BioPharma in 2024: At a Crossroads

Table of Contents

This fourth edition of FTI Consulting’s Healthcare and Life Sciences Outlook Survey sees healthcare and biotechnology organizations facing a transition point. Despite being less optimistic about the industry overall in 2024 compared to previous years and expressing concerns about economic and political uncertainty, the 250 industry leaders we surveyed still highlighted a number of gamechanging opportunities for the sector in the year ahead. One potential bright spot for 2024: the transformational impact that technology and artificial intelligence (AI) are expected to have on the drug development process and life sciences more broadly.

From navigating uncertainties around public and regulatory affairs, corporate reputation, capital market communications, ESG to cybersecurity, we invite you to meet with us, in-person or virtually.

Click here to schedule a meeting at a time convenient for you.

Healthcare and Life Sciences (HCLS) leaders are divided about what the 2024 economic and political outlook means for their industry.

Sixty-eight percent of respondents feel optimistic about the HCLS industry overall, notably down (-8%) from 76% in last year’s iteration of this survey.1 While the United States’ economy continues to perform well, growth is expected to slow, and these results are indicative of the challenges the industry faced in 2023 including inflation and rising interest rates,2 increased scrutiny by the Federal Trade Commission (FTC) around Mergers and Acquisitions (M&A) deals,3 and a slowdown in biotech Initial Public Offerings (IPOs).4 As a result, respondents are not approaching 2024 with the same positive views.

When they do look on the bright side, leaders are most optimistic about their organizations’ financial performance (79%), though this is also down (-8%) from 87% last year.5

Respondents also emphasized the potential for increased spending in research and development (R&D) as the industry adapts to the realities of a post-COVID-19 operating context.

The unique juxtaposition of the challenging macroeconomic and political conditions and the opportunities made possible by increased focus on R&D and the potential of AI has put the HCLS industry at a crossroads.

From a communications perspective, while the sector experienced a surge in reputational gains during the height of the COVID-19 pandemic,6 companies are transitioning into a post-COVID era and now face the challenge of maintaining and strengthening any reputational wins.7

The industry’s focus now shifts from crisis response to sustaining growth – requiring biopharma firms to demonstrate an ongoing commitment to innovation. Proactive communication about long-term strategies, community engagement, and advancements in R&D will be crucial to solidifying these newfound reputational gains and navigating the additional challenges that are arising.

Clear and tailored communication with stakeholders, including investors, regulators, and the public, is essential to fostering confidence in the sector’s resilience and the individual organizations’ potential. Companies operating in this complex space can strategically craft their narratives to instill trust and credibility in what looks to be an unpredictable economic and political environment in the year ahead.

Corporate Reputation

Where Does the Money Go? Leaders with Increased Budgets Prioritize R&D, Marketing, and Talent

While 22% of respondents surveyed are tightening their purse strings, nearly half (48%) of the companies will be increasing their overall budget compared to 2023. The top areas where they’ll be spending more include R&D (48%) and marketing (44%), as well as in retaining (43%) and recruiting (42%) talent.

