Done Deal – Insights from our M&A and Activism team – March 2024

Insights from our M&A and Activism team

Welcome to the latest installment of Done Deal! In this edition, our team shares their key takeaways from the Tulane Corporate Law Institute event held last week. This event brought together the best and brightest in M&A and securities practitioners, leading corporate counsel, and the investment banking community. We then move on to share our latest research, where we surveyed perspectives on M&A from D.C. policymaking elites. Additionally, we delve into competition issues related to telecommunications mergers in another piece. Finally, we are delighted to share some quick thoughts from Katherine Bell, one of our Financial Services experts based in London, on key trends we are observing amidst the increasing activity in banking M&A.

Insights from Tulane Corporate Law Institute

In this video, our global team on the ground at the 36th Annual Tulane Corporate Law Institute share their top 7 takeaways from the event.

M&A Policy Perspectives: Spotlight on D.C.

Mergers and acquisitions frequently draw the attention of Wall Street and Washington D.C. alike, but perspectives on M&A from the D.C. policymaking elites are not often quantified. 2024 is shaping up to be an important year for antitrust policy, as companies continue to transact despite increased attention and antitrust investigations, further complicated by a looming election that could disrupt balances in power in D.C. and across the United States.

Our M&A, Activism and Governance team conducted a poll of D.C. policy influencers to gauge their perspectives on M&A policy and the administration’s current regulatory frameworks to better understand key stakeholder sentiment during this pivotal year.

The digital infrastructure investment dilemma: what’s next (if anything) in European telecoms consolidation?

The EU’s antitrust watchdog is rarely so blunt. But on 6 March 2024 at the OECD in Paris, Olivier Guersent, Director-General of the EC’s competition directorate was clear: the EC rejects the premise that further consolidation in national telecom markets around Europe must happen in order to unlock the significant investments required in the sector. What does this mean for potential telco mergers? Our experts analyze this in our latest thought paper.

What We’re Up To

A special shout out to our UK team, who were delighted to pick up the award for “Best M&A Communications in Support of a Transaction” alongside our client Deutsche Numis at the PRCA City and Financial Awards. Congratulations to our team and client for having their invaluable contributions recognised by the industry.

Meet our Team: 30 seconds with Katherine Bell

What is your focus area at FTI Consulting?

What is your focus area at FTI Consulting?

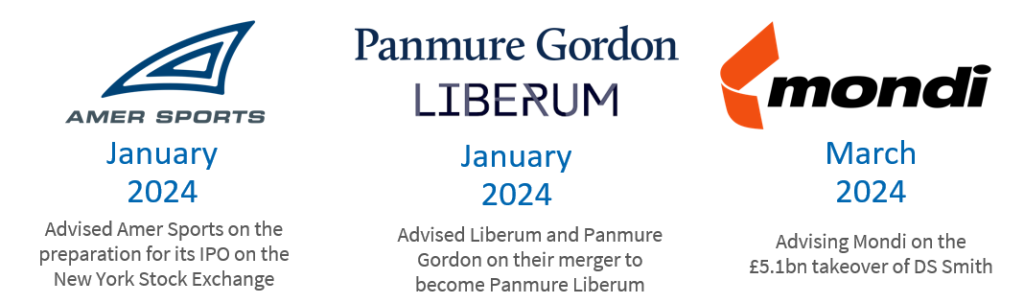

I sit in our financial services team in London, advising listed and private businesses on their corporate reputation – and particularly as it intersects with the capital markets. In my time at FTI I have helped clients in all sorts of transactions; from high profile and transformative mergers, take privates and carve-outs, through to significant acquisitions made by existing clients. From smaller bolt-ons to working with ancillary parties with a vested interest in a transaction, we get fired up by unique, complex and nuanced situations. We apply our strong sector knowledge to these situations to get the best outcomes for clients, leveraging our media relationships alongside our expertise.

What M&A trends are you seeing in your marketplace?

The London capital markets have seen better days, but I am excited by the potential of the next 12 months. We are already seeing private capital itching to deploy its dry powder (and exit its success stories), while the dynamic of undervalued plc is unsustainable. We expect the status quo to be challenged from all sorts of angles, and look forward to the interesting communications challenges this type of M&A will pose.

What do you do outside of work that helps you reset and stay sharp for the next professional challenge?

I’m a big believer in staying fit to stay sharp and focused. I love to re-set by going for a run or lifting weights in the gym, both of which are great to clear the mind. I also play a lot of hockey, where I get to meet like-minded people – and is a productive outlet for my competitive streak! I’ve recently started coaching at my hockey club, which lets me give back to my community in a small way and come back to the office recharged and ready to go.

Contact Us

To be added to the distribution list for FTI Consulting’s M&A and Activism Insights, or for further information on the dedicated M&A and Activism team at FTI Consulting, please contact Edward Bridges ([email protected]) Pat Tucker ([email protected]) or Alex Le May ([email protected]).

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals. ©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |