Growing Scrutiny of M&A in Space and Defense Demands Enhanced Due Diligence to Manage Risk and Secure Deal Approval

Managing Director, Transaction Advisory and Transformation, Corporate Finance

[email protected]

Key Takeaways

- M&A is on the rise in the space sector driven by a variety of factors, including:

- The need for legacy space to better compete within the rapidly evolving market;

- The need for additional capital by new space companies to bring their services and products to market;

- Cooling valuations amidst a high level of “dry powder”;

- Growing pressure of “investment realization” for active funds; and

- Ambitions by foreign governments to quickly develop sovereign space capabilities.

- Amidst this growth in M&A, companies are facing greater regulatory and political scrutiny that can directly impact the timeline, economics, and outcome of a deal. U.S. Defense Secretary Lloyd Austin has specifically called out concerns over consolidation in the defense industrial base, the Federal Trade Commission (“FTC”) sued to block proposed major A&D transactions in recent years, and prominent Members of Congress, including Senator Elizabeth Warren (D-MA), have taken aim at a variety of space and defense transactions.[1]

- With multiple M&A deals on the horizon, such as the possible sale of United Launch Alliance (“ULA”),[2] the likely divestiture of MAXAR Space Systems, and anticipated consolidation within earth observation, we anticipate that government regulators and policymakers will be paying close attention to current market dynamics and the potential impact of specific transactions. Importantly, outside detractors such as customers, competitors, and politicians will look to turn up the volume on transactions for their own agenda. As such, the following four actions are critical for companies and investors to incorporate in their commercial due diligence (“CDD”) process.

Key Considerations for Enhanced Due Diligence

- Regulatory and Political Risk Analysis: Given the significant influence of regulatory authorities in M&A (e.g., FTC, Department of Justice, Committee on Foreign Investment in the United States (“CFIUS”), Federal Communications Commission (“FCC”), etc.), as well as frequent attempts by policymakers and outside parties to influence the outcome of regulatory approvals, transacting parties must clearly identify regulatory and political risks and determine the level of overall deal risk well in advance of deal signing and announcement. To achieve this objective, FTI Consulting’s team of regulatory, political, and industry experts conduct a detailed risk analysis that consider the reputation of transacting parties; the market and workforce impact of the combined company; involvement of foreign investors; and likely transaction detractors and their ability to influence the political and regulatory process.

- Risk Mitigation Planning: Depending on the output of the Regulatory and Political Risk Analysis, FTI Consulting develops customized risk mitigation plans that take into account the market, regulatory, and political environment, as well as unique factors of the transaction. This primarily includes a comprehensive M&A rollout plan that ensures the transacting parties are communicating the right messages with the right stakeholders (e.g., investors, customers, employees, suppliers, politicians, etc.) for the purpose of minimizing outside noise and supporting the company and its other advisors as they work to secure necessary approvals.

- Landscape Influence: In the case of transactions that have a high likelihood of public opposition, FTI Consulting carefully works to ensure a constructive public environment prior to deal announcement, while maintaining deal confidentiality. This often involves using influential third-party voices to make accurate and convincing arguments through strategic communications channels such as beltway op-eds, earned media articles, or social media posts. Importantly, having a “first mover” advantage to strategically disseminating key messages can preempt any challenges by detractors and subsequently place them in a reactive posture.

