ESG+ Newsletter – 25th March 2021

Your weekly updates on ESG and more

In this week’s edition, we look at how ESG’s reach is impacting pre-IPO companies and debt markets. We also detail the far-reaching consequences of European regulatory advances and tap into the debate over the impact of sustainable investing. Finally, as investors demand more on human capital disclosure, is the C-Suite responding?

LGIM calls for investment bankers to receive shares instead of fees in IPOs

Earlier this week it was reported that Legal & General Investment Management (LGIM), one of Europe’s largest asset managers, will propose an innovative idea and suggest that fees paid to investment bankers as part of an IPO should be paid partly in stock. LGIM is of the view that this measure will safeguard the interests of investors by aligning investment bankers’ interest with those of shareholders and potential investors at the time of the public offering. LGIM will also suggest that a Chairperson should be in place for at least six months prior to listing. These proposals, which were first reported by Sky News, are to be submitted as part of a consultation that the Financial Conduct Authority (FCA) is conducting over reforms to the current listing regime and follows on from the recent publication of the UK Listing Review report led by Lord Hill, the former EU financial services commissioner. His report outlined a number of recommendations including “modernising listing rules to allow dual-class share structures on the LSE which would give directors (in particular, founders) enhanced voting rights on certain decisions” and “reducing free float requirements – the amount of a company’s shares that are in public hands – from 25% to 15%.” It is expected that the FCA will review and consult on many of Lord Hill’s proposals in the coming months.

Europe’s SFDR reaches beyond the EU’s shores

As outlined in a report by PwC, Europe’s new Sustainable Finance Disclosure Regulation (SFDR) is a standardised framework that aims to bring further transparency on sustainability within financial markets. The Wall Street Journal (WSJ) reports that this new regulation, “requires banks, private-equity firms, pension funds, hedge funds, and other asset managers to meet a slew of ESG requirements.” While it is becoming increasingly important to have a clear set of rules and requirements around sustainable investments, this new regulation has been met with some concern, in particular from the U.S., where financial service providers are not currently required to report ESG data in a similar manner. However, as sellers of investment products into the EU, the SFDR will force them to comply with a much more detailed set of disclosure rules. However, a Blackrock spokesperson (the WSJ reports) sees this as a positive catalyst to accelerate the transition towards the greening of financial products.

Every vote counts as SEC aims to augment shareholder democracy

The SEC has continued its drive to ensure that retail investors are provided with the ability to exercise their own voting franchise by calling for greater transparency and disclosure standards governing shareholder votes. In a speech entitled “Every Vote Counts” at an Investment Company Institute conference last week, Allison Herren Lee, acting chair of the SEC said there was “a lot of work to do” to ensure the US system of shareholder democracy functioned in the interests of ordinary investors. As the Financial Times notes, almost half of US households now own a mutual fund, up from 6 per cent in 1980, concentrating huge power into the hands of asset managers responsible for voting investors’ shares at company meetings. Ordinary investors, however, have little say in the development of voting policies of asset managers or proxy advisers. Save for a handful of proxy battles, such as between Procter & Gamble and Trian, retail investors are rarely thrust into the proxy voting limelight. However, with on average 29% of every company in the US-owned by retail investors, a huge voting bloc may be about to find its voice.

Ex-Blackrock exec questions value of sustainable investing

A high-profile newspaper op-ed by a former BlackRock executive that questioned the value of sustainable investing in solving problems has prompted other industry analysts to forcefully defend the role of funds that push for change in ESG corporate policies. One time Chief Investment Officer for Sustainable Investing, Tariq Fancy, wrote in USA Today earlier this month that many ESG funds have almost no impact and create “a placebo effect to delay the overdue regulatory reforms in government we need” to address issues like climate change. This view caused ESG specialists to fire back in defence of the sector: “Fancy provides only the sketchiest of evidence to support a rather outlandish position,” Morningstar analyst Jon Hale argued. Blackrock themselves responded that they disputed Fancy’s view and said sustainable investing “can deliver strong investment returns while also helping to address urgent social and environmental concerns.” The debate comes as U.S. regulators look set to make fundamental changes to how ESG claims and disclosure are regulated.

JPMorgan expects dramatic growth in sustainability-linked bonds

As detailed in previous ESG+ newsletters, the popularity of ESG-linked financing has grown significantly over the past few years and now JP Morgan is predicting that sustainability-linked bonds (SLB) could grow by 20-fold this year. Ahead of its global ESG conference, JP Morgan’s Head of ESG Dept Capital Markets, Marilyn Ceci, spoke to Reuters where she stated that “COVID-19 had proved a stress test for ESG” and, as a result, she expected that the SLB market would grow “to around $120 to $150 billion” this year, with year-to-date volumes standing at c.$6.9 billion. In 2020, Novartis issued the first SLB with social targets, with repayments linked to expanding access to medicines. SLBs allow companies to raise liquidity for general corporate purposes, but if they fail to meet the sustainability targets attached to the SLB – for example cutting carbon emissions or increasing its renewable energy capacity – repayments to bond holders increase. However, as noted in the article, SLBs are a relatively new financing instrument, with investors being less familiar with them than the more common green bonds which, in contrast, restrict the use of funds raised in debt markets. Therefore, the process of how companies pay certain penalties for failing to meet sustainability targets and obligations linked to the SLB is somewhat untested.

