Renewables and Affordable Power: A Tale of Two States

Can renewable energy reliably and affordably power the American economy? There is no firm consensus. Some experts observe that wind and solar are now more affordable than conventional, fossil fuel-based generation. Others suggest the exact opposite, pointing to concerns about the intermittent nature of the breeze and sunshine.

What if there were a scenario where these claims could be tested? In the country’s heartland, there is.

Case Study Key Findings

- Renewable technologies, particularly wind, are affordable and competitive.

- Natural gas is still the driving factor in low power prices.

- The affordability of a gas-renewables mix has made coal assets increasingly uneconomic to operate.

- High penetration of renewables has little influence on reliability.

- A cleaner energy system built on more renewables and natural gas could protect consumers from volatility and high prices.

Sunflowers and Sooners

Based on data from the Southwest Power Pool, over 40% of the electric power mix in Kansas came from wind in 2019 – one of the highest shares in the country. Ironically, in 2015, Kansas made its renewable energy standard – requiring 20% of all power come from renewables by 2020 – a voluntary measure rather than a mandate. Wind power alone in the Sunflower State rendered that target obsolete.

But according to a December 2018 rate study from the Kansas Corporation Commission (KCC), Kansas also has some of the highest power prices in the region. KCC looked at a dramatic rise in rates from 2008 to 2017, determining a key cause was the “addition of renewable resources,” including the build-out of transmission infrastructure needed to connect those to the grid.

High renewable reliance and high power prices. Case closed, right? Wrong.

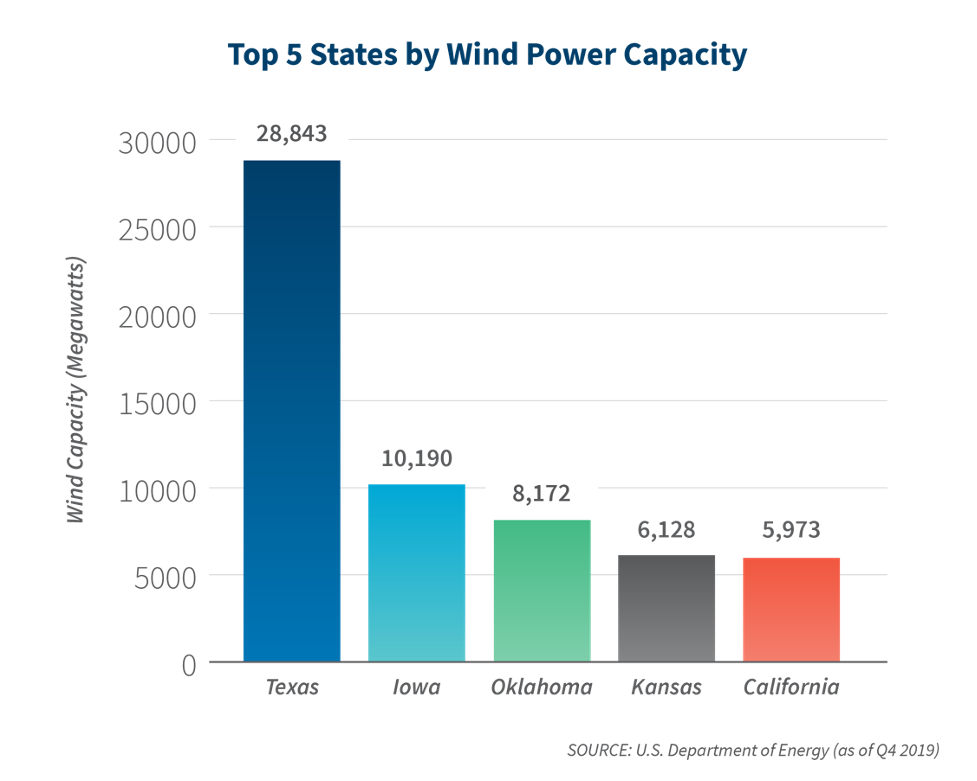

Wind power in neighboring Oklahoma also accounts for approximately 40% of the state’s power. Oklahoma ranks third in total installed wind capacity, trailing only Texas and Iowa. It also has about 2,000 megawatts (MW) more installed wind capacity than Kansas.