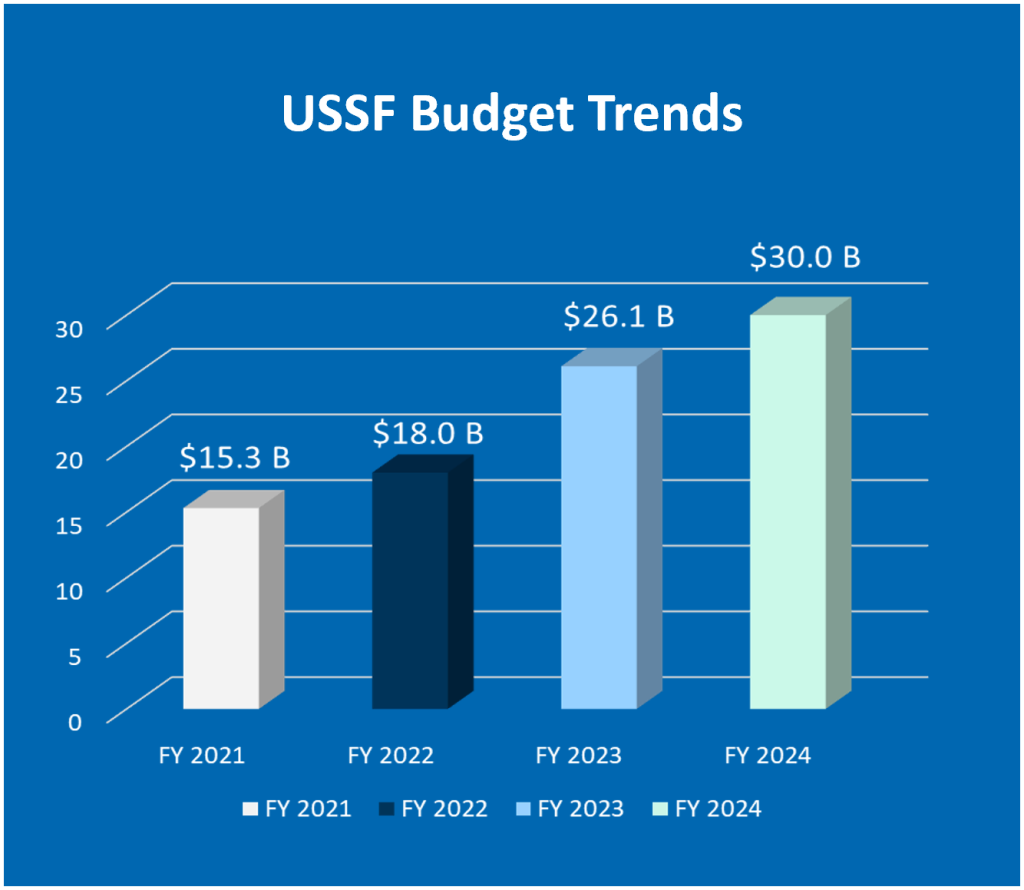

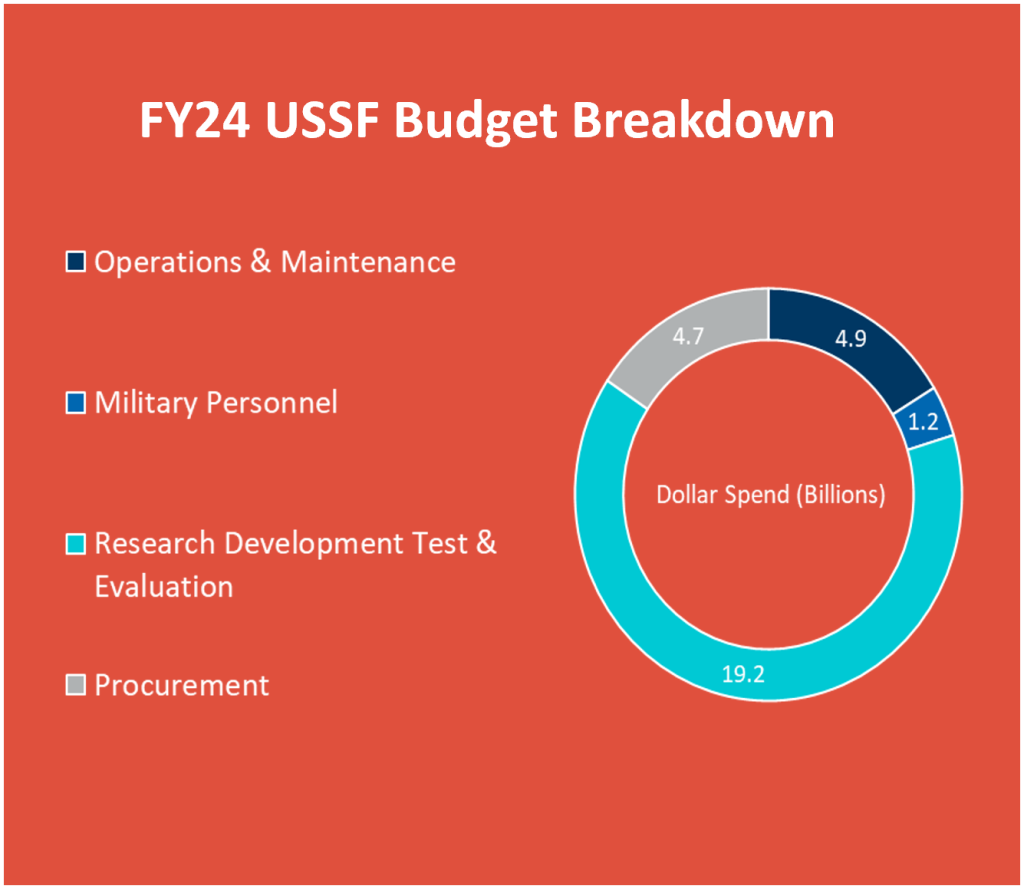

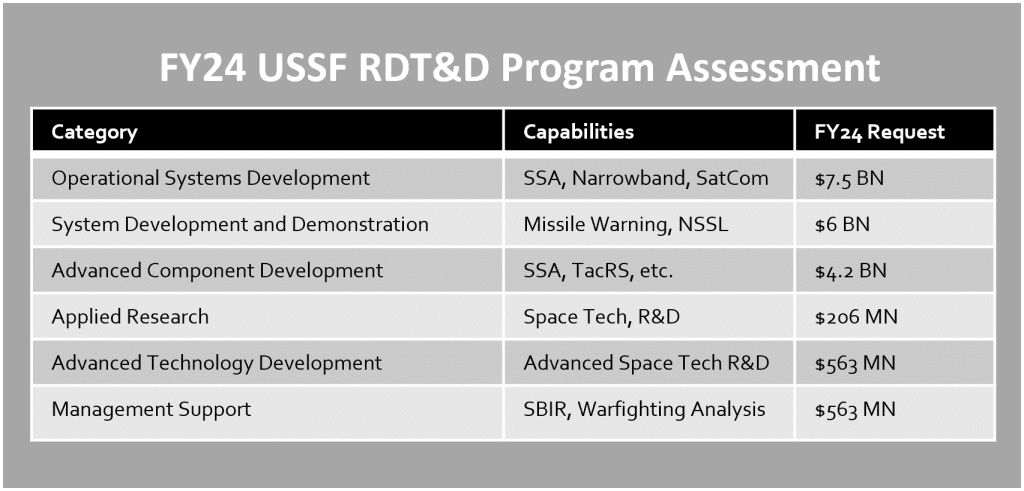

- Enhanced Institutional Revenue Diligence: Most space companies are heavily reliant on institutional revenue from government customers. Importantly, institutional contracts function very differently from commercial contracts and are often influenced by the politics of the day. For example, if Congress does not pass a FY 2024 budget by April 30, 2024, then government budgets will be automatically cut by 1% from FY 2023 levels.[3] This will have a direct impact on current and future contracts. Therefore, FTI Consulting’s team of experts in government budgets and congressional appropriations further supports the CDD process by analyzing the target’s contracts and backlog, the likelihood and time that it will take for the target to realize its backlog, the amount of political support for government programs, and any other government programs that the target is well positioned to secure.

Over the last 40 years, FTI Consulting has grown to become a market-leading global consulting firm that brings together distinct capabilities and experts to serve as the trusted advisor to clients when they are facing their greatest opportunities and challenges. Each practice is a leader in its own right, staffed with experts recognized for the depth of their knowledge and a track record of making an impact. Collectively, FTI Consulting offers a comprehensive suite of services designed to assist clients across the business cycle—from proactive risk management to the ability to respond rapidly to unexpected crises and dynamic environments.

[1] Diane Bartz, “U.S. Senator Warren urges FTC to stop L3Harris deal to buy Aerojet,” Reuters (January 27, 2023), https://www.reuters.com/markets/deals/us-senator-warren-urges-ftc-stop-l3harris-deal-buy-aerojet-2023-01-27/

[2] Eric Berger, “Blue Origin has emerged as the likely buyer for United Launch Alliance,” ARS Technica (February 21, 2024), https://arstechnica.com/space/2024/02/blue-origin-has-emerged-as-the-likely-buyer-for-united-launch-alliance/

[3] John A. Tirpak, “Budget Officials: USAF Modernization at Risk If Sequester Hits, But Sentinel ‘Will Be Funded’,” Air & Space Forces Magazine (January 24, 2024), https://www.airandspaceforces.com/usaf-budget-modernization-sequester-sentinel/.