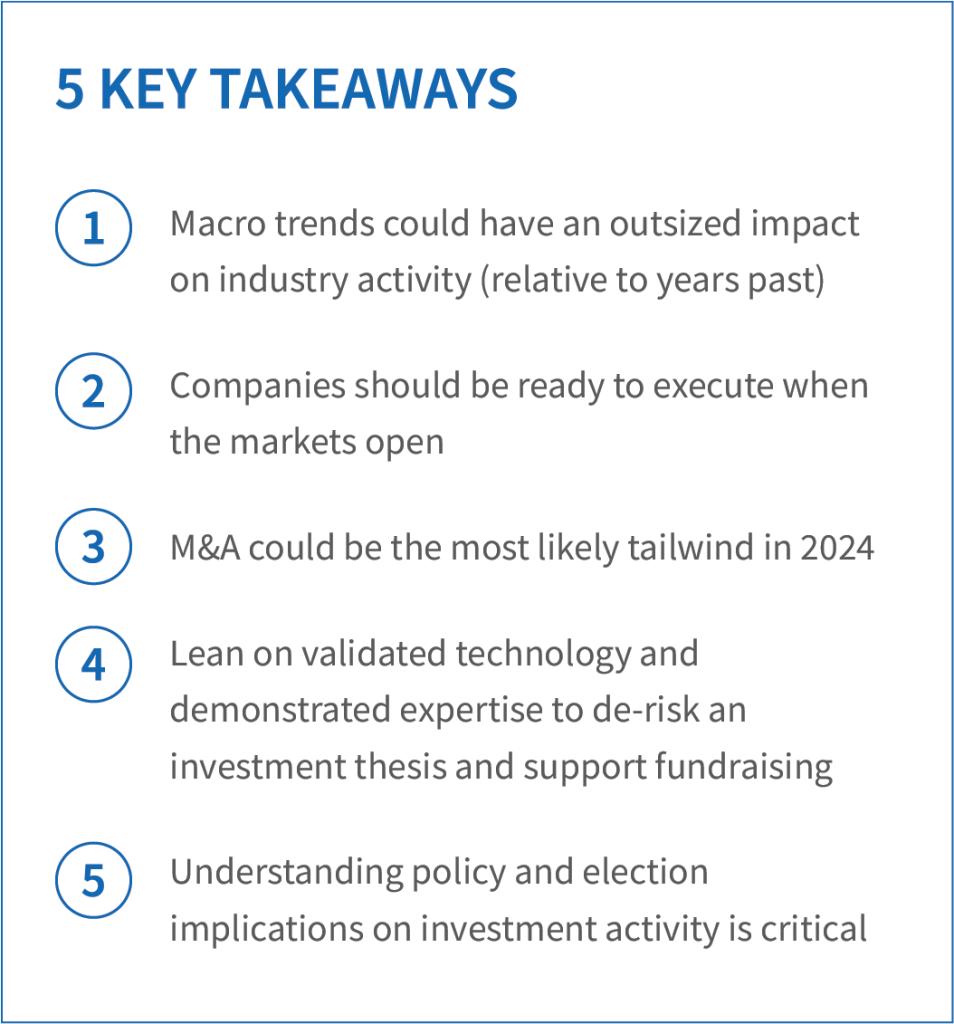

Tempered Expectations for Increased Market Activity

After another challenging year for the HCLS capital markets, there is a sense among industry professionals that the sector may finally be rounding a corner in 2024, albeit a year later than most had anticipated. However, broader economic uncertainty is driving continued caution across the sector year over year. Compared to the fast money of the pandemic era, which was free flowing into life sciences companies in particular, the industry will most likely wait to see how the broader market plays out before making major moves in 2024.

M&A ACTIVITY

IPO & FUNDRAISING ACTIVITY

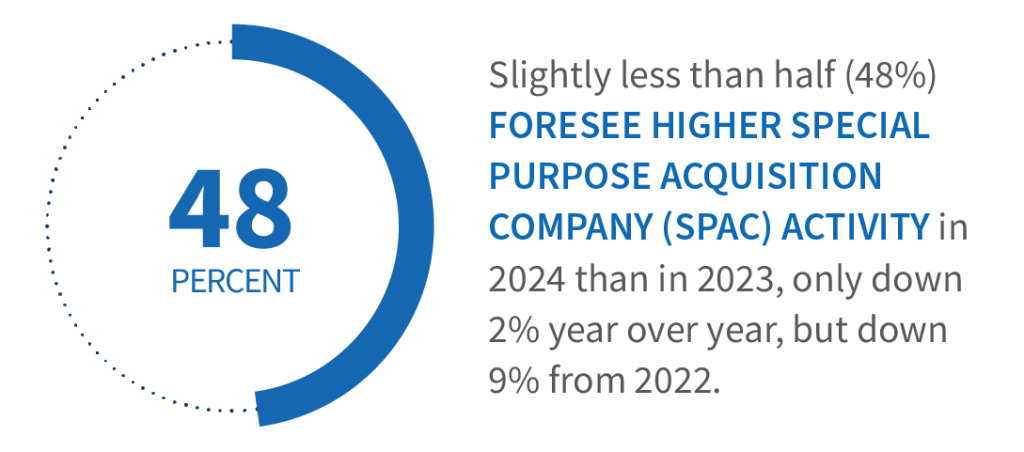

Respondents were slightly more tempered around accessing the capital markets in the coming year.

