A New Dawn for Carbon Capture in the U.S.

Download a PDF of this articleBoth the International Energy Agency (IEA) and the U.N. Intergovernmental Panel on Climate Change (IPCC) have identified carbon capture and sequestration (CCS) as an essential tool to reduce greenhouse gas emissions. But some researchers and policymakers have expressed skepticism that CCS will ever become a commercially viable solution, pointing to stalled projects in the United States that critics have seized upon to label the technology a failure.

But a careful review of the current CCS project pipeline in the U.S. suggests that dynamic is quickly changing. The urgency in finding climate solutions as well as two landmark laws, the Infrastructure Investment and Jobs Act of 2021 (IIJA) and the Inflation Reduction Act of 2022 (IRA), have altered the cost curve for CCS and with it the type of projects in development, providing a new wave of momentum.

Global Status of CCS

According to the Global CCS Institute’s latest annual report, there were 196 CCS projects in the pipeline worldwide as of September 2022[1], including 61 new facilities[2]. The total capture capacity of these facilities is now nearly 244 million metric tons of CO2 per year, roughly equivalent to the annual emissions of 65 coal-fired power plants.[3] That capture capacity is also a 44 percent increase from 2021.[4]

SOURCE: Global CCS Institute [5]

According to the IEA, more than half of all CCS operating capacity globally is in the United States, and future capacity is projected to more than quadruple by 2030.[6]

Past Projects, Lingering Skepticism

Over the past 15 years, there have been several high-profile CCS projects that did not materialize as expected. For example, FutureGen 2.0 in Illinois[7] and the Kemper County Energy Facility in Mississippi[8] were heavily touted as a solution to reduce emissions from coal-fired power plants, but neither ever came to fruition.

The Petra Nova CCS facility in Texas showed impressive results during its initial phases, capturing more than 3.5 million metric tons of carbon dioxide, equivalent to the annual emissions of nine natural gas power plants.[9] Unfortunately, shifting market economics led the facility to be shuttered in 2020, although the owners recently announced it could be restarting.[10]

Critics have highlighted these examples to claim CCS “cannot be the centerpiece of any serious climate plan,” as one prominent environmental group recently stated.[11] A slew of other headlines have questioned whether CCS is a “false solution”[12] or even “green washing.”[13]

Why CCS Today Is a Different Proposition

There are several reasons that the current pipeline for CCS marks a new dawn.

Most carbon capture projects to date have been associated with Enhanced Oil Recovery (EOR), where the captured CO2 is injected into oil or natural gas wells to spur more production. This has also been a point of criticism[14] among CCS skeptics, who claim the technology will simply “perpetuate oil extraction in old oil fields,”[15] rather than reducing greenhouse gas emissions.[16]

But new incentives in the United States have spurred increased interest in permanent sequestration. The IRA increased the credit for EOR from $35 to $60 per ton of CO2 captured under Section 45Q. However, permanent sequestration now gets $85/ton, up from $50/ton.[17] As described in more detail below, the $85/ton credit for permanent sequestration shifts the cost curve dramatically, making it economical to use CCS for many more industrial applications without EOR.

Additionally, while the projects often cited by critics as illustrative failures were found in the power sector, investment is increasingly targeting other industries, including biofuels and manufacturing. Approximately 85 percent of the commercial CCS facilities in the development pipeline in the United States are related to hydrogen, cement, iron and steel, ethanol, bioenergy, gas processing, direct air capture, and chemicals.[18] According to the IEA, CO2 capture capacity for use in hydrogen production alone is expected to grow nine-fold globally by 2030. For other industrial uses (i.e., cement, steel, chemicals) it is expected to grow four-fold over that same period.[19]