But unlike Kansas, Oklahoma power prices are low. In fact, a report from S&P Global Market Intelligence found that Oklahomans paid the lowest retail electric rates in the country in 2018. Data from the U.S. Department of Energy show that electricity prices in Oklahoma in 2018 were 23% lower than the national average.

Comparing electric grids is complex, to say the least. Individual states have their own unique sets of rules and regulations, not to mention different industries and consumption patterns. But the fact that two neighboring states can have a similarly high reliance on wind power with dramatically different results suggests something else is at play when it comes to power prices.

Indeed, the KCC rate study found that the rate increases in Kansas were “primarily driven by large capital investments,” investments that were dominated by retrofitting existing coal-fired power plants. KCC further concluded that “electric utilities whose generation portfolios are primarily gas-fired generation have achieved a significant advantage over electric utilities that are primarily coal-fired due to the extended period of very low natural gas prices.” Coal remains one of the largest sources of power in Kansas and new investments in coal generation were still considered viable in 2019.

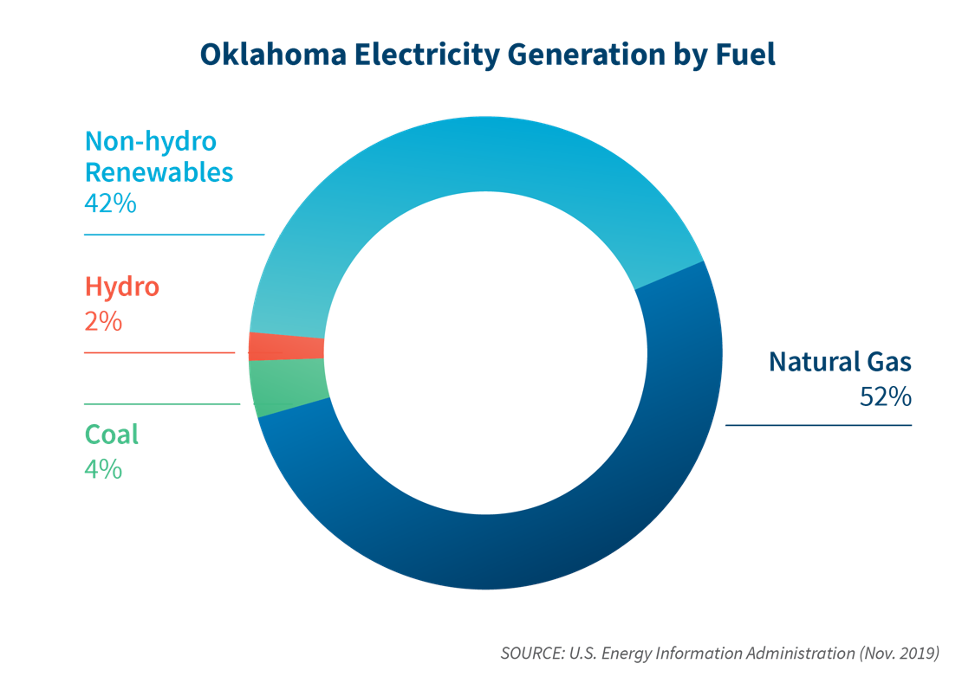

But in Oklahoma, natural gas is the largest source of electricity, generating nearly 14 times as much power as coal. A 2018 story in The Oklahoman observed that power prices were generally rising nationwide but falling in Oklahoma. The reason: “Oklahoma utilities generally are increasing their use of natural gas- and wind-generated electricity and reducing their reliance on coal-fired power.”

To further illustrate the lack of causality between high power prices and wind generation, federal data show that four of the five largest wind producing states have average residential electricity prices that are below the national average. Even prices in Kansas, while high for the region, are still lower than what the average American pays.

Reliability

Low prices are great for consumers, but one of the chief criticisms of renewables is their intermittency. Power bills may be low, but can they keep the lights on?

According to data from the U.S. Energy Information Administration (EIA), Kansas and Oklahoma are both among the top five largest generators of non-hydro renewable energy, and both fall near the national average in grid reliability. These reliability rankings are instructive in that they tell us what most grid experts will acknowledge: reliability is more a function of the “poles and wires” in a grid, rather than the specific generation source. Why? Without the means to bring electricity to customers through transmission and distribution, the reliability of generation in meaningless.

According to a 2020 WIRES report, the Southwest Power Pool specifically (which includes Kansas and Oklahoma) has been able to bring more renewable resources online due to the development of a “high-voltage backbone.”

As less-carbon intensive fuels are used to power the nation, the appropriate development of transmission and distribution networks will be essential, as will the continued development and deployment of battery storage and other technologies. Furthermore, this development must be mindful of additional resilience measures needed to protect from extreme weather. As indicated in a recent report from the North American Electric Reliability Corporation, “extreme weather events” are the number one source of power outages and transmission interruptions.

Cleaner Energy Future

Of course, when it comes to electric power systems, prices are only one consideration. The major investments in environmental retrofits for its coal-fired power plants and the dramatic expansion of wind power have actually driven carbon dioxide emissions in Kansas to a 40-year low, even as electricity consumption has trended upward.

But nationally, the electric grid bears a stronger resemblance to Oklahoma.

Power generators have been moving away from coal-fired power and transitioning to natural gas and renewables. In 2010, coal’s share of the U.S. electricity mix was twice that of natural gas. By 2015, natural gas overtook coal for the first time ever, and in 2019, natural gas accounted for over 38% of the U.S. electricity mix, while coal had dwindled to just 24%. The hybrid gas-renewable system, which takes advantage of abundant domestic supplies of natural gas and the lack of fuel cost for sources like wind and solar, allows for reduced carbon emissions and economic savings for consumers.

As the KCC rate study observed, the “reduction in natural gas prices and the influx of renewable energy (primarily wind-powered) in the Southwest Power Pool (SPP) had led to significant declines in wholesale market prices.”

According to data from the International Energy Agency (IEA), U.S. energy-related CO2 emissions declined 2.9% in 2019, driven mostly by coal-to-gas fuel switching and renewables. Since 2005, the increased use of natural gas and renewables has reduced CO2 emissions in the power sector by more than 4.6 billion metric tons, according to the U.S. Department of Energy.

This trend is likely to continue as states and businesses big and small move to implement 100% renewable energy use targets and net-zero carbon policies. According to the National Conference of State Legislatures, over 30 states and U.S. territories – spurred by an interest in reducing emissions – have mandatory renewable energy standards. As of this writing, over 220 large businesses around the world have committed to 100% renewable energy.

Ensuring the sufficient investment in transmission and distribution infrastructure, as well as supporting technologies to ensure reliability, will be critical to meeting these targets.

Conclusion

This case study demonstrates that states with similar energy resources can be worlds apart when infrastructure investment decisions are made. Abundant and inexpensive natural gas has enabled the energy transition to a cleaner economy by displacing older, coal-fired generation. The flexibility of gas-fired generation outperforms coal-fired generation in having nimble response times to allow for dips in renewable power generation, which in turn has helped create a stable platform into which renewable energy can be integrated, while also protecting consumers from higher monthly energy bills.

Replicating this low-emissions, low-cost power mix could be difficult in other states. Existing assets, state tax regimes, and other mandates all play a factor in determining which electricity mix will deliver the lowest prices to consumers. In many parts of the country, particularly Appalachia and the Mountain West, coal-fired power plants will remain operating for years if not decades.

But the broader trend in U.S. power markets is toward renewables and natural gas, and to continue down this path to cleaner and more affordable energy, continued investments in enabling infrastructure will be necessary. These investments will also enhance the reliability of the grid, irrespective of which fuel – fossil or renewable – is dominant.

If the experience in Oklahoma is any guide, this energy transition will not only result in lower emissions but also protect American households from higher prices.