Financial Communications

Bracing for the Political Unknown

Reflecting on the legislative and regulatory activity the industry experienced in 2023, it is not surprising that HCLS leaders are divided on the Biden administration’s expected impact on the industry (49% positive; 40% negative), with a +5% increase in expected negative impact compared to the previous year.

HCLS leaders also have mixed views about the IRA. On one hand, the regulations are expected to lead to the development and demand for vaccines (62%) and biologics (60%), while on the other, respondents expect the legislation to negatively affect patient access to and affordability of care (25%) and curtail orphan drug development (22%) in the coming year.

However, what may be the most telling is respondents’ predictions for increased legal action due to the IRA. After the Act was announced, biopharmaceutical companies such as Novartis, Astellas (since withdrawn), AstraZeneca, Boehringer Ingelheim, Bristol Myers Squibb, Johnson & Johnson, and Merck filed lawsuits against the federal government around the regulation’s price setting measures.11 Notably, 58% of respondents expect more lawsuits to be filed against the U.S. government by pharmaceutical and life sciences companies due to the regulation’s impact on business activity.

Americas Head of Healthcare & Life Sciences

AI Powers BioPharma Into the Future

Like many other industries, AI is driving change across HCLS. From accelerating drug discovery to driving diversity in clinical trials and improving patient engagement, intelligent technologies are transforming the way companies operate.

Tackling Disinformation Head-on

Although health disinformation is not a new phenomenon, the pervasiveness of false and inaccurate information became more widespread during the COVID-19 pandemic, exacerbated by the proliferation of social media.12 In this survey, 40% of respondents reported feeling pessimistic about the pharmaceutical and life sciences industry’s ability to prevent misinformation/disinformation. On a positive note, they feel slightly less pessimistic (34%) when it comes to the pharmaceutical and life sciences industry’s ability to respond to and correct misinformation/disinformation.

New tools, such as FTI Consulting’s proprietary disinformation monitoring system, are helping companies to not only identify harmful narratives before they spread but also to identify the individuals and organizations— from the niche to the mainstream — responsible for disseminating this information. Using these tools in parallel with FTI Consulting’s subject matter experts, companies can more easily predict and respond to damaging narratives in the early stages before they negatively impact a company’s reputation or mislead patients.

Q4 2023 Healthcare Quarter in Review

Facing the Danger of Increasing Healthcare Costs and Declining Reimbursement Rates

Respondents cite declining reimbursement rates as one of the biggest risks to the HCLS sector — with 90% of respondents stating that they are not fully prepared to respond, and 38% are not prepared at all to respond to this increasing financial risk. Furthermore, nearly eight in 10 (78%) agree that declining reimbursement rates will pose a significant threat to the life sciences and pharmaceuticals industry in 2024 and beyond and 67% agree that it is becoming increasingly difficult to sustainably provide healthcare services.

Backlash Causes Companies to Rethink ESG

The recent conflict over the ESG movement highlights the intersection of politics and business as corporations weigh the potential economic and social consequences of taking a stance on hot-button issues in the face of scepticism toward, or direct opposition to, the burgeoning integration of ESG considerations into business decisions.

ESG & Sustainability Advisory

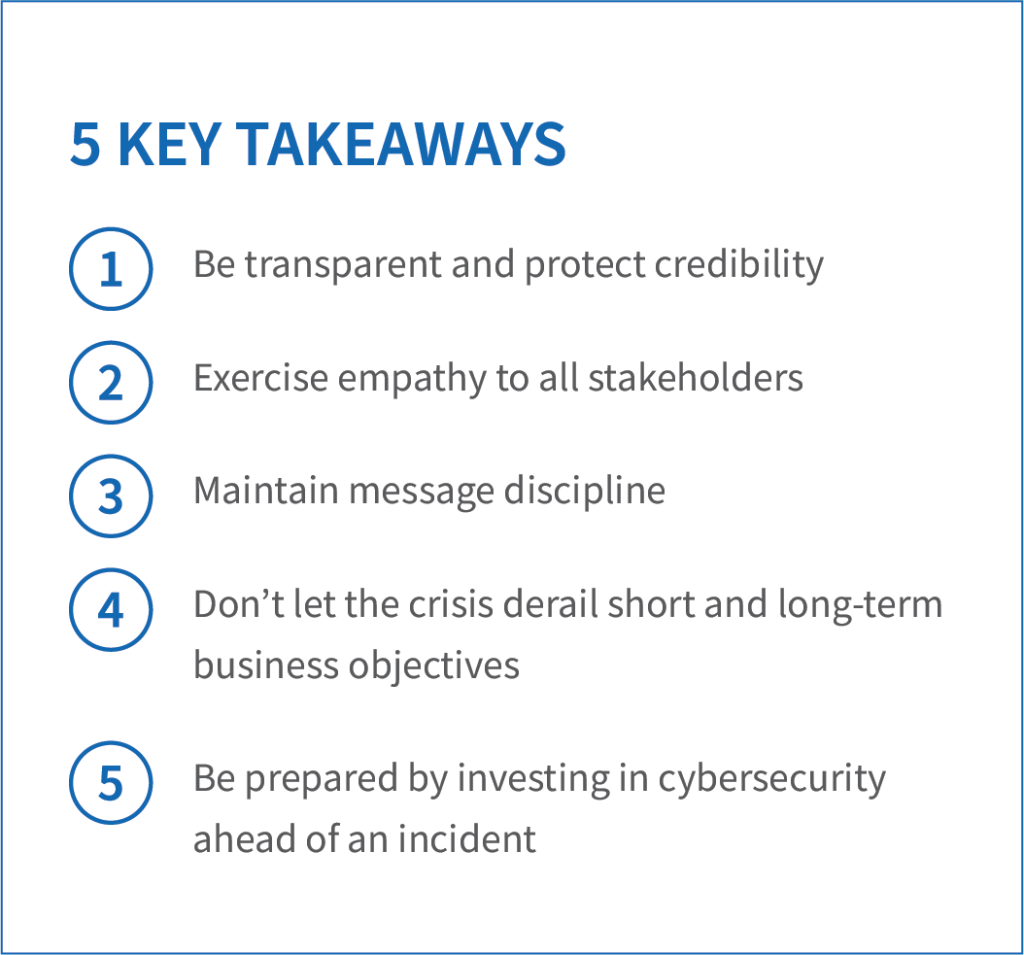

Cybersecurity Threats Continue to Plague Healthcare Companies

The HCLS industry remains a prime target of cybersecurity threat actors, largely due to the value of the data these organizations maintain and the operational havoc that can be inflicted on an industry whose primary mission is to save lives. Leaders are acutely aware of these risks; cybersecurity threats were cited by survey respondents as the industry’s second biggest risk for 2024 – a steep climb from the 7th biggest risk last year.14 Second only to economic uncertainty, nearly a quarter (24%) of respondents believe cybersecurity incidents are the most significant risk to their company over the next 12 months.

Heading into 2024, half the industry (50%) feels vulnerable to a potential cyber attack or incident (up from 42% last year), with significant areas of vulnerability including malware and ransomware (54%) and incidents that involve privacy violations like the Health Insurance Portability and Accountability Act (HIPAA) and personally identifiable information (PII) (46%), and phishing (41%). Notably, more than one-third (36%) of respondents think their working model will have a negative impact on the risk of cyber incidents to their organization, with half the industry (50%) requiring full-time, in-person work over the next year and 41% using a hybrid working approach.

Healthcare organizations acknowledge the potential significant impacts of a cybersecurity incident. Similar to last year’s survey findings, data access/exposure (56%), financial costs (49%), and patient care (46%) remain the biggest cited risks of a cyber attack to the industry.

Against this backdrop, healthcare leaders have rightfully adopted a preparedness mindset and are investing in cybersecurity crisis planning efforts. More than half of the industry (55%) already has a crisis communications plan in place for cyber attacks or incidents, and more than one-third (37%) has participated in a cyber-related crisis simulation or table-top exercise. In the next year, nearly half of the industry (46%) is considering a simulation or table-top exercise, while one-third (30%) of respondents are considering developing a crisis communications plan.

Cybersecurity & Data Privacy Communications

Final Thoughts & Takeaways

- Leaders remain optimistic about where the pharmaceutical and life sciences industry is going, growing, and innovating

- Economic and political uncertainty continues to temper potential growth and leaders’ optimism about the industry’s future

- There is a strong political divide in the perceptions around new regulations and companies must continually assess the landscape to mitigate risks

- Cybersecurity continues to be a key risk that leaders need to prepare for and take seriously, as well as monitoring and addressing misinformation

- AI will be critical to creating efficiencies in innovation and development, and the industry can better prepare for and harness this potential for continued growth

Positioning Organizations for Success in 2024

As this year’s FTI Consulting Healthcare & Life Sciences Outlook survey shows, organizations in the sector continue to operate in an increasingly complex and globally interconnected landscape where information is difficult to control, reputations develop and change quickly, and crises move rapidly.

These changing market forces and external disruptors make it critical for organizations to communicate their business story clearly and persuasively to a variety of stakeholders and be prepared to protect and promote their reputations in 2024. FTI Consulting’s experienced HCLS team understands the economic, legal, and regulatory challenges confronting organizations in this industry and provides strategic counsel in all aspects of financial, corporate, public policy, brand, and medical communications to best position organizations for future success.

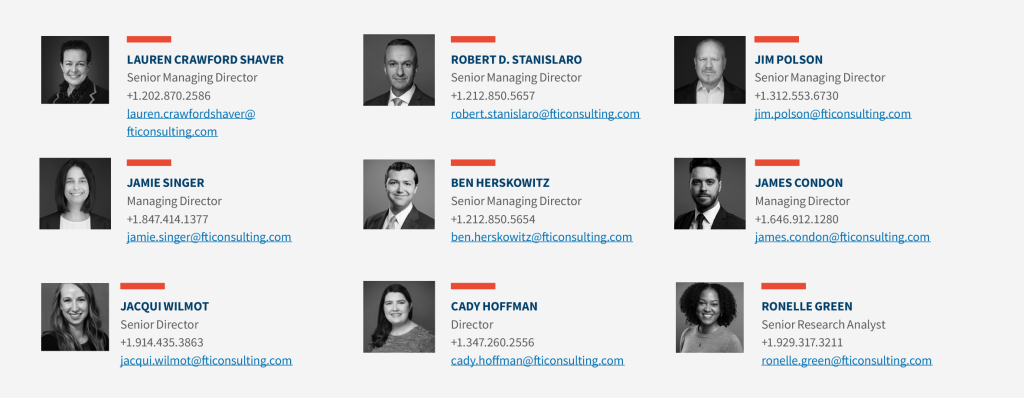

Meet Our Team

Interested in discussing how these insights may impact your organization? Contact us below to schedule a time convenient for you. We are happy to meet in-person or virtually.

Research Methodology

This research was conducted online by FTI Consulting’s Strategic Communications team between October 9-18, 2023 with n=250 decision makers in corporate communications, investor relations, public affairs, business development, and marketing for healthcare and life sciences companies in the U.S. Due to the standard convention of rounding, some totals may not add up to 100%.

[1] Robert Stanislaro, Dan Margolis, Citseko Staples Miller, Jim Polson, and James Condon, “Facing Forward: A Time for Cautious Optimism – FTI Consulting’s 2023 Healthcare & Life Sciences Industry Outlook,” FTI Consulting (January 5, 2023), https://fticommunications.com/fti-consulting-hcls-industry-outlook-2023/.