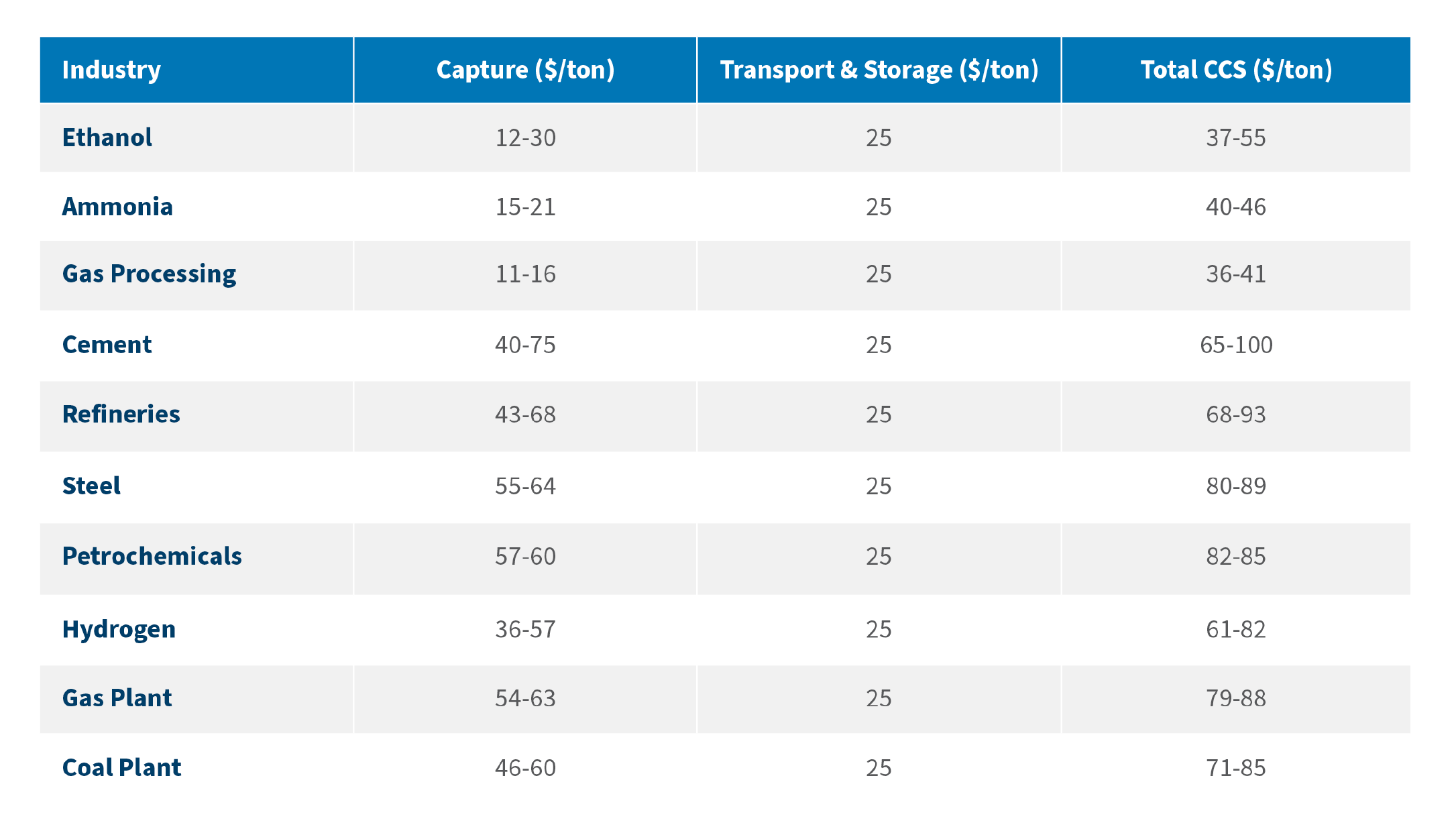

The cost to apply CCS to these sectors can be considerably lower than capturing CO2 emissions from a coal- or natural gas-fired power plant. According to data compiled by the Clean Air Task Force, the total CCS cost – including capture, transportation, and storage – for ethanol or ammonia could be less than half of the cost for a coal- or natural gas-fired power plant.[20]

SOURCE: Clean Air Task Force[21]

Another differentiator is policy momentum. The IIJA and IRA have provided a huge catalyst for CCS and other carbon removal technologies by increasing funding for research, lowering capture thresholds to qualify for financial incentives, expanding transferability, and extending the start dates for tax credit availability.[21]

