Facing Forward: A Time for Cautious Optimism – FTI Consulting’s 2023 Healthcare & Life Sciences Industry Outlook

Download a PDF of this articleAfter a year marked by inflationary pressures, geopolitical instability and the world returning to a new normal post-COVID-19 pandemic, our third annual FTI Consulting Survey: U.S. Healthcare & Life Sciences Industry Outlook asked 250 industry leaders for their expectations for the sector in 2023. Emerging trends include adopting a cautiously optimistic outlook for the year ahead due to the expected increase in financial investment in the sector, a need to be better prepared for potential cybersecurity threats and a greater focus on environmental, social and governance (ESG) initiatives.

This year’s survey comes off the back of positive momentum over the past few years for the industry. Driven by life-altering medical innovations, including gene and cell therapy1 , enhanced public perceptions of the sector due to the COVID-19 pandemic2 and relentless demand for more scientific and technical talent3 , the healthcare and life sciences sector has experienced an increased level of attention from a wide variety of stakeholders. Given how much the political and economic landscape has changed over the course of 2022, however, the question is what lies ahead.

FTI Consulting conducted its third annual survey of 250 senior decision makers working in corporate communications, investor relations, public affairs, business development and marketing for healthcare and life sciences companies in the U.S. to understand the key trends and challenges currently facing the industry.

Looking to 2023, there is significant optimism among senior leaders about the future of the industry. In fact, more than 76% of respondents noted that they were “largely optimistic overall,” particularly as it pertains to their organization’s financial performance (87%), safely returning to the workplace (84%) and finding balance in hybrid ways of working (79%). However, despite this positivity, the healthcare industry still has a tempered economic outlook compared to 2022. Nearly nine in 10 respondents (85%) expressed concern about the potential economic outlook of the industry in the U.S. and what it could mean for investments in the coming year.

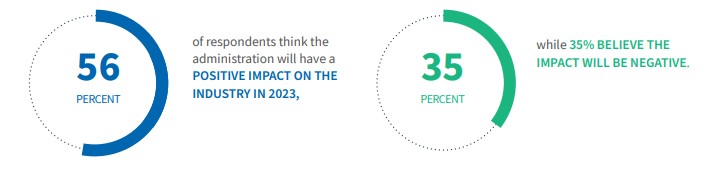

One significant finding from this year’s survey is the growing threat of cybersecurity incidents. Roughly two-thirds (70%) of respondents stated that they have experienced a cybersecurity incident in the last 12 months, with malware/ransomware (31%) and phishing (27%) emerging as the top threats. Given the results of the U.S. midterm elections and the divided government in 2023 and beyond, it is not surprising that the political landscape is a major area of interest for industry leaders. Respondents are fairly divided on the Biden administration’s expected impact on the industry in 2023 (56% positive, 35% negative).

Other significant trends facing the industry include an increased focus on diversity and inclusion (D&I), particularly in clinical trials and an emphasis on ESG. Similar to last year, the industry has continued to prioritize D&I efforts with 27% of respondents (+2%) describing the progress they have made so far as “excellent.” And while significant progress has been made in this area, increased investment is still needed in the broader area of ESG. The top three ESG challenges the industry faces include the availability and quality of relevant data (32%), a lack of ESG expertise/resources (24%) and a generally risk-averse culture against disclosure (22%).

Our team of strategic communications and healthcare & life sciences experts recommends keeping an eye on the following key trends in 2023.

Adapting to a Post-Pandemic World

After several years of change and transition, U.S. healthcare and life science leaders are largely optimistic overall (76%; although down from 85% in 2021)4 about the future of the industry, particularly when it comes to financial performance (87%), safely returning to the workplace (84%) and finding balance in hybrid ways of working (79%).

Budgets Prioritize Communication and Talent

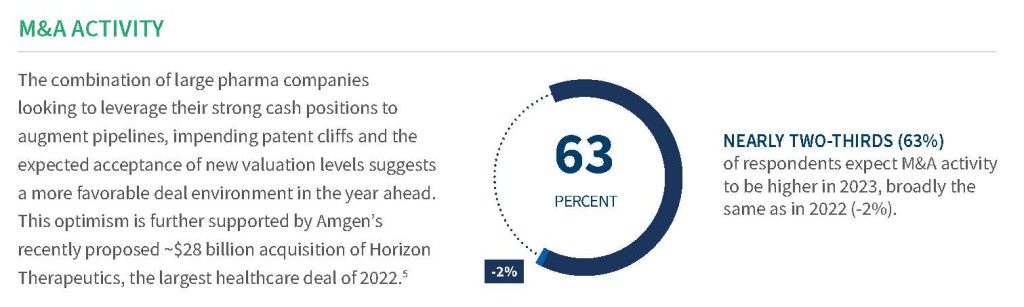

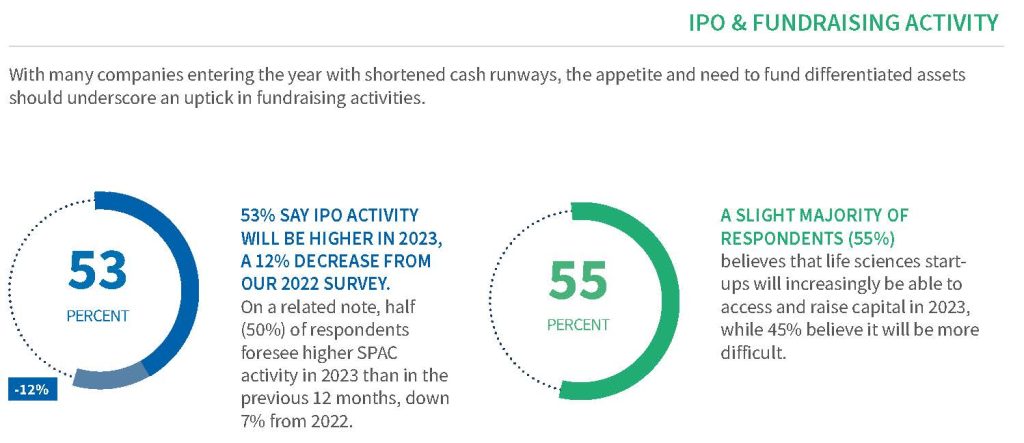

Cautious Optimism about Healthcare Capital Markets Activity in 2023

Cybersecurity Threats are an Increasing Risk

As digital transformation continues to accelerate, spurred by the COVID-19 pandemic, the healthcare industry is increasingly becoming a prime target of cyber criminals. The potential operational, financial, legal and reputational impacts of a cybersecurity event for a healthcare organization can be severe. In the face of potential threats to an organization’s continuity and reputation, preparedness and positioning for swift, decisive reaction are the keys to a timely recovery and to establishing confidence among stakeholders.

In the past 12 months, 70% of respondents experienced a cybersecurity incident, with malware/ransomware (31%) and phishing (27%) emerging as the top threats. Most organizations contained and remediated their latest cybersecurity incident immediately (57%). More than one-third (41%) contained and remediated the attack, but with a delay.

Healthcare organizations acknowledge that the potential impacts of a cybersecurity incident are wide-ranging. Data access/exposure (60%), financial costs (52%), patient care (44%), operational disruptions (44%) and reputational impact (38%) were cited as the biggest risks of a cyber attack to the healthcare industry.

Amid the backdrop of the constantly evolving cybersecurity landscape, 42% of respondents think their company is vulnerable to a potential cyber attack or incident, with significant areas of vulnerability including malware and ransomware (47%), incidents that involve privacy violations (i.e., HIPAA, PII) (46%) and phishing (43%). Given the increased risk of a cyber attack, 58% of respondents say they have a crisis plan in place. However, slightly more than one-third of respondents (36%) are considering participating in a crisis simulation or table-top exercise in the next year.

Eyes On DC

Nearly two years into the Biden administration, the industry appears divided on the administration’s impact on healthcare and life sciences companies.

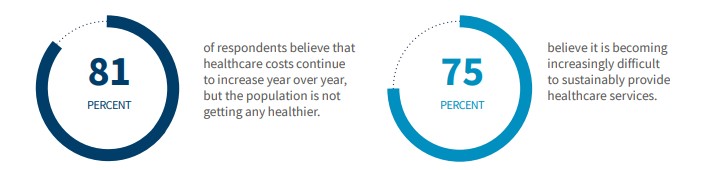

Increasing Healthcare Costs

ESG is Top of Minds

ESG efforts will be a notable area of investment for the healthcare and life sciences industry in 2023. Companies are focused on turning their ESG goals into action, as they are increasingly expected to play an active role in ensuring sustainability goals are met and to demonstrate progress around ESG to a range of stakeholders.

In line with the growing interest, 60% of respondents expect their budget allocation to their ESG strategy, program and reporting to increase. In the healthcare and life sciences sector, the top ESG themes of increasing focus in 2023 include employee engagement and D&I (49%), health equity (48%) and drug access and affordability (47%).

The top three ESG challenges the industry faces, however, are the availability and quality of relevant data (32%), a lack of expertise/resources (24%) and a generally risk-averse culture toward disclosure (22%). Given the increased investment in ESG efforts, it is notable that less than one-third (27%) of respondents feel their disclosure and reporting often achieves desired visibility among key stakeholders, pointing to a need for a better communications strategy to tell their ESG story to the right audiences at the right time.

Positioning Organizations for Success in 2023

As our survey shows, organizations in the Healthcare and Life Sciences sector continue to operate in a complex and globally interconnected landscape where information is difficult to control, reputations develop and change quickly, and crises move rapidly. These changing market forces and external disruptors make it critical for organizations to communicate their story strategically to a variety of stakeholders and be prepared to protect and promote their reputations in 2023. FTI Consulting’s healthcare and life sciences team understands the economic, legal and regulatory challenges confronting organizations in this industry and provides strategic counsel in all aspects of financial, corporate, public policy, brand and medical communications to best position Healthcare and Life Sciences organizations for future success.

Cover image: https://www.shutterstock.com/image-photo/medical-laboratory-scientist-hands-using-microscope-564359815

1 Halliday, A. “Cell and Gene Therapy: Rewriting the Future of Medicine,” Technology Networks (September 30, 2022), https://www.technologynetworks.com

biopharma/articles/cell-and-gene-therapy-rewriting-the-future-of-medicine-365801

2 Sagonowsky, E. “Pharma saw huge reputation gains in the last year. It should make sure not to squander them, expert says,” Fierce Pharma (October 14,

2021), https://www.fiercepharma.com/marketing/pharma-saw-huge-reputation-gains-last-year-it-should-make-sure-not-to-squander-them

3 Parrish, M. “The 2 areas in life sciences most in need of talent,” PharmaVoice (October 4, 2022), https://www.pharmavoice.com/news/2-areas-life-sciencestalent-recruitment-Phaidon/633190/

4 Stanislaro R., Margolis D., Staples Miller C., Polson J., and Condon J., “New Horizons: US Healthcare & Life Sciences Industry Outlook 2022,” FTI Consulting

Survey (December 28, 2021), https://www.fticonsulting.com/insights/reports/survey-healthcare-life-sciences-industry-2022

5 Pagliarulo. N. “Amgen to buy Horizon in year’s biggest biotech deal,” BioPharmaDive (December 12, 2022), https://www.biopharmadive.com/news/amgenhorizon-acquire-biotech-drug-deal/638485/

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com