[2] “The Biotech IPO Slump Persists in 2023, But Signs of Recovery Emerge,” The Healthcare Technology Report (July 21, 2023), https://thehealthcaretechnologyreport.com/the-biotech-ipo-slump-persists-in-2023-but-signs-of-recovery-emerge/#:~:text=The%20biotechnology%20industry%20has%20experienced,slowest%20pace%20in%20six%20years.

[3] “Biopharmaceutical Giant Amgen to Settle FTC and State Challenges to its Horizon Therapeutics Acquisition,” Federal Trade Commission (September 1, 2023), https://www.ftc.gov/news-events/news/press-releases/2023/09/biopharmaceutical-giant-amgen-settle-ftc-state-challenges-its-horizon-therapeutics-acquisition.

[4] Amanda Heidt, “5 Life Sciences IPOs in 2023 —and the Future Forecast,” Biospace (September 20, 2023), https://www.biospace.com/article/5-life-sciences-ipo-in-2023-and-the-future-forecast-/.

[5] See supra note 1.

[6] Eric Sagonowsky, “Pharma saw huge reputation gains in the last year. It should make sure not to squander them, expert says,” Fierce Pharma (October 14, 2021), https://www.fiercepharma.com/marketing/pharma-saw-huge-reputation-gains-last-year-it-should-make-sure-not-to-squander-them.

[7] Jacqueline Renfrow, “Pharma reputation scores drop to pre-COVID levels as Haleon tops most respected, but it’s a huge fall from grace for Pfizer and Moderna,” Fierce Pharma (Jan 20, 2023), https://www.fiercepharma.com/marketing/pharma-reputation-scores-drop-pre-covid-levels-haleon-tops-most-respected-its-huge-fall.

[8] See supra note 1.

[9] Foo Yun Chee, “Pfizer wins unconditional EU antitrust okay for $43 bln Seagen buy,” Reuters (October 19, 2023), https://www.reuters.com/markets/deals/pfizer-wins-unconditional-eu-antitrust-okay-43-bln-seagen-buy-2023-10-19/.

[10] “Pfizer Receives All Required Regulatory Approvals to Complete the Acquisition of Seagen,” Pfizer Press Release (December 11, 2023), https://www.pfizer.com/news/press-release/press-release-detail/pfizer-receives-all-required-regulatory-approvals-complete.

[11] Kevin Dunleavy, “Novartis files suit against IRA after blockbuster Entresto makes CMS’ price negotiations list,” Fierce Pharma, (September 5, 2023), https://www.fiercepharma.com/pharma/novartis-files-suit-against-ira-3-days-after-entresto-makes-cms-price-negotiations-list#:~:text=The%20Swiss%20company%20joins%20Astellas,first%20round%20of%20price%20negotiations.

[12] Lunna Lopes, Audrey Kearney, Irving Washington, Isabelle Valdes, Hagere Yilma, and Liz Hamel, “KFF Health Misinformation Tracking Poll Pilot,” KFF (August 22, 2023), https://www.kff.org/coronavirus-covid-19/poll-finding/kff-health-misinformation-tracking-poll-pilot/.

[13] Munira Z. Gunja, Evan D. Gumas, and Reginald D. Williams II, “U.S Health Care form a Global Perspective, 2022: Accelerating Spending, Worsening Outcomes,” The Commonwealth Fund, (January 31, 2023), https://www.commonwealthfund.org/publications/issue-briefs/2023/jan/us-health-care-global-perspective-2022.

[14] In FTI Consulting’s 2023 Healthcare & Life Sciences Industry Outlook research, Question 24 asked, “What do you believe are the biggest risks for your company over the next 12 months?” “Cyber incidents/attacks” (21%) was ranked 7th most significant risk by respondents. This research was conducted online by FTI Consulting’s Strategic Communications segment between November 18-30, 2022 with n=250 decision makers in corporate communications, investor relations, public affairs, business development and marketing for healthcare and life sciences companies in the U.S. Contact [email protected] with any questions.

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals. ©2023 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |