Capital Markets Days: spotlight on emerging trends

Key takeaways

- An internal cross sector survey at FTI Consulting shows that while Capital Market Days (CMDs) remain a key milestone in any corporate’s IR journey, shorter and focused investor teach-ins are increasingly popular to bring all the dimensions of a business to life, beyond the quarterly earnings cycle.

- CMDs do not always provide price sensitive updates and are instead used more frequently to build market confidence in the Company’s execution abilities.

- Events have become increasingly interactive, using a wealth of digital tools and channels, best suited to cater to the information requirements of an ever more diverse stakeholder audience.

- It has become standard practice to emphasise the strength of an organisation at many levels beyond just the C-suite, with divisional executives as well as board members playing a key role in showing cohesion and bench strength.

- The content of CMD presentations is evolving beyond the usual “what we’ve done, where we are and where we want to go”. Topics have become more diverse and now regularly feature sustainability, digital transformation, and AI implementation. Multimedia content, product demonstrations and third-party testimonies increasingly contribute to the success of CMDs.

- Preparation is key, and FTI Consulting’s experience in managing CMDs confirms that a clear plan often leads to a successful event – one that successfully manages market expectations by clearly outlining upside potential and delineating execution risks.

CMDs serve as key moments for businesses to communicate their vision, strategy, and performance to shareholders. What was once a traditional full day event has been transformed by the onset of the COVID19 pandemic, which compelled corporate issuers to reimagine their approach to investor-focused events and embrace a digitally enhanced format. As the dust has settled and the world has adapted to the new normal, it has become imperative to identify the emerging trends shaping CMDs.

A recent survey conducted by FTI Consulting across its financial communications practitioners sheds new light on these trends, offering insights gleaned from our experiences in attending these events and in preparing management teams ahead of them. From format innovations to audience engagement strategies and content development, we explore how CMDs have evolved, particularly in response to the challenges posed by the pandemic, and the implications for the future of financial communications.

Shorter, interactive events bring all of the company’s dimensions to life

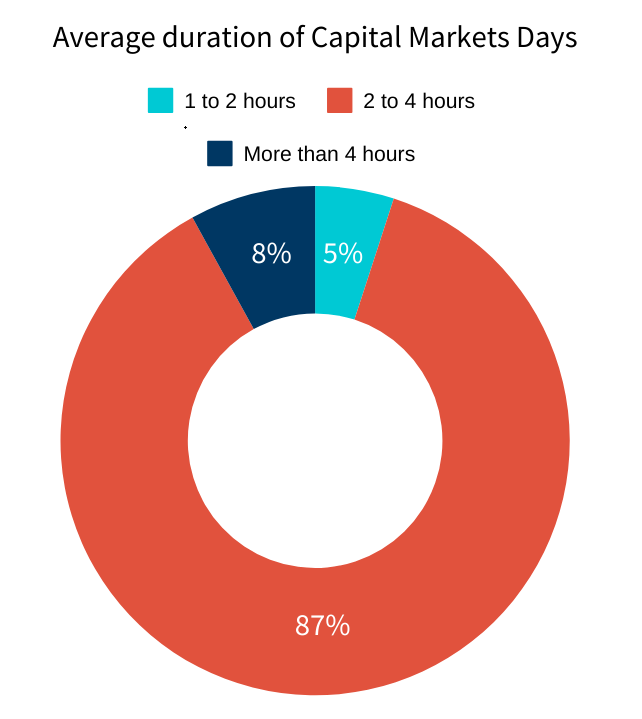

Our findings confirm the importance of CMDs in corporate life, but also a clear trend for lighter and more frequent investor teach-ins in IR programmes. Since 2022, companies prefer events with an average duration of 2-4 hours, as opposed to all day-events historically. We hear similar feedback from analysts and investors, who seem to prefer shorter events.

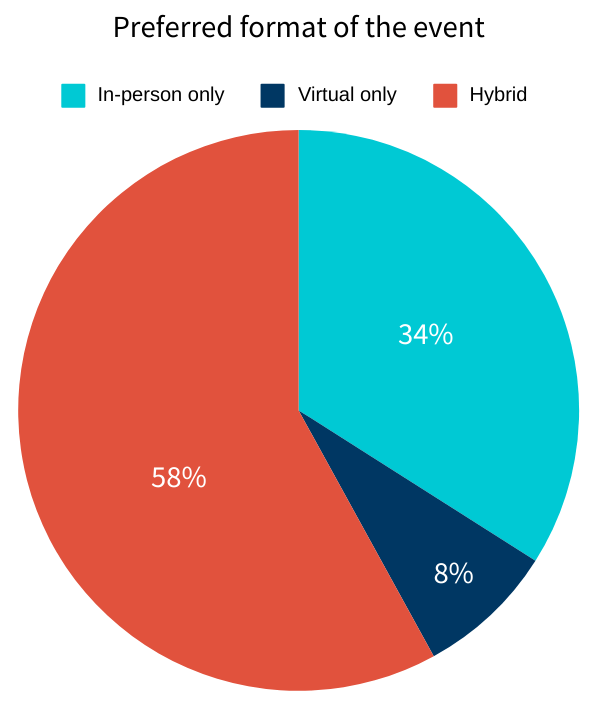

The format has also continued to evolve, with the majority of respondents noting hybrid as the preferred option, whilst a third still opt for in-person events only. As companies continue to experiment, live Q&A and chat functions are becoming more prevalent during investor events, with 63% of our practitioners embracing the use of such options in the past two years. Whilst the use of digital technology is becoming more prevalent, networking remains an important additional element with an average of 53% of respondents noting their clients offered breakfast and / or lunch, networking coffee breaks and a drinks reception. And alongside traditional options, networking goes increasingly digital with many events offering virtual break-out sessions and the possibility for audience participants to engage remotely in some instances.

Thinking about event production, most investor days tend to focus on live content delivery (50%), but more than a third (39%) said their clients had pre-recorded elements. Here, customer testimonials, product and technology demos, as well as pre-recorded videos of other speakers were cited as most frequent use cases, demonstrating the potential to bring in new voices and uncover new themes through the use of technology.

Management bench strength is key, and so is the support of the Board of Directors

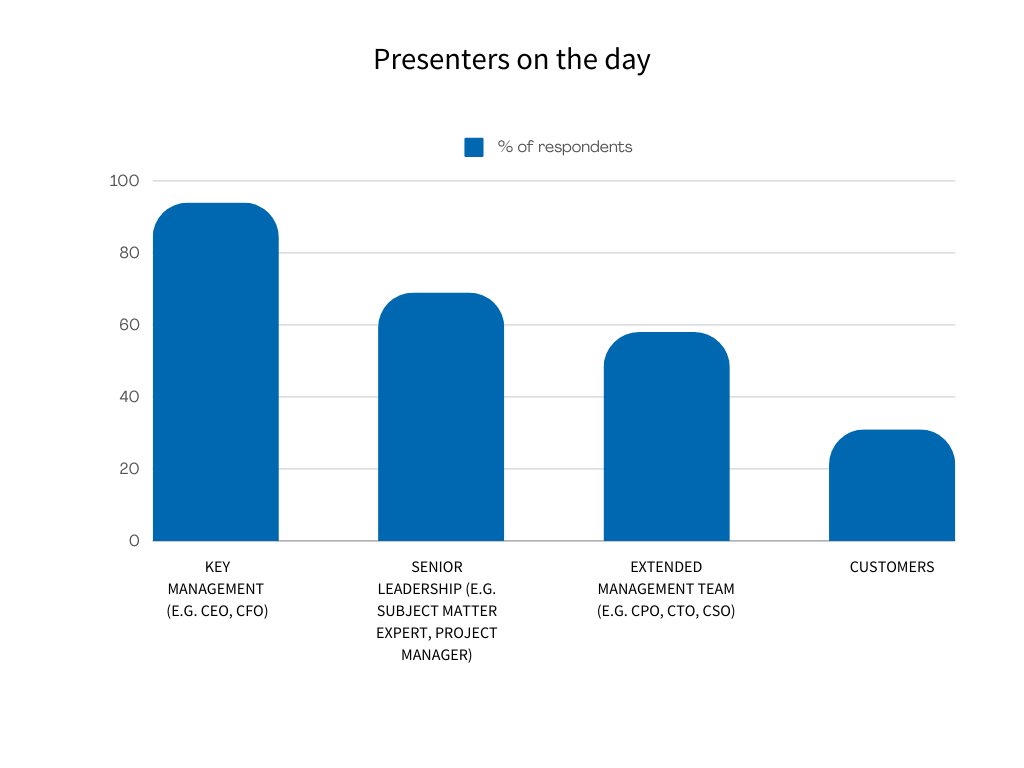

Invariably, CMDs are used to demonstrate the strength of an organisation beyond just the CEO/CFO/COO trio, reducing perceived key people risk. Our findings show that, in nearly 60% of cases, the extended management team and other senior leaders were amongst presenters. Equally, an increasing number of events feature an introduction from the chairperson, which shows unity and cohesion at board level between executive and non-executive directors. Lastly, key customers and third-party experts are increasingly brought to the party to provide an independent perspective, as suggested by a third of respondents.

This might be partly driven by the fact that the target audience is also evolving. Whilst investors and analysts remain the priority audience, companies appear more likely now to invite media (21%) than customers (13%) to their investor events. In this context, it might make sense to add elements beyond financial performance and to offer perspectives on industry themes and other hot topics, as managing broader expectations becomes more important in the future. The rapid emergence of sustainability-focused investor days has been a clear trend since COVID19, in spite of all the recent challenges. However, it is worth pointing out that inviting media to investor-focused events remains a controversial subject.

Content is (still) king

Overall, as mentioned above, our client experience shows a clear divide between two types of events: dense strategic updates on the one hand, and shorter teach-ins aimed at discussing specific parts of the business on the other.

For large events, the majority of our corporate clients still use CMDs as an opportunity to provide new price-sensitive updates, with new targets on a 3–5-year horizon being introduced half of the time. On the flipside, the other half still see CMDs as an occasion to update the investment community on how they execute on a mid-term plan, suggesting that CMDs are not always meant to offer new material information but rather to provide additional comfort that execution of management’s plan is on track – particularly if the market struggles to put all the pieces of the puzzle together.

When it comes to the structure of typical CMDs, in addition to traditional topics like company profile, strategy, growth enablers and business segment deep dives, sustainability transition, digital transformation and AI implementation have emerged as growing areas of focus, subject to what is material to each business. In addition, live demos of products and tech capabilities are featured increasingly to provide more substance and bring a set of slides to life.

Alongside large events, smaller investor teach-ins often appear as a credible – and certainly more cost-effective – alternative that allows issuers to touch base more frequently with investors. Rather than choosing one over another, we strongly encourage issuers to use a combination of both, in order to optimise the management of market expectations on an ongoing basis.

Listen, brainstorm, execute and rehearse

Whether you are gearing up for a full-blown CMD, a halfway investor update or a smaller teach-in, anticipation and preparation are key. Understanding market expectations over the next year and the mid-term is a critical pre-requisite, while careful monitoring of any updates up until the event is also paramount. A perception audit remains the best way to gauge the investment community’s qualitative views of a company and its valuation drivers, while quantitative consensus expectations must be scrutinised carefully, with a heightened focus on material KPIs. In our experience, the ideal time to run perception audits is either post Q1 results (across May-June for companies with a December year-end) or post Q3 results (between November and early January).

The brainstorming phase of a CMD should not be neglected either. More often than not, issuers fail to take the time to tackle the right questions upfront, implying complications further down the line. Reviewing valuation drivers holistically and in depth, in light of the overall capital market positioning versus relevant peers, will generate greater awareness among the project group and eventually yield a better outcome altogether. Making sure this is done in a collegial way, with all relevant senior business executives involved, is also critical to avoid surprises. A well-crafted messaging storyboard should conclude the brainstorming phase and represent the reference document for the execution phase.

A successful CMD will then require a well organised project group with a clear allocation of responsibilities, a project manager and a number of (well aware) internal contributors. Clear deadlines must be adhered to, so that the skeleton of the presentation slowly builds up towards a slick and well-articulated final product. Meanwhile, event logistics, media production workstreams and post event follow-ups (replay, transcripts, feedback survey) will need careful planning to avoid unnecessary delays and to maximise the resonance of your event across all audiences.

As the event draws near, two to three rehearsal sessions should allow speakers to feel fully prepared, while a comprehensive Q&A session, covering each section and dissecting potential implications on analysts’ models, is a must. No stone can be left unturned as the devil hides in the detail.

On the day, it is important to remember that a CMD is not only about the presentation but also about the company’s morning announcement, in case of any price sensitive information being released. As share price performance on the day will be largely influenced by the company’s morning announcement, an equal amount of scrutiny must be paid to the latter to avoid wiping out the expected benefits of many months of work.

Concluding remarks

In summary, a CMD is not a sprint and should not be rushed – it should rather follow a well-structured plan covering at least six months. Too often management teams miss the opportunity to really convince analysts and investors, primarily due to a lack of preparation ahead of the event. See it like an IPO: would you start preparing only three months ahead of it? In addition, far from being just an externally focused exercise, a CMD is a unique team-building opportunity which brings the full management team to the table to discuss the most crucial strategic questions. Therefore, at your next management offsite, put next year’s CMD on the agenda and start brainstorming – and we’d love to join the conversation.

To learn more about our Financial Communications offering, click here.

FTI Consulting, Inc. is a global business advisory firm dedicated to helping organisations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. With more than 8,000 employees located in 33 countries and territories, FTI Consulting professionals work closely with clients to anticipate, illuminate and overcome complex business challenges and make the most of opportunities. For more information, visit www.fticonsulting.com

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2024 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com