ESG+ Newsletter – 2nd September 2021

Your weekly updates on ESG and more

It has been a critique-filled summer for the combined sustainability efforts of global business and the autumn looks set to be no different, as investor scrutiny and insatiable demand for data reaches fever-pitch. This week ESG+ has the very latest perspectives on how ESG is evolving and indeed, responding to that demand through science-based targets and making strides in Asia. Among other developments, we also consider how to reach a shared definition of workplace flexibility in the ‘new normal’ and the growing complexities of cybersecurity.

Latest research highlights investors demand greater ESG transparency

Opening this week’s newsletter, and tying into some of this week’s other stories on ESG data and market scrutiny, is our recently issued research which shows that global institutional investors are seeking more information from companies on their sustainability and ESG approaches. Our latest research among 250 investors with a combined $10 trillion in assets under management found that 76% are asking firms for more information about their sustainability strategies, an increase from 63% in 2020. Investors are also calling for greater disclosure, with 85% seeking more goals to be set in reporting and 81% noting they see greater pressure to divest from companies with a poor ESG performance.

Data, Scrutiny and Greenwashing

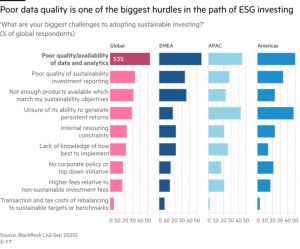

Following on from last week’s ESG+ piece on DWS investment claims being under investigation, the Financial Times is reporting that asset managers are becoming fearful that “exaggerated claims over sustainability-focused investments could become a mis-selling scandal across the industry.” The FT outlines that asset managers have “showcased their sustainability credentials” in recent years to capture asset flows into “investments that do good for the climate and society as well as generating returns.” However, Catherine Howarth of ShareAction believes asset managers’ credibility on ESG investing “needs to be tested to the nth degree”. An underlying problem for asset managers – and across the ESG landscape – is data quality; with the FT citing an unnamed financial industry source who stated that “Data quality is really bad”. This is supported in a survey of 425 investors published by Blackrock (see this week’s chart of the week below), which highlights that “poor quality or availability of ESG data and analytics represent the biggest obstacle to sustainable investing.”

This is on the agenda of regulators. The EU has introduced SFDR to help address perceptions of ‘greenwashing’ while the UK’s FCA also wrote to asset managers in July speaking about building trust in the market and improving quality and clarity. In particular, their letter highlights that applications for new investment funds with an ESG or sustainability focus contained claims “that do not bear scrutiny”. As the focus on both issuers’ and investors’ ESG practices and reporting grows, it is likely that scrutiny of perceived greenwashing is going to increase rather than decrease – in the short-term at least. All capital market participants, companies and investors need to ensure claims, and data, can stand up to that scrutiny.

Blackrock study for the European Commission finds European banks slow to integrate ESG

Remaining on the theme of ESG scrutiny and data, a report commissioned by the EU executive shows that ESG integration into the EU banking prudential framework, and into banks’ business strategies and investment policies, is at an early stage and argues that the pace of implementation needs to be accelerated. The study highlights that the lack of adequate data and common standards remain key challenges for the sector to overcome. It recommends the development of a more granular definition of ESG risks, measurement methodologies, and associated quantitative indicators. Of particular interest, it suggests that ESG product classifications could be harmonised by ensuring compulsory compliance with standards such as the EU Green Bond Standard or the EU Taxonomy.

ESG Accounting Requires Accountants

In a somewhat light-hearted look at the expanding world of ESG, Matt Levine’ latest ‘Money Stuff’ column for Bloomberg ponders how the introduction of standardised ESG reporting metrics for companies looks set to create several additional layers of work for accountants. While the so-called ‘Big Four’ have all jumped on “the ESG bandwagon”, the real opportunities are yet to come as the measurement and reporting are not yet standardized in the way that financial reporting is. Levine is jovial about accountants seizing the opportunity that increased parity of esteem between financial and non-financial reporting presents, but it does bear reminding that all of the underlying assumptions about ESG do require a robust and transparent set of books in order to consolidate the legitimacy that it craves.

Allbirds pioneering the first sustainable IPO

Sustainable shoemaker Allbirds has filed for a public listing in the US as demand for sustainable fashion brands continues to accelerate. The company is pioneering what would effectively be a ‘sustainable’ public offering. Allbirds products are produced using naturally derived materials and the company claims that its carbon impact from manufacturing shoes is about 30% less than rival produces; and, its supply chain is carbon neutral. Listing as a sustainable IPO means it has to adhere to select environmental, social and governance standards including “maintaining a minimum ESG rating, implementing “best practices” towards climate change and making “commitments to make meaningful progress on important ESG matters”. Allbirds is hoping to pioneer a framework for the sustainable public equity offering, forging a path for others to follow.

Nature Action 100 launch brings science-based targets for nature into the spotlight

While companies’ sustainability targets may be heavily weighted towards net zero and other climate-related activities, nature-based initiatives may need to be pushed to the fore with biodiversity set to be the next frontier for investors. The focus on biodiversity is being accelerated by the imminent launch of the Nature Action 100 (NA100) initiative and the associated science-based targets (SBTs) for Nature.

NA100 was due to be launched at the Conference of the Parties to the Convention on Biological Diversity (COP15 CBD) in October this year. While this conference is likely to be delayed, the NA100 launch is nevertheless expected to happen before the end of this year. While the specific goals and structure of the initiative are still unclear, an article from Environmental Finance provides some indications. A recent report from the World Bank looked at lessons learned from the Climate Action 100+ initiative to develop a framework for NA100 and proposed investor targets of “net-zero loss of biodiversity in the near-to-medium term and net positive impact on biodiversity in the long term”. Environmental Finance also states the World Benchmarking Alliance (WBA) has offered to identify targets of engagement using research they’ve conducted to identify companies that have the most impact on biodiversity. The Finance for Biodiversity Foundation, whose biodiversity pledge was signed by 26 banks, asset managers, insurers, and impact funds has offered its support by acting as a secretariat.

The development of NA100 will also be informed by SBTs for Nature and the Taskforce on Nature-related Financial Disclosures (TNFD). The Science-based Targets Network (SBTN) plans to update its guidance for business in December this year which provides a five-step guide for companies to establish SBTs for Nature. Given the momentum now gathering around biodiversity financing, by acting now companies can get ahead of any formal targets that may be coming down the line.

Concrete effort needed from investors to defeat deforestation

On the theme of environment and nature, companies would be forced to take deforestation seriously if they were met by a concerted effort by investors to thwart it. That’s the conclusion of a BBC special report on the alleged role of the world’s largest banks and asset managers in funding producers and traders driving the destruction of habitats crucial to the continuation of life as we know it. In Brazil, deforestation has reached a 12-year high and this is being driven primarily by the demand for beef. Deforestation could not happen on this scale without vast financial investment and according to the report, loans totalling $249bn were extended to companies linked to deforestation between 2013 and April 2020. And while there are signs that investors are starting to wake up to the risks associated with deforestation, there also seems to be a degree of ‘buck passing’ on the part of investors.

In September 2019, 251 investors representing roughly $17.7 trillion AUM signed a letter urging companies “to redouble their efforts and demonstrate a clear commitment to eliminating deforestation within their operations and supply chains”. Unfortunately, in a November 2020 briefing paper, the think tank Global Canopy found that just 33 signatories had clear deforestation policies themselves. The overarching questions remain as to whether the will of the stewards is really there, to begin with, and ultimately, will Governments defy a resilient market-led ideology and implement their own solutions.

Calling BS on workplace flexibility

As office workers begin to filter back to the workplace, Emma Jacobs writing in this week’s Financial Times raises the issue of flexibility and ‘autonomy’ and how this impacts employees across a wider range of roles – not simply offices workers but those in essential roles. As businesses collectively think more deeply about their ‘S’ responsibilities for the future, she raises some interesting questions for employers.

Jacobs’ initial context is the idea of ‘bullshit jobs’ proposed by David Graeber in 2018 – jobs that differ from what is considered essential work – work that’s important to society became clearer during the pandemic. Challenging perhaps the binary nature of Graeber’s idea, Jacob’s points to a study by researchers from the Universities of Cambridge and Birmingham that workers “sense of uselessness may not be a direct indication of the social value of that work” but an “a symptom of bad management and toxic workplace cultures.” So the first consideration for companies, whatever role their employees hold, is the culture that is fostered in the organisation and how employees are managed (or micromanaged).

The second consideration, brought into focus by a Gartner study, speaks to the gap in perception and reality among more senior and junior employees. According to Gartner’s research “Seventy-two per cent of executives agree they can work out their own flexible work arrangement with their manager, whereas only half of the employees feel they have that same privilege.” As people return to the office and have had greater autonomy over their work practices for the past 18 months, companies will need to think about how to accommodate the new normal. It is not simply about 2 days in and 3 days at home; it is about considering new ways of working – and ensuring that flexibility and autonomy are equally shared. Recent studies of the four-day week, for example, suggest no loss in productivity among workers.

US turns to private industry to address cybersecurity shortfalls

President Joe Biden recently hosted a White House summit with representatives from private industry aimed at addressing the growing cybersecurity problem. The summit follows on from the President’s executive order issued in May on “Improving the Nation’s Cybersecurity” and comes during a period of heightened levels of cybercrime, fuelled by a ransomware epidemic. The summit brought together leaders from tech, energy, banking, insurance, and education. Several tech companies such as Google, IBM, and Microsoft pledged investment in cybersecurity, with some also agreeing to provide training to shore up gaps in cybersecurity skills. Insurance company Resilience also stated that its cyber-insurance policyholders would have to meet certain cybersecurity best practices as a condition of coverage.

There has been increased pressure on private industry to address the growing cybersecurity problem. Much of the focus has been on the software supply chain, the source of several recent high-profile attacks. This week the US Homeland Security Committee also released a draft bill that would require critical infrastructure owners and providers to disclose details of cyber-attacks. The push towards greater transparency around cyber-attacks and cybersecurity may start to extend to the broader industry and comes at a time when organisations’ cybersecurity, and ability to respond to attacks, is coming under increasing scrutiny.

Asia-Pacific’s ESG performance is on the up

The Asia-Pacific region has at times been known for low ratings on ESG performance due to minimal ESG adoption and limited ESG regulation and reporting. The region has lagged the rest of the world when it comes to ESG performance but the latest view of MSCI is that this trend is in reversal. According to the new report, 80% of the sectors in the APAC market have improved their overall ESG scores over the last three years. The improvement has been credited to increased regulatory and investment pressure. The regulatory environment has tightened in places like Japan and China around ESG. Despite the improvement, the APAC region is still considered behind the rest of the world on ESG performance. The improvement in scores shows the trends we are seeing in sustainability globally with increased adoption and stakeholder expectations, making APAC a potentially more attractive investment for global investors.

In Case You Missed It

- The Asset reports that participation in the GRESB 2021 assessments grew by 26% over 2020, surpassing expectations amid the global Covid-19 pandemic, 1,520 property companies, real estate investment trusts (Reits), funds and developers participated in the GRESB real estate assessment, up from 1,229 companies in 2020. Combined they generate a benchmark that covers US$5.7 trillion of AUM, up from US$4.8 trillion last year.

- Moody’s has launched a data solution to help investors align their strategies with UN Sustainable Development Goals. The new solution will provide data for approximately 5,000 listed companies covering over 300 data points, aiming to develop integrated solutions to incorporate the SDGs into investment strategies, funds, indices, and reporting.

- A call for feedback on the EU’s plans for social taxonomy that aligns with its green taxonomy will end next week on 6 September. A draft report on Social Taxonomy was published by the subgroup of the Platform for Sustainable Finance was published in July.

- Nike is to be asked to prove to its shareholders that it is indeed a role model. Intelligize reports that the company is pushing back against a shareholder proposal related to its diversity, equity and inclusion (DEI) program from activist investor group, arguing that it already discloses adequate DEI information.

Chart of the Week

Source: Financial Times

Gain insights and stay informed on ESG, sustainability, building back better or on any industry or topic that interests you here. To be added to the distribution list for our ESG+ Newsletter, please click here to input your details or email [email protected].

| The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

©2021 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com |