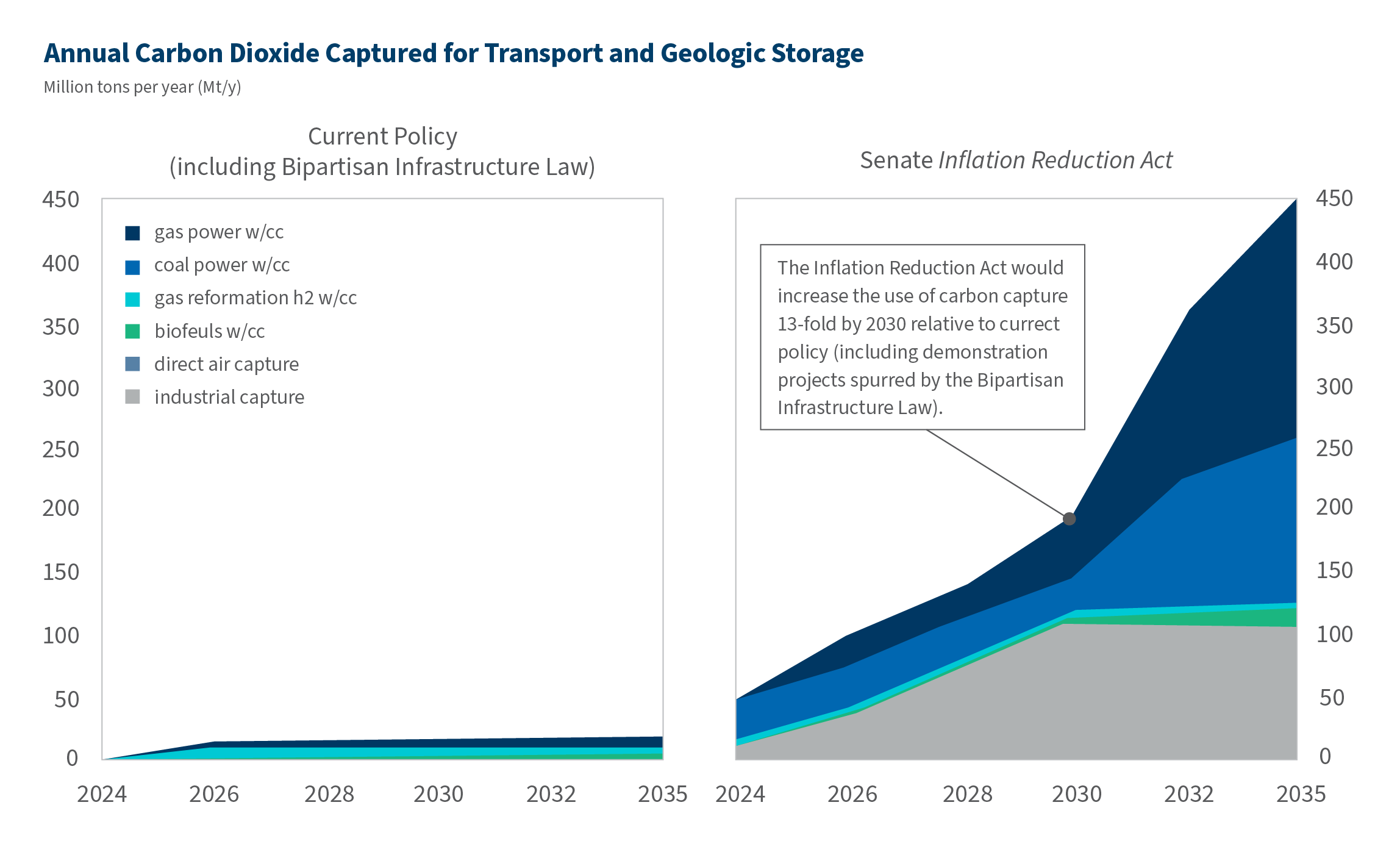

According to an analysis from researchers at Princeton University, the IRA alone will drive nearly $3.5 trillion in investments in new energy supply infrastructure, including more than $20 billion in annual investment in CCS and CO2 transport and storage and by 2030,[22] resulting in the capture of approximately 200 million tons of CO2 per year. That’s the equivalent of taking more than 43 million passenger vehicles off the road.[23] More than half of those emissions reductions will come from the industrial sector.

The Princeton team’s analysis projects that the IRA will spur a 13-fold increase in carbon capture infrastructure compared to the trajectory from policies that were already in place.

SOURCE: REPEAT Project, Princeton University[25]

That policy momentum has in turn led to increased interest in CCS among the states. Injection wells for CO2 are regulated by the U.S. Environmental Protection Agency under the federal Underground Injection Control (UIC) program and classified as Class VI wells. However, the UIC program allows for state regulatory agencies to assume “primacy” over well permitting and enforcement if they can demonstrate that their regulatory regimes meet or exceed federal standards.[26]

Currently, only North Dakota and Wyoming have secured Class VI primacy,[27] but other states including Arizona, Colorado, Kansas, Louisiana, Montana, New Mexico, Oklahoma, Texas, and West Virginia[28] are exploring doing so. Pennsylvania also recently announced that it wants to tap funds available from IIJA to secure primacy.[29] Experience has shown that states can approve permit applications in a timelier fashion. For example, securing a Class VI permit from the U.S. EPA takes an average of three years, whereas it took North Dakota less than five months to issue a permit.[30]

The federal government has also recognized the importance of state primacy. The IIJA included $75 million for Class VI permitting, $50 million of which was earmarked to “support states’ efforts to attain Class VI primacy.”[31] The U.S. Department of Energy is also pushing for more states to obtain primacy,[32] although there is growing bipartisan frustration that the EPA lacks urgency in approving those state applications.[33] There are also currently more than 70 Class VI permit applications that are pending at the U.S. EPA.[34]

Conclusion

Influential new policies have provided significant momentum for carbon capture technologies. Nonetheless, the fact that many high-profile CCS projects failed to materialize in the recent past has created deep-rooted skepticism about the technology. Even with a significant increase in policy support, critics continue to view CCS as a long-shot at best and false solution at worst.

But the landscape has shifted. Projects that were not previously viable can now be profitable thanks to the incentives from IIJA and IRA. The project failures that critics have cited were predominantly in the power sector, but the current CCS trajectory is focused more on industrial decarbonization – the so-called “hard to abate” industries like cement, steel, and chemicals.

Ultimately, companies investing in CCS will have to walk the walk by deploying facilities that capture large quantities of carbon dioxide that can remain in operation. That has proven difficult in the recent past, but given the current momentum, the outlook for CCS appears much more optimistic and should be seen as markedly different from the past.

[1] “Global Status of CCS,” Global CCS Institute (last visited on May 8, 2023), https://status22.globalccsinstitute.com/2022-status-report/global-status-of-ccs/.

[2] “Carbon Capture and Storage Experiencing Record Growth as Countries Strive to Meet Global Climate Goals,” Global CCS Institute (October 17, 2022), https://www.globalccsinstitute.com/news-media/press-room/media-releases/carbon-capture-and-storage-experiencing-record-growth-as-countries-strive-to-meet-global-climate-goals/#:~:text=With%2061%20new%20facilities%20added,over%20the%20past%2012%20months.

[3] “Greenhouse Gas Equivalencies Calculator,” United States Environmental Protection Agency (updated April 2023), https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator.

[4] “Global Status of CCS,” Global CCS Institute (last visited on May 8, 2023), https://status22.globalccsinstitute.com/2022-status-report/global-status-of-ccs/.

[6] “Operating and planned facilities with CO2 capture by region , 2022,” IEA (last updated October 26, 2022), https://www.iea.org/data-and-statistics/charts/operating-and-planned-facilities-with-co2-capture-by-region-2022.

[7] Christa Marshall, “Clean Coal Power Plant Killed, Again,” Scientific American; E&E News, Environment (February 4, 2015), https://www.scientificamerican.com/article/clean-coal-power-plant-killed-again/.

[8] Kristi E. Swartz, “Southern Co.’s clean coal plant hits a dead end,” E&E News; Politico (June 22, 2017), https://subscriber.politicopro.com/article/eenews/1060056418.

[9] “Final Scientific/Technical Report. Petra Nova,” U.S. Department of Energy (March 31, 2020), https://www.osti.gov/servlets/purl/1608572

[10] Kevin Crowley, “The World’s Largest Carbon Capture Plant Gets a Second Chance in Texas,” Bloomberg (February 8, 2023), https://www.bloomberg.com/news/articles/2023-02-08/the-world-s-largest-carbon-capture-plant-gets-a-second-chance-in-texas.

[11] Oakley Shelton-Thomas, “Carbon Capture: Billions of Federal Dollars Poured Into Failure,” Food & Water Watch (September 27, 2022), https://www.foodandwaterwatch.org/2022/09/27/carbon-capture-failures/.

[12] “Carbon capture: key decarbonizing tool or ‘false solution?,’” Spectrum News (April 14, 2022), https://www.baynews9.com/fl/tampa/ap-online/2022/04/13/carbon-capture-key-decarbonizing-tool-or-false-solution.

[13] Heather Richards and Carlos Anchondo, “CCS in the Gulf: Climate solution or green washing,” E&E News: Energy Wire (January 31, 2022), https://www.eenews.net/articles/ccs-in-the-gulf-climate-solution-or-green-washing/.

[14] Letter from 350.org, Ben & Jerry’s, et al. to President Biden, Speaker Pelosi, and Majority Leader Schumer re: Carbon capture is not a climate solution (July 19, 2021), https://www.ciel.org/wp-content/uploads/2021/07/CCS-Letter_FINAL_US-1.pdf.

[15] Tony Briscoe, “California hopes to fight global warming by pumping CO2 underground. Some call it a ruse,” Los Angeles Times (July 25, 2022), https://www.latimes.com/environment/story/2022-07-25/is-carbon-capture-and-storage-a-cover-for-oil-production.

[16] Analyses have shown that the use of EOR results in lower net carbon intensity of the oil produced. For example, the Clean Air Task Force, using data from the IEA, has concluded: “EOR results in 37% reduction in CO2 emissions per barrel compared to conventional production.” See, “CO2 EOR Yields a 37% Reduction in CO2 Emitted Per Barrel of Oil Produced,” Clean Air Task Force (last visited on May 8, 2023), https://www.catf.us/wp-content/uploads/2019/06/CATF_EOR_LCA_Factsheet_2019.pdf.

[17] “Inflation Reduction Act (IRA) Summary: Energy and Climate Provisions,” Bipartisan Policy Center (August 4, 2022), https://bipartisanpolicy.org/blog/inflation-reduction-act-summary-energy-climate-provisions/.

[18] “Facilities Database [Public],” Global CCS Institute (last visited on May 8, 2023), https://co2re.co/FacilityData.

[19] Sara Budinis, et al., “Carbon Capture, Utilisation and Storage,” IEA (September 2022), https://www.iea.org/reports/carbon-capture-utilisation-and-storage-2.

[20] Matt Bright, “The Inflation Reduction Act creates a whole new market for carbon capture,” Clean Air Task Force (August 22, 2022), https://www.catf.us/2022/08/the-inflation-reduction-act-creates-a-whole-new-market-for-carbon-capture/.

[22] “The Inflation Reduction Act (IRA) of 2022,” Carbon Capture Coalition (August 2022), https://carboncapturecoalition.org/wp-content/uploads/2022/08/IRA-2022-Fact-Sheet-8.16.pdf.

[23] J.D. Jenkins, et al., “Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022,” REPEAT Project (August 2022), https://repeatproject.org/docs/REPEAT_IRA_Prelminary_Report_2022-08-04.pdf.

[24] Calculations made based on “Greenhouse Gas Equivalencies Calculator,” U.S. Environmental Protection Agency (accessed on March 25, 2022), https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator.

[25] J.D. Jenkins, et al., “Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022,” REPEAT Project (August 2022), https://repeatproject.org/docs/REPEAT_IRA_Prelminary_Report_2022-08-04.pdf.

[26] “Primary Enforcement Authority for the Underground Injection Control Program,” United States Environmental Protection Agency (last updated August 18, 2022), https://www.epa.gov/uic/primary-enforcement-authority-underground-injection-control-program-0#what_states.

[28] “Class VI Wells: Permitting & Primacy for Secure, Long-Term Storage of CO2,” Carbon Capture Coalition (April 2021), https://carboncapturecoalition.org/wp-content/uploads/2021/06/Class-VI-backgrounder.pdf.

[29] Carlos Anchondo, “Pa. pursues oversight of CO2 wells,” Energy Wire; Politico (April 10, 2023), https://subscriber.politicopro.com/article/eenews/2023/04/10/pa-pursues-oversight-of-co2-wells-00090855.

[30] Carlos Anchondo, “Texas wants oversight of CO2 wells. Other states may follow.,” E&E News: Energy Wire (October 3, 2022), https://www.eenews.net/articles/texas-wants-oversight-of-co2-wells-other-states-may-follow/.

[31] “Bipartisan Infrastructure Law: A Historic Investment in Water,” United States Environmental Protection Agency (last visited on May 8, 2023), https://www.epa.gov/system/files/documents/2021-11/e-ow-bid-fact-sheet-final.508.pdf.

[32] Carlos Anchondo and Camille Bond, “DOE outlines plan to ease CCS permitting crunch,” Energy Wire; Politico (February 10, 2022), https://subscriber.politicopro.com/article/eenews/2022/02/10/doe-outlines-plans-to-ease-ccs-permitting-crunch-00007378.

[33] James Osborne, “EPA scrutinized over carbon storage backlog,” Houston Chronicle (February 16, 2023), https://www.houstonchronicle.com/business/energy/article/epa-carbon-storage-permits-backlog-17784457.php.

[34] “Class VI Wells Permitted by EPA,” United States Environmental Protection Agency (last updated March 29, 2023), https://www.epa.gov/uic/class-vi-wells-permitted-epa.