Attrition rates a start but investors are demanding more

US-based companies are sharing more details about employee turnover with investors under new disclosure requirements. Before last August, companies merely needed to provide the number of employees that they have on their books but under a change to SEC Regulation S-K, must now work towards providing detailed information about their workforce. Firms must now provide descriptions of their “human capital resources,” which can include information about company diversity, employee turnover rates and initiatives related to worker training and safety. According to the WSJ however, a teething problem has emerged as a result of the role of CFOs in this information flow, “because finance chiefs handpick the information they provide.”

A wide level of discretion is left to companies regarding exactly what they disclose, and they are under no obligation to provide attrition rates for previous years, meaning that in many instances investors are left with more questions than answers. This new era of workforce disclosure is exactly that, however, new, and there are companies who are still coming to terms with what they can and what they ought to disclose. These issues are rising up the agenda of investors while simultaneously becoming increasingly material to business performance – both points that demand greater disclosure which will remove the ability to “handpick.”

In focus: Workforce Disclosure Initiative

Last week’s ESG+ newsletter drew attention to the fact that corporate leaders have become more serious about social reporting and are looking to make good pronouncements made in 2020. At the heart of many big statements made by companies last year was a declaration of the importance of their employees. FTI’s latest article suggests that companies that do not respond to developing perspectives on the relationship between employers and employees risk laggard status. Workforce: Driving value through Disclosure outlines how leveraging ShareAction’s Workforce Disclosure Initiative (WDI) can improve practice, enhance ESG credentials and drive corporate value. Moreover, it is one of the strongest concrete examples yet of a maturing of metrics in the social reporting space.

A total of 141 companies engaged with the WDI in 2020, up from 99 in 2019 and 66 in 2018. It now boasts 53 investor signatories with £7 trillion of assets under management. While the article contextualises workforce disclosure in the so-called “new normal”, ushered in as a result of the COVID-19 pandemic, it draws attention to how this space was already coming under regulatory and investor pressure, following years of political and public scrutiny. There is now a firm expectation that the unfettered voice of employees finds its way up to Boardroom level and feeds into the strategic direction of a company.

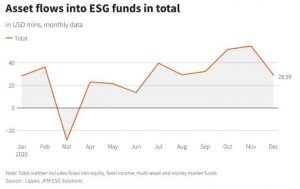

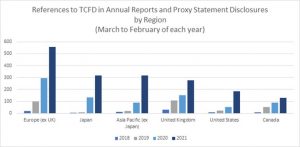

Charts of the Week

Source: Sentieo

In Case You Missed It

- EU considers labelling gas as partially sustainable technology under its landmark green labelling system for investors. According to the Financial Times, the decision has faced controversy as it seems to be paving the way for technologies such as gas generated by fossil fuels to be recognised in its “taxonomy for sustainable finance”, raising fears about “greenwashing” in Brussels.

- The number of Banks that foster a culture of sustainability and updated their governance structures accordingly is up by 51%, according to research by Mazars. The study also shows an increase of 45% in the number of banks that have aligned their disclosures with ESG reporting standards.

- As Moscow seeks to enhance its sustainability credentials, Russia’s central bank and finance ministry have started consultations on a green bond issue, Reuters reports. Russia, whose economy is largely built on fossil fuels, mining, and hydrocarbon production, has some way to go to convince investors of its ESG potential but has identified the risk posed by failing to make transition efforts.

- Following the introduction in Europe of the Sustainable Finance Disclosure Regulation (SFDR), fund selectors will have to scrutinise how strategies fit into three new sustainable fund categories according to Citywire Selector. These are: Article 6 (products that don’t have a sustainably focused strategy), Article 8 (products promoting any environmental or social characteristics) or Article 9 (products with a sustainable investment objective).

Say on Climate – A Tracker

As the focus on climate change grows, we will track and share learnings from those companies voluntarily putting their climate plans and strategies to a shareholder vote:

- Unilever

- Moody’s

- Royal Dutch Shel

- Canadian National Railway

- Glencore

- Rio Tinto

- VINCI

- Ferrovial

- National Grid

- Santos

- Nestlé

- S&P Global

- Total

- Woodside Petroleum

- Calida Group

Upcoming events

March 29: High Pay Centre Event: Reforming audit and governance – do the government’s plans go far enough?

March 30: FTI host Mark Carney in conversation with the BBC’s Dominic O’Connell

March 30: BI Analyst Briefing: Is ESG Spending Sustainable for Europe’s Asset Managers in a Post-MiFID II World?

March 30-31: Bank of America ESG Consumer Conference

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |