity of 300 GWh – a scale that only pumped hydro can currently match. The ACES project demonstrates the unique role hydrogen can play in long duration energy storage – a key tool in balancing and enabling the full build out of renewables in the electricity system. The electrolyzers use low to no cost off peak or curtailed solar and wind power from the grid, and the produced and stored hydrogen in turn feeds an 840-MW combined cycle gas turbine at the Intermountain Power Agency IPP sending power to the LADWP (Los Angeles Department of Power and Water) system. The ACES project is a unique end-to-end energy network solution demonstrating at scale, the integration of low-cost renewable energy input, hydrogen storage to gas fired power and the gas and electricity transmission systems serving Western U.S market demand. It will provide year-round carbon-free power generation to help Los Angeles reach its goal of net-zero by 2035.

Environmental justice and communities

Finally, of critical importance will be not only hubs’ projected climate, environmental and economic impact but especially their contribution to local and regional development with strong emphasis on environmental justice and underserved communities. Notably, the IIJA also prioritizes hub initiatives that will create the most opportunities for skilled training and long-term employment for the proposed region’s residents. Getting this part of a hub strategy right and winning the support of a broad range of stakeholders may ultimately turn out to be among the most complex aspects of the process.

WHO is likely to apply for federal funding?

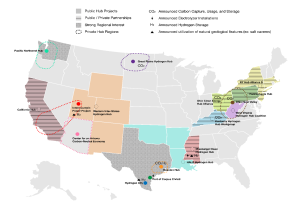

In the meantime, the first hub consortia are moving forward to announce their plans. FTI Consulting’s initial analysis of these public announcements shows the following:

- As of May 16, 2022, plans for 17 hubs have been made public.

- Those include industry alliances in the Appalachia/Ohio River Valley and Gulf Coast regions, as well as multi-state, governor-led coalitions including the Western Inter-States Hydrogen Hub of Colorado, New Mexico, Utah, and Wyoming, and the New York Hub Alliance of both private and public actors with the New York, Connecticut, Massachusetts, and New Jersey Governors collaborating with over 40 industry partners.

- Among these, five have chosen to publish preliminary investment figures, ranging from $1.7 billion (The Intermountain Power Project) to $3 billion (The Mississippi Clean Hydrogen Hub).

- Five have made available information regarding project carbon impact: the Houston Hub would capture carbon emissions equivalent to that of 20 million cars; and the New York Hub Alliance is expected to be a critical part of member state’s climate goals for an 80% reduction in greenhouse gas emissions (CT, NY) and carbon neutrality (MA, NY) by 2050.

- Hydrogen production methods among them include a variety of primary energy sources such as wind, solar and natural gas. While most announced hubs have yet to identify planned production methods, they are expected to draw from various regional attributes per the requirements detailed in the IIJA.

- In terms of end uses, three hub announcements say they will include hydrogen fueling to decarbonize transportation. However, information regarding anticipated demand side hub partners is relatively sparse, though industry alliance members like utilities, aviation companies, and industrial processors lend some ideas of potential end markets.

- Notably, 32% of state governors (16/50) have expressed support or have a formal role in a hub project, with an almost even split of 8 Democrats and 7 Republicans (MS, CO, NM, UT, WY, ND, KY, LA, OK, AR, WV, NY, CT, MA, NJ, PA), which demonstrates the high level of political interest in this opportunity.

WHAT’S NEXT for hydrogen hubs?

- These conversations are just the beginning of what is shaping to be a complex, lengthy, highly political and fiercely competitive process. The DOE’s strategy is expected to gain further contours in the coming months while more announcements – and ultimately bids for funding – follow.

- Stiff competition will require hub candidates to be laser focused on articulating their unique value proposition, supported by robust qualitative and quantitate data, as well as their contribution to the nation’s overall hydrogen strategy – keeping in mind the program’s core objective: to demonstrate viability of hydrogen through hubs and using these as springboards to unleash the sector’s potential at large.

[i] The DOE has made the decision to not release these responses publicly, likely due to the number and detail of these documents that may contain sensitive business information.

—

ABOUT FTI CONSULTING

FTI Consulting is a global business advisory firm offering multidisciplinary solutions for our client’s complex challenges and opportunities. Our energy experts have worked on hydrogen for well over a decade, and our experience includes leading industry coalitions as well as individual clients across the entire value chain and all key global markets.

Combined with deep expertise and broad experience across the entire energy system, our team provide strategic, commercial, economic, regulatory and communications advice focused on navigating change and maximising sustainable, long-term value. Our key service areas in hydrogen include:

- Hydrogen value chain assessment: Production, storage and end-use, including power, long duration storage, transport, heavy industry

- Market and policy analysis by end-use sector; implications for demand and supply

- E-fuels/power to X market entry strategy and opportunity identification

- Project development, planning, & implementation support

- Financing: Development and equity capital, debt

- Strategic communications: public and government affairs, coalition building and advocacy, corporate reputation, digital and insights, corporate reputation, crisis communications, financial communications, and transaction communications.

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